IRS 8863 2017 free printable template

Show details

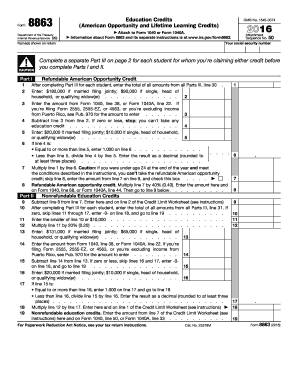

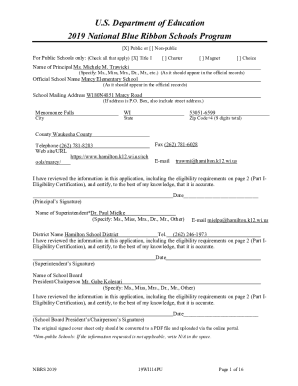

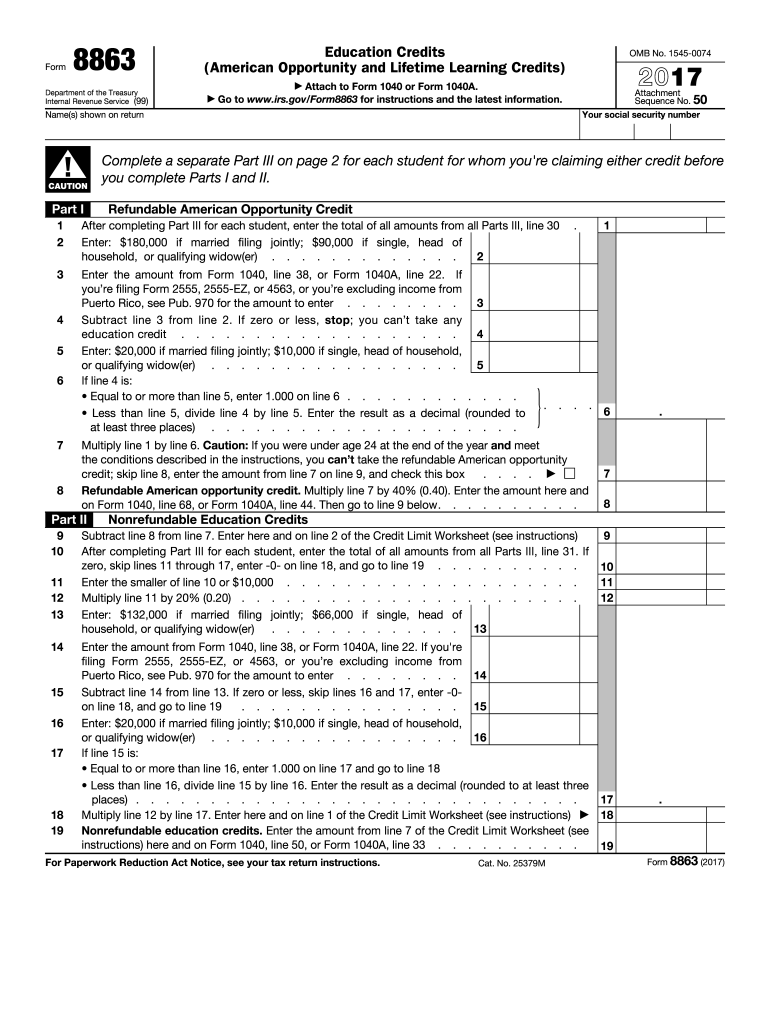

Cat. No. 25379M Form 8863 2017 Page 2 Complete Part III for each student for whom you re claiming either the American opportunity credit or lifetime learning credit. Form Department of the Treasury Internal Revenue Service 99 Education Credits American Opportunity and Lifetime Learning Credits OMB No. 1545-0074 Attach to Form 1040 or Form 1040A. Go to www.irs.gov/Form8863 for instructions and the latest information. Attachment Sequence No. 50 Your social security number Name s shown on return...CAUTION Part I Complete a separate Part III on page 2 for each student for whom you re claiming either credit before you complete Parts I and II. Go to www.irs.gov/Form8863 for instructions and the latest information. Attachment Sequence No. 50 Your social security number Name s shown on return CAUTION Part I Complete a separate Part III on page 2 for each student for whom you re claiming either credit before you complete Parts I and II. Refundable American Opportunity Credit After completing...Part III for each student enter the total of all amounts from all Parts III line 30 Enter 180 000 if married filing jointly 90 000 if single head of household or qualifying widow er. Enter the amount from Form 1040 line 38 or Form 1040A line 22. If you re filing Form 2555 2555-EZ or 4563 or you re excluding income from Puerto Rico see Pub. Form Department of the Treasury Internal Revenue Service 99 Education Credits American Opportunity and Lifetime Learning Credits OMB No* 1545-0074 Attach to...Form 1040 or Form 1040A. Go to www*irs*gov/Form8863 for instructions and the latest information* Attachment Sequence No* 50 Your social security number Name s shown on return CAUTION Part I Complete a separate Part III on page 2 for each student for whom you re claiming either credit before you complete Parts I and II. Refundable American Opportunity Credit After completing Part III for each student enter the total of all amounts from all Parts III line 30 Enter 180 000 if married filing jointly...90 000 if single head of household or qualifying widow er. Enter the amount from Form 1040 line 38 or Form 1040A line 22. If you re filing Form 2555 2555-EZ or 4563 or you re excluding income from Puerto Rico see Pub. 970 for the amount to enter. Subtract line 3 from line 2. If zero or less stop you can t take any or qualifying widow er. If line 4 is Equal to or more than line 5 enter 1. 000 on line 6. Less than line 5 divide line 4 by line 5. Enter the result as a decimal rounded to at least...three places. Multiply line 1 by line 6. Caution If you were under age 24 at the end of the year and meet the conditions described in the instructions you can t take the refundable American opportunity credit skip line 8 enter the amount from line 7 on line 9 and check this box. on Form 1040 line 68 or Form 1040A line 44. Then go to line 9 below. Nonrefundable Education Credits zero skip lines 11 through 17 enter -0- on line 18 and go to line 19. Enter the smaller of line 10 or 10 000. filing...Form 2555 2555-EZ or 4563 or you re excluding income from places.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8863

How to edit IRS 8863

How to fill out IRS 8863

Instructions and Help about IRS 8863

How to edit IRS 8863

To edit IRS 8863, access a blank form through pdfFiller. Use pdfFiller's editing tools to input or modify information directly on the form. Review your changes for accuracy before final submission, as each piece of information can impact tax calculations.

