Get the free Distribution of Payroll Expense

Show details

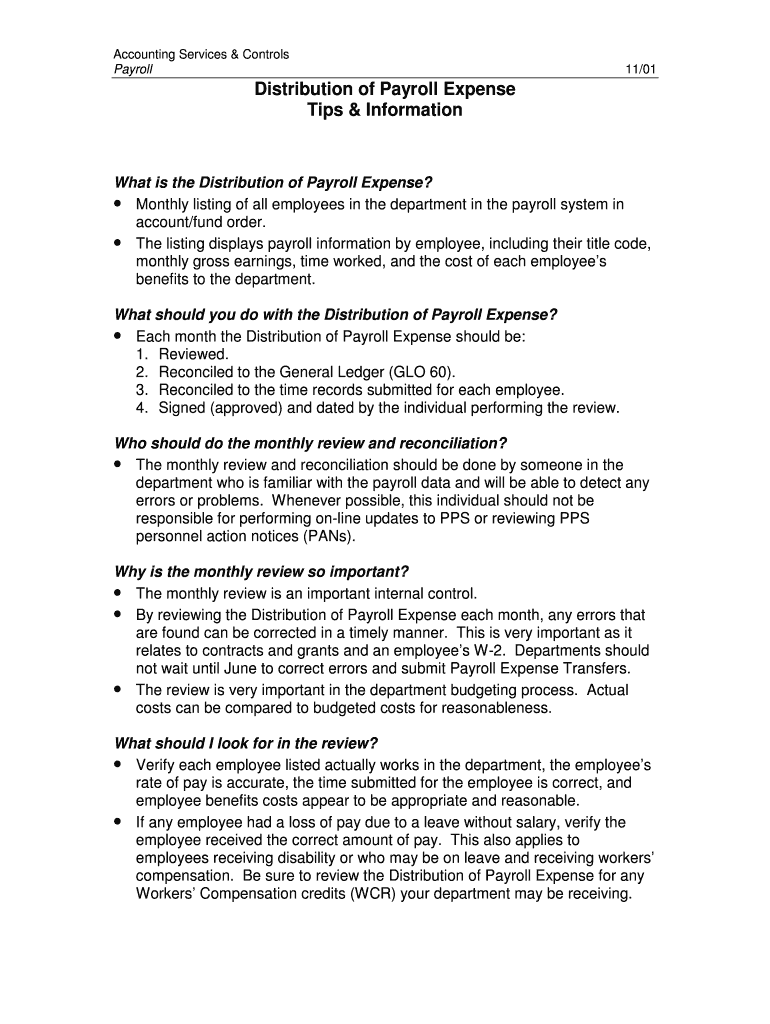

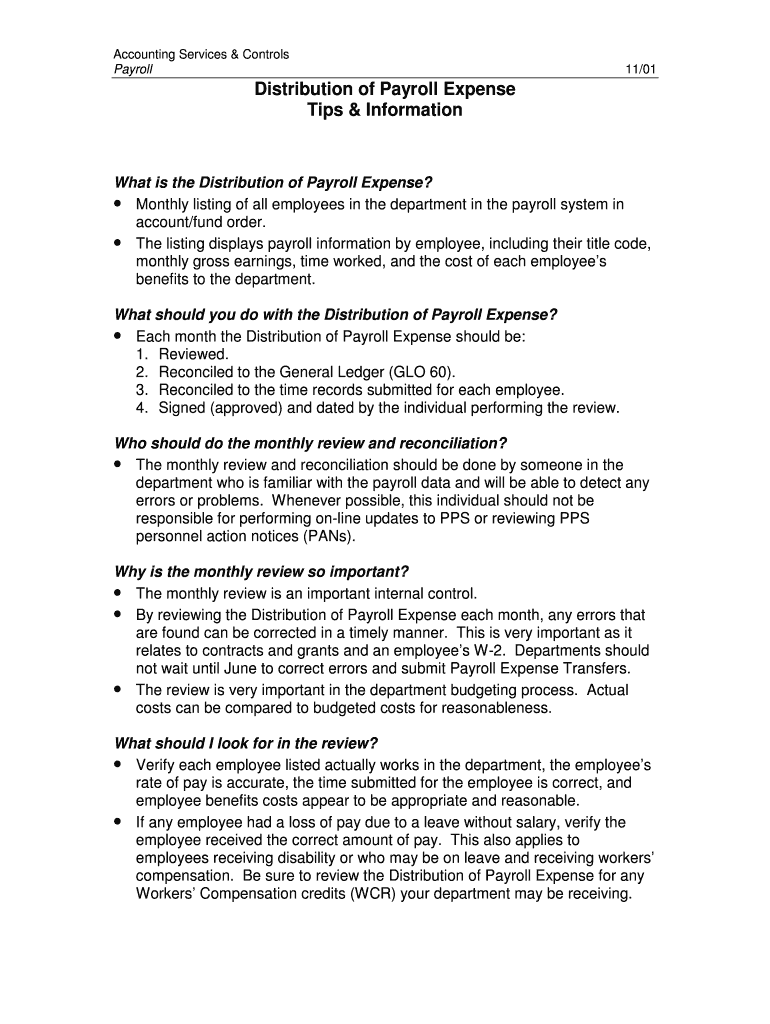

Accounting Services & Controls Payroll11/01Distribution of Payroll Expense Tips & Informational is the Distribution of Payroll Expense? Monthly listing of all employees in the department in the payroll

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign distribution of payroll expense

Edit your distribution of payroll expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your distribution of payroll expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit distribution of payroll expense online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit distribution of payroll expense. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out distribution of payroll expense

How to Fill Out Distribution of Payroll Expense:

01

Start by gathering all necessary information related to the payroll expense, such as employee names, hours worked, wages, and any applicable deductions or benefits.

02

Divide the payroll expense based on specific cost centers, departments, or project codes. This allows for proper allocation and tracking of the expense across different areas of the organization.

03

Determine the distribution percentages for each cost center or department. This can be based on factors like the number of employees in each area, the amount of time spent on specific projects, or any other relevant criteria.

04

Calculate the distribution amount for each cost center or department by multiplying the total payroll expense by the respective distribution percentage.

05

Record the distribution of payroll expense in the appropriate accounting or payroll software system. Ensure that the expense is accurately allocated to the correct cost centers or departments.

06

Prepare reports or summaries detailing the distribution of payroll expense for management or budgeting purposes. These reports provide a clear overview of how the expenses are allocated and allow for effective decision-making based on the financial information.

07

Reconcile the distribution of payroll expense with the actual payroll amounts paid to ensure accuracy and address any discrepancies.

08

Ensure proper documentation of the distribution of payroll expense for auditing or compliance purposes.

