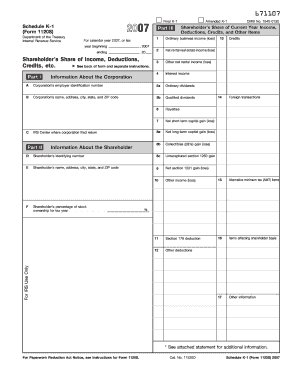

UK DD Payroll SLA Provision of Payroll free printable template

Show details

Service Level Agreement Provision of Payroll Service Charges (including VAT) 7.50 per payroll run for up to 6 employees plus an additional 60 for annual tax returns for each financial year total 157.50

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK DD Payroll SLA Provision of Payroll

Edit your UK DD Payroll SLA Provision of Payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK DD Payroll SLA Provision of Payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK DD Payroll SLA Provision of Payroll online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK DD Payroll SLA Provision of Payroll. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out UK DD Payroll SLA Provision of Payroll

How to fill out UK DD Payroll SLA Provision of Payroll Service

01

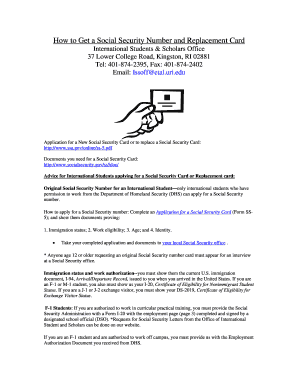

Gather necessary documentation including employee details and payroll data.

02

Access the payroll software or system used for processing payments.

03

Navigate to the section for setting up the SLA (Service Level Agreement) for payroll.

04

Input the agreed service levels including processing times, response times, and reporting schedules.

05

Review the SLA terms with relevant stakeholders to ensure they meet organizational requirements.

06

Submit the SLA for approval to management or the designated authority.

07

Once approved, communicate the SLA details to the payroll team and relevant departments.

08

Regularly review and update the SLA as needed to reflect any changes in service requirements.

Who needs UK DD Payroll SLA Provision of Payroll Service?

01

Businesses operating in the UK that require payroll processing services.

02

HR departments looking to establish clear expectations with payroll service providers.

03

Organizations experiencing complexity in payroll management due to a large workforce.

04

Firms seeking to ensure compliance with UK payroll regulations and laws.

Fill

form

: Try Risk Free

People Also Ask about

How much does a payroll service cost?

QuickBooks Payroll is a cloud-based payroll software that allows businesses to pay employees, file payroll taxes and manage employee benefits and HR in one place. The software saves time by automatically calculating, filing and paying federal and state payroll taxes.

What is the best payroll company?

Our payroll pricing is categorized into 3 plans. Our basic program specially designed for small businesses in India cost is ₹25 per employee per month. Our other 2 plans (Premium: ₹39 /Month /Employee) and (Ultimate: ₹49 /Month /Employee) are designed for medium and large-size businesses in India.

What is a payroll service?

Yes. All QuickBooks Online Payroll plans offer full-service payroll. That means, in addition to automated payroll, you'll receive full-service features. Automated taxes and forms: Federal and state payroll taxes—including your year-end filings—are calculated, filed, and paid automatically.

What is payroll services in Canada?

A payroll service provider is a company that automatically processes payroll calculations, remits the resulting statutory amounts, produce year-end employee tax forms and files them electronically with the Canada Revenue Agency (CRA) and Revenue Quebec (RQ) for any Quebec employees, produces Records of Employment (ROE)

How do payroll services make money?

Charging fees per pay frequency is the most common way payroll companies charge for their services. That means however often you pay employees (weekly, bi-weekly, semi-monthly or monthly), you'll be charged for the number of employees you pay each pay period.

What is a payroll example?

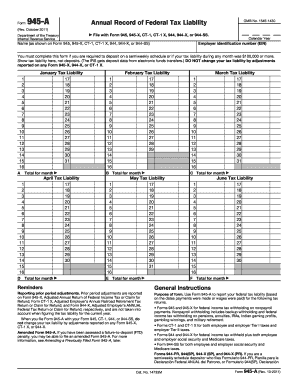

A document that details the employee's gross wages, taxes, and deductions; employer contributions and taxes; and the employee's net pay. Forms employers must file with tax agencies (e.g., the IRS) that summarize employee pay information, such as wages and taxes. Examples include Form 941 and Form W-2.

What are payroll services?

A payroll service provider is a company that either assists with or assumes all aspects of payroll on behalf of another business. This arrangement is often beneficial for employers who value their time and want to ensure that their employees and taxes are paid accurately and on schedule.

What is payroll and how does it work?

Payroll is the compensation a business must pay to its employees for a set period and on a given date. The payroll process can include tracking hours worked for employees, calculating pay, and distributing payments via direct deposit or check.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out UK DD Payroll SLA Provision of Payroll using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign UK DD Payroll SLA Provision of Payroll and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit UK DD Payroll SLA Provision of Payroll on an iOS device?

Use the pdfFiller mobile app to create, edit, and share UK DD Payroll SLA Provision of Payroll from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out UK DD Payroll SLA Provision of Payroll on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your UK DD Payroll SLA Provision of Payroll. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is UK DD Payroll SLA Provision of Payroll Service?

UK DD Payroll SLA refers to the Service Level Agreements established for Direct Debit payroll services, outlining the standards and responsibilities of service providers in processing payroll.

Who is required to file UK DD Payroll SLA Provision of Payroll Service?

Employers who utilize Direct Debit for payroll processing are required to file the UK DD Payroll SLA Provision of Payroll Service.

How to fill out UK DD Payroll SLA Provision of Payroll Service?

To fill out the UK DD Payroll SLA Provision of Payroll Service, employers need to provide details regarding payment amounts, employee information, and the frequency of payroll processing on the relevant forms.

What is the purpose of UK DD Payroll SLA Provision of Payroll Service?

The purpose of the UK DD Payroll SLA Provision of Payroll Service is to ensure consistency, reliability, and compliance in payroll transactions conducted through Direct Debit.

What information must be reported on UK DD Payroll SLA Provision of Payroll Service?

The information that must be reported includes employee payment details, payment dates, total payroll amounts, and any changes in employee status or payment methods.

Fill out your UK DD Payroll SLA Provision of Payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK DD Payroll SLA Provision Of Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.