Get the free CT-1040 EXT State of Connecticut 2017

Show details

Form CT1040 Department of Revenue Services

State of Connecticut

(Rev. 12/17)

1040EXT 1217W 01 9999See the instructions before you complete this form. Complete this form in blue or black ink only.

We are not affiliated with any brand or entity on this form

Instructions and Help about ct-1040 ext state of

How to edit ct-1040 ext state of

How to fill out ct-1040 ext state of

Instructions and Help about ct-1040 ext state of

How to edit ct-1040 ext state of

To edit the ct-1040 ext state of, first, ensure you have the latest version of the form. You can utilize pdfFiller's editing tools to make necessary changes. After uploading the form, select the fields you want to modify and enter the new information. Once edits are complete, save your updated document for future reference.

How to fill out ct-1040 ext state of

Filling out the ct-1040 ext state of requires specific information regarding your state tax situation. Start by gathering all necessary documents, including income statements and previous tax returns. Follow the instructions provided within the form carefully, entering your information in each required field accurately. Review the completed form for any errors before submission.

Latest updates to ct-1040 ext state of

Latest updates to ct-1040 ext state of

Stay informed about updates to the ct-1040 ext state of by checking the official state tax website or the IRS communications. Annual changes may include updates to tax rates, forms, or compliance requirements affecting how you fill out the form.

All You Need to Know About ct-1040 ext state of

What is ct-1040 ext state of?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About ct-1040 ext state of

What is ct-1040 ext state of?

The ct-1040 ext state of is an extension form used by taxpayers to request additional time to file their state tax returns. This form does not extend the time to pay taxes owed but only the filing deadline.

What is the purpose of this form?

The purpose of the ct-1040 ext state of is to provide taxpayers with a mechanism to delay the submission of their state tax return without incurring penalties for late filing. It allows taxpayers who require more time to gather necessary documents or complete their taxes to extend their filing deadline.

Who needs the form?

Any taxpayer who cannot complete their state tax return by the original due date may need the ct-1040 ext state of. This includes individuals, businesses, and corporations who estimate they will need more time to prepare their returns. It's particularly useful for those with complex financial situations or unforeseen circumstances impacting their ability to file on time.

When am I exempt from filling out this form?

You may be exempt from filling out the ct-1040 ext state of if you are submitting a return that meets particular criteria or if you do not owe any state tax. Additionally, some states automatically grant extensions without the need for an extension form, so it is vital to check your specific state's regulations.

Components of the form

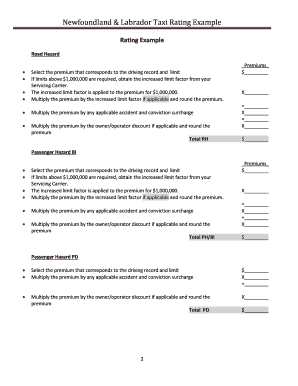

The ct-1040 ext state of generally includes fields for personal identification information, such as your name and taxpayer identification number. It may also ask for details regarding your estimated tax obligations and any payments you have already made. Ensure to fill in all relevant sections to avoid complications with your extension request.

What are the penalties for not issuing the form?

Failing to submit the ct-1040 ext state of may result in penalties, including fines for late filing and potential interest accruing on unpaid taxes. Without a valid extension, you risk facing harