IRS 1120S 2017 free printable template

Show details

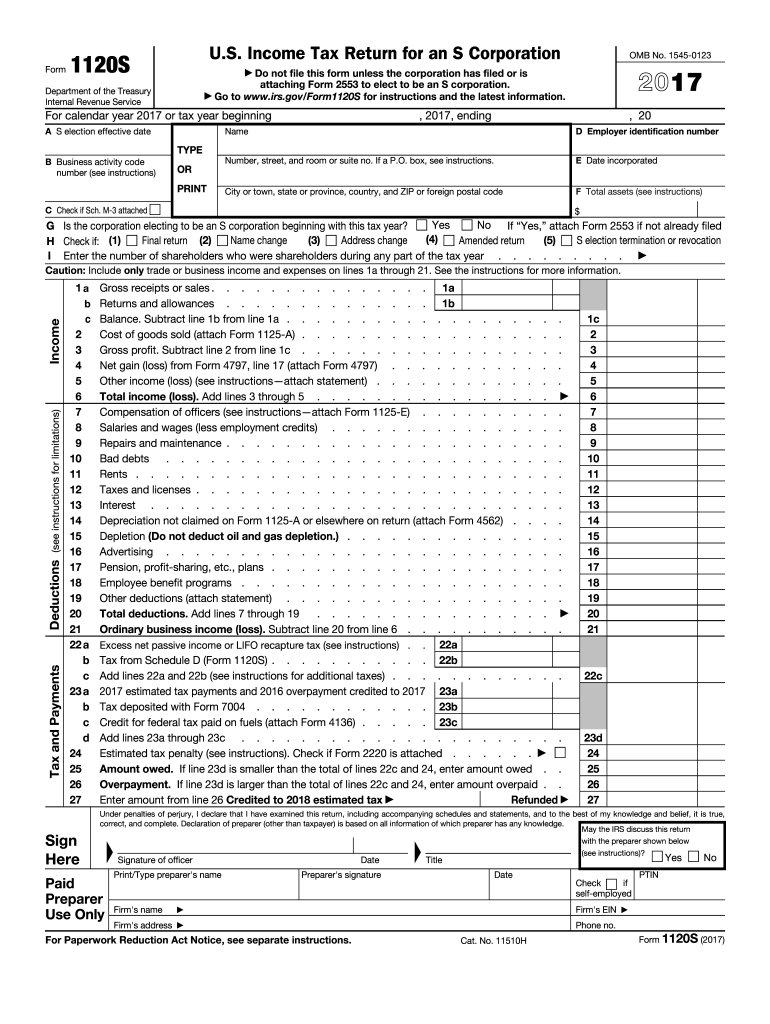

5b Royalties. Net short-term capital gain loss attach Schedule D Form 1120S. 8 a Net long-term capital gain loss attach Schedule D Form 1120S. Excess net passive income or LIFO recapture tax see instructions. 22a Tax from Schedule D Form 1120S. Form 1120S U.S. Income Tax Return for an S Corporation OMB No. 1545-0123 Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. Go to www.irs.gov/Form1120S for instructions and the latest...information. Department of the Treasury Internal Revenue Service For calendar year 2017 or tax year beginning A S election effective date TYPE B Business activity code number see instructions OR PRINT 2017 ending Name D Employer identification number Number street and room or suite no. For Paperwork Reduction Act Notice see separate instructions. Cat. No. 11510H PTIN Form 1120S 2017 Schedule B Page Other Information see instructions a See the instructions and enter the Check accounting method...Yes No Cash Accrual Other specify b Product or service At any time during the tax year was any shareholder of the corporation a disregarded entity a trust an estate or a nominee or similar person If Yes attach Schedule B-1 Information on Certain Shareholders of an S Corporation. If a P. O. box see instructions. E Date incorporated City or town state or province country and ZIP or foreign postal code F Total assets see instructions C Check if Sch* M-3 attached Yes No If Yes attach Form 2553 if...not already filed G Is the corporation electing to be an S corporation beginning with this tax year Name change Address change S election termination or revocation Final return 2 Amended return H Check if 1 I Enter the number of shareholders who were shareholders during any part of the tax year. Caution Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information* 1a. 1b Balance. Subtract line 1b from line 1a. Cost of goods sold attach Form...1125-A. Gross profit. Subtract line 2 from line 1c. Net gain loss from Form 4797 line 17 attach Form 4797. Other income loss see instructions attach statement. Total income loss. Add lines 3 through 5. Compensation of officers see instructions attach Form 1125-E. Salaries and wages less employment credits. Repairs and maintenance. Bad debts Rents. Taxes and licenses. Interest. Depreciation not claimed on Form 1125-A or elsewhere on return attach Form 4562. Depletion Do not deduct oil and gas...depletion*. Advertising. Pension profit-sharing etc* plans. Employee benefit programs. Other deductions attach statement. Total deductions. Add lines 7 through 19 Ordinary business income loss. Subtract line 20 from line 6. 22b Add lines 22a and 22b see instructions for additional taxes. 2017 estimated tax payments and 2016 overpayment credited to 2017 23a Tax deposited with Form 7004. 23b Credit for federal tax paid on fuels attach Form 4136. 23c Add lines 23a through 23c Estimated tax penalty...see instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

