MA LW-2 2009 free printable template

Show details

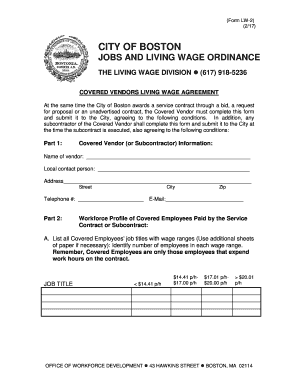

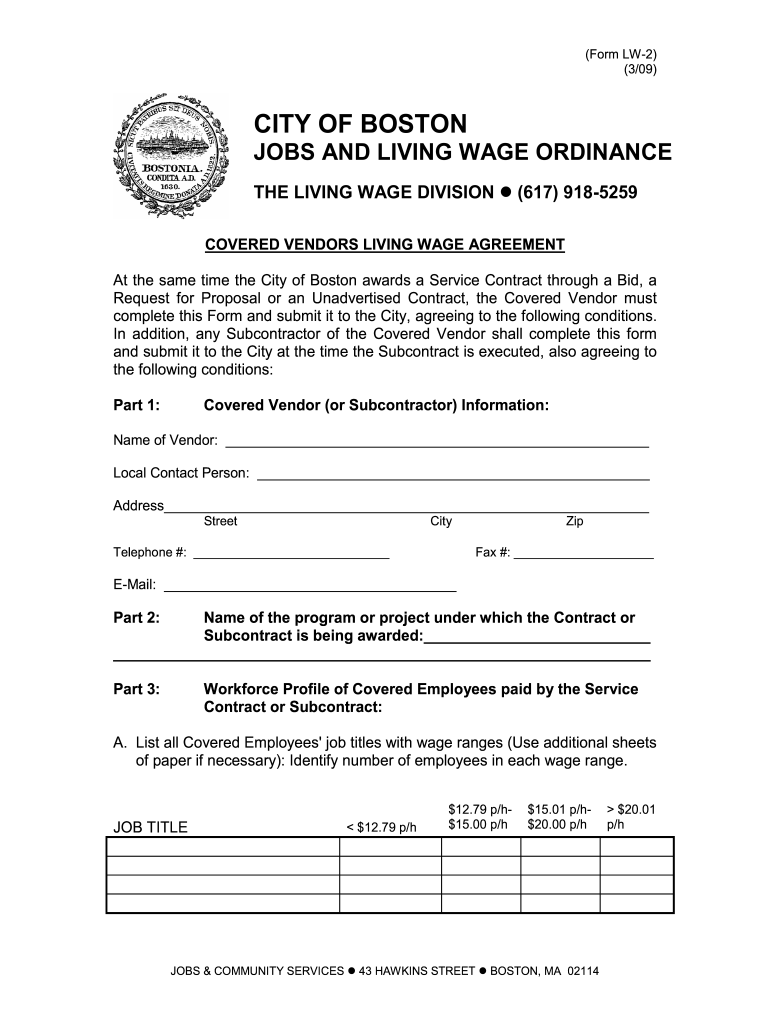

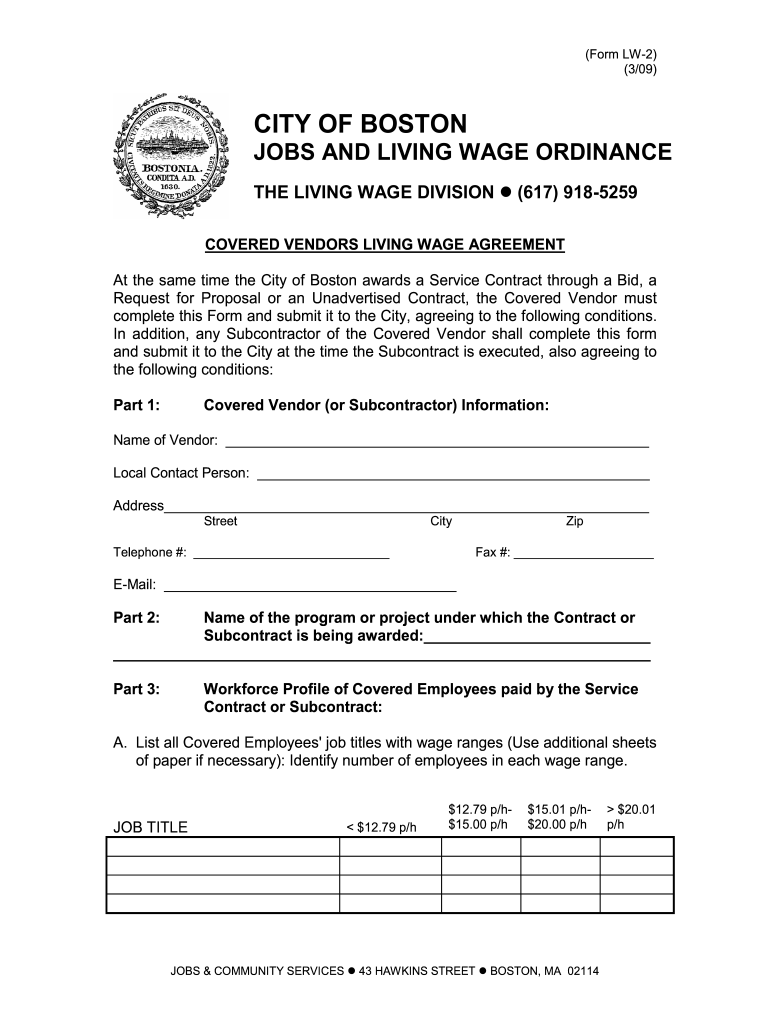

(Form LW-2) (3/09) CITY OF BOSTON JOBS AND LIVING WAGE ORDINANCE THE LIVING WAGE DIVISION (617) 918-5259 COVERED VENDORS LIVING WAGE AGREEMENT At the same time the City of Boston awards a Service

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA LW-2

Edit your MA LW-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA LW-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA LW-2 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MA LW-2. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA LW-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA LW-2

How to fill out MA LW-2

01

Obtain the MA LW-2 form from the Massachusetts Department of Revenue website or your local tax office.

02

Enter your personal information, including your name, address, and Social Security number.

03

Specify your employment status and list all sources of income in the designated sections.

04

Indicate any deductions or credits you are eligible for based on your financial situation.

05

Review the form for accuracy, ensuring all information is complete and correct.

06

Sign and date the form before submission.

07

Submit the completed MA LW-2 form to the appropriate tax authority or include it with your tax return.

Who needs MA LW-2?

01

Individuals who have earned income in Massachusetts and are required to report their income for state tax purposes.

02

Taxpayers who qualify for certain deductions or credits and need to claim them on their state tax return.

03

Anyone who has received wages from an employer within the state of Massachusetts.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an abatement on excise tax in Massachusetts?

You have until three years after the excise is due — OR one year after you pay the excise bill — to file an abatement. You can find the abatement form on the reverse side of your excise tax bill. You can also download and print a blank abatement form online: Motor vehicle abatement form.

What is the City of Boston primary residential exemption?

Every taxpayer in the City of Boston who owns residential property as of January 1, 2022, and uses that property as his or her principal residence for their calendar year 2021 Massachusetts income taxes, may be eligible for the Fiscal Year 2023 residential exemption.

