Get the free 1128 WRIT OF GARNISHMENT

Show details

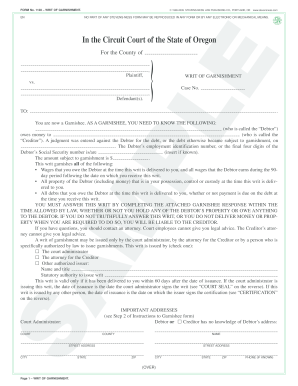

FORM No. 1128 WRIT OF GARNISHMENT. EN 19992009 STEEPNESS LAW PUBLISHING CO., PORTLAND, WWW.steepness.combo PART OF ANY STEEPNESS FORM MAY BE REPRODUCED IN ANY FORM OR BY ANY ELECTRONIC OR MECHANICAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1128 writ of garnishment

Edit your 1128 writ of garnishment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1128 writ of garnishment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1128 writ of garnishment online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1128 writ of garnishment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1128 writ of garnishment

How to fill out 1128 writ of garnishment:

01

Gather all necessary information such as the debtor's name, address, and Social Security number.

02

Determine the amount of money owed by the debtor that you intend to collect through garnishment.

03

Consult the specific guidelines and requirements for filling out the 1128 writ of garnishment form in your jurisdiction.

04

Complete the form by accurately providing all requested information, including your own name, contact information, and the court case or judgment number.

05

Clearly state the amount of money being garnished and specify the source of income or property to be garnished.

06

Sign and date the form, ensuring that all necessary signatures are obtained.

Who needs 1128 writ of garnishment:

01

Creditors who have obtained a court judgment against a debtor are the ones who need the 1128 writ of garnishment.

02

This writ is typically used by creditors to legally instruct employers or financial institutions to withhold money from the debtor's wages or account.

03

The creditor uses this writ as a means to collect the money owed to them by the debtor through garnishment.

Fill

form

: Try Risk Free

People Also Ask about

What is a writ of garnishment of wages in Michigan?

After a court decides you owe the money, it will enter a judgment against you. The creditor must wait 21 days after the judgment is entered. Then it can get a Writ of Garnishment. This is a court order that tells the garnishee to give your money to the creditor.

How long is a Writ of garnishment good for in AZ?

The Writ of Garnishment will expire 45 days after the Answer is filed if no objections are filed. If the judgment creditor fails to obtain a signed Order of Continuing Lien before the 45 days run out, the garnishee will be released, and the judgment creditor will have to start the garnishment process over again.

What is a writ of garnishment earnings Arizona?

The Writ of Garnishment and Summons is an order from the court requiring you to immediately withhold nonexempt earnings from the judgment debtor. Please make copies of this form before completing for use in future pay periods.

What is a Writ of garnishment in Arizona?

The writ of garnishment is a court order requiring the garnishee to withhold a certain amount from your earnings and to continue to withhold a portion of your earnings until the judgment is satisfied or the writ is quashed by the court or released by the judgment creditor.

What is garnishment of earnings in Arizona?

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

How long is a writ of garnishment good for in Michigan?

A writ of non-periodic garnishment is in effect for 182 days. This means the non-periodic garnishment expires on the 183rd day after the court issued it. After that you must request another writ of garnishment to keep collecting this way. It can only be used once; it expires when it is used.

How do I stop a Writ of garnishment in Arizona?

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

What is a writ of garnishment of wages Maryland?

Garnishment of Wages The creditor can file a request to have your employer to withhold part of your wages. Wages will be withheld until you pay the judgment in full. You have the right to contest the garnishment. Use the DC-002, Motion to explain your defense or objection.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 1128 writ of garnishment without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 1128 writ of garnishment. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send 1128 writ of garnishment to be eSigned by others?

Once your 1128 writ of garnishment is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit 1128 writ of garnishment on an Android device?

You can make any changes to PDF files, such as 1128 writ of garnishment, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is 1128 writ of garnishment?

The 1128 writ of garnishment is a legal document that allows a creditor to collect debts owed by a debtor by seizing funds or property from a third party, known as the garnishee.

Who is required to file 1128 writ of garnishment?

The creditor or the party seeking to enforce a judgment against the debtor is required to file the 1128 writ of garnishment.

How to fill out 1128 writ of garnishment?

To fill out the 1128 writ of garnishment, one must provide details such as the names and addresses of both the creditor and debtor, the judgment information, the amount being garnished, and the garnishee's information.

What is the purpose of 1128 writ of garnishment?

The purpose of the 1128 writ of garnishment is to provide a legal mechanism for creditors to collect debts by directing a third party to withhold funds or property belonging to the debtor.

What information must be reported on 1128 writ of garnishment?

The information that must be reported on the 1128 writ of garnishment includes the creditor's and debtor's contact information, judgment details, amounts owed, and specific information about the garnishee.

Fill out your 1128 writ of garnishment online with pdfFiller!

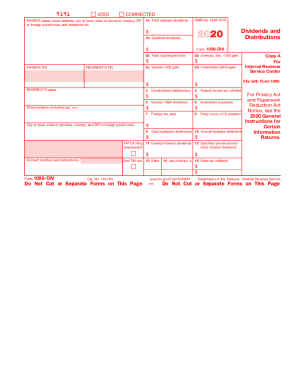

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1128 Writ Of Garnishment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.