How to fill out IRS 8863

To fill out IRS 8863 accurately, gather all necessary documentation related to your education expenses. Proceed by entering your personal information at the top of the form, including your Social Security number. Next, provide details regarding the education expenses for which you are claiming tax credits. Be sure to accurately report the number of qualifying students and their associated costs.

About IRS 8 previous version

What is IRS 8863?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8863?

IRS 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is used by taxpayers to claim education credits on their tax returns. This form allows eligible students or their parents to benefit from substantial tax reductions based on qualified education expenses.

What is the purpose of this form?

The purpose of IRS 8863 is to provide a structured way for taxpayers to claim education-related tax credits available under U.S. tax law. These credits can significantly lower a taxpayer's tax liability, thereby making education more affordable.

Who needs the form?

Individuals who are eligible for education credits must fill out IRS 8863. This typically includes parents claiming credits for dependent students or independent students pursuing higher education. To qualify, students must meet specific eligibility criteria related to enrollment and expenses.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 8863 if you do not have qualifying education expenses or if neither you nor your dependents are enrolled in an eligible educational institution. Additionally, if your income exceeds the specified thresholds for claiming education credits, you would not need to use the form.

Components of the form

The components of IRS 8863 include personal information fields, sections for detailing education expenses, and the calculation area for applicable tax credits. Key sections involve reporting qualified tuition and related expenses, the number of eligible students, and total amounts spent.

What are the penalties for not issuing the form?

Failing to file IRS 8863 when required can result in the loss of valuable tax credits. Additionally, inaccurate information may lead to penalties from the IRS. It is essential to ensure that all information is accurate and that the necessary forms are submitted to avoid these consequences.

What information do you need when you file the form?

When filing IRS 8863, you need information regarding qualified educational expenses. This includes receipts for tuition, enrollment fees, and other related costs. Additionally, Social Security numbers for both the student and the taxpayer are necessary to complete the form effectively.

Is the form accompanied by other forms?

IRS 8863 is generally submitted alongside your Form 1040 or Form 1040A. These forms collectively demonstrate your overall tax situation, making it crucial to have them prepared concurrently to ensure the accuracy of your tax return.

Where do I send the form?

IRS 8863 should be sent to the address specified in the form instructions, which usually corresponds with where you are filing your tax return. If you file electronically, the software you use will prompt you with the right submission details.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

This is amazing! It is simple to edit a PDF document and also has so many other option to use. I was just going to do the trial, but now I will be subscribing to this service.

EVERYTHING WAS EASY TO USE AND IT WORKED FINE FOR ME

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.