What is Boston resident tax abatement?

If you own and live in your property as a primary residence, you may qualify for the residential exemption. The residential exemption reduces your tax bill by excluding a portion of your residential property's value from taxation.

How do I file an abatement in Boston?

Complete your application We make applications available through Assessing Online after we issue third-quarter tax bills. You can also contact the Assessing Department at 617-635-4321. We will send you an Abatement application, along with an Information Requisition Form.

What is an abatement for taxes Massachusetts?

An abatement is a reduction of a tax or penalty assessed by the Department of Revenue (DOR). See 830 CMR 62C. 37.1. Taxpayers seeking to obtain an abatement of a tax or penalty that has been assessed by DOR should use MassTaxConnect (MTC) and follow the instructions provided for disputing a tax or penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MA LW-2?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the MA LW-2. Open it immediately and start altering it with sophisticated capabilities.

How do I edit MA LW-2 online?

With pdfFiller, it's easy to make changes. Open your MA LW-2 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit MA LW-2 on an Android device?

You can make any changes to PDF files, like MA LW-2, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is MA LW-2?

MA LW-2 is a form used in Massachusetts for reporting wage information for employees who earn a minimum wage or are subject to wage laws.

Who is required to file MA LW-2?

Employers who pay employees in Massachusetts and are subject to the state's minimum wage laws are required to file MA LW-2.

How to fill out MA LW-2?

To fill out MA LW-2, employers need to provide information such as the total wages paid, number of employees, and specific employee details. It’s crucial to follow the form's instructions carefully.

What is the purpose of MA LW-2?

The purpose of MA LW-2 is to ensure compliance with Massachusetts wage laws by reporting wage and hour information to the state.

What information must be reported on MA LW-2?

The information that must be reported on MA LW-2 includes total wages paid, number of employees, employee details such as names and hours worked, and compliance with minimum wage laws.

Fill out your MA LW-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA LW-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.