Who needs distribution of payroll expense?

01

Organizations or businesses with multiple cost centers or departments that want to accurately allocate and track payroll expenses across different areas.

02

Project-based companies or organizations that need to determine the payroll expenses associated with specific projects or initiatives.

03

Management teams or budgeting departments that require detailed financial information to make informed decisions and monitor expenses effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute distribution of payroll expense online?

With pdfFiller, you may easily complete and sign distribution of payroll expense online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit distribution of payroll expense in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing distribution of payroll expense and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out distribution of payroll expense on an Android device?

Complete your distribution of payroll expense and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is distribution of payroll expense?

Distribution of payroll expense is the breakdown of how payroll costs are allocated among different departments or categories within a business.

Who is required to file distribution of payroll expense?

Employers are required to file distribution of payroll expense to accurately report how payroll costs are distributed within the organization.

How to fill out distribution of payroll expense?

Distribution of payroll expense can be filled out by recording the total payroll expenses and distributing them among different departments based on the proportion of each department's payroll costs.

What is the purpose of distribution of payroll expense?

The purpose of distribution of payroll expense is to provide transparency and accountability in how payroll costs are allocated within an organization.

What information must be reported on distribution of payroll expense?

The distribution of payroll expense should include the total payroll expenses, breakdown of costs by department or category, and any notes explaining the allocation.

Fill out your distribution of payroll expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Distribution Of Payroll Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.