Instructions and Help about IRS 1120S

How to edit IRS 1120S

You can edit the IRS 1120S tax form by downloading it from the IRS website or services like pdfFiller. Once downloaded, open it in any PDF editor, where you can add or modify text. After making the necessary changes, ensure you save the edited file properly before proceeding to file.

How to fill out IRS 1120S

Filling out the IRS 1120S form involves several steps. Start by gathering all necessary financial documents of the S corporation. Follow these steps:

01

Download the IRS 1120S form from the IRS website or use pdfFiller for an online option.

02

Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

03

Report gross receipts or sales, cost of goods sold, and other income in the respective sections.

04

Complete the deductions section, listing all expenses like salaries, rent, and utilities.

05

Ensure to review the completed form for accuracy before submission.

About IRS 1120S 2017 previous version

What is IRS 1120S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120S 2017 previous version

What is IRS 1120S?

IRS 1120S refers to the tax form used by S corporations to report income, deductions, and credits. This form allows the income to pass through directly to shareholders, avoiding double taxation characteristic of C corporations.

What is the purpose of this form?

The purpose of IRS 1120S is to allow S corporations to report their income, losses, and distributions to shareholders. This enables the shareholders to account for the income on their individual tax returns, ensuring tax liabilities are correctly applied.

Who needs the form?

Any corporation that has elected S corporation status with the IRS must file Form 1120S annually. This includes both domestic and foreign corporations that meet eligibility criteria for S corporation status.

When am I exempt from filling out this form?

Entities that are not S corporations or do not meet the specific IRS requirements for S status are exempt from filing the IRS 1120S form. Additionally, if the S corporation has no income, it might not need to file, but should confirm specific state regulations.

Components of the form

The IRS 1120S form consists of several parts, including:

01

Income: Detail gross receipts and adjusted gross income.

02

Deductions: List allowable business expenses.

03

Tax and payments section: Any taxes owed or credits claimed.

04

Shareholder information: Reading is required to complete with personal information for tax reporting.

What are the penalties for not issuing the form?

Failure to file IRS 1120S by the due date can lead to significant penalties. These penalties can accrue daily, and may reach up to several hundred dollars depending on how long the filing is overdue. It's essential to file in a timely manner to avoid excess fees.

What information do you need when you file the form?

When filing the IRS 1120S, you will need financial records that include revenue, expenses, and the distribution of profits among shareholders. Specifically, gather:

01

Financial statements from the current tax year.

02

Details of existing and new shareholders.

03

Documentation for all business expenses.

04

Records of any special deductions or tax credits.

Is the form accompanied by other forms?

Yes, IRS 1120S may require additional forms for complete filing. Form K-1 (Shareholder’s Share of Income, Deductions, Credits, etc.) is commonly used to report each shareholder’s share of income. Depending on the specific tax situation, other schedules and forms may also be necessary.

Where do I send the form?

The IRS 1120S form should be mailed to the address indicated in the form's instructions, depending on whether you are including payment. For most filers, this will be the appropriate Processing Center listed for your state. Alternatively, you may file electronically using approved e-filing methods.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Work and Study Budy

Overall I love the app and all the features it offer! The benefits totally outweigh the cost. Amazing app!

What I like most about the feature is I can use it both for work to fill out pdf files and for my personal studies where I can write notes, comment, add highlights and more to the file.

What I least like about this is it can be a bit pricey to maintain especially if I were only a student. But good thing I am also using it for work so I can really maximize its use.

A very useful tool for PDFs

Very good experience. In my beginnings I had a little trouble but everything came very quickly. I mainly use it for my professional paperwork with the administrations when I need to edit some files and sometimes I use it to sign. Not only do we save paper but also if we don't have a printer or are on a mobile or the tablet one can use this application. It's great !

Multiple features, easy and practice of use, especially for the modification of documents.

One thing to take into account is that pdfFiller is not easy for one who doesn't know more about this kind of software. Slight bugs sometimes but otherwise nothing to report on the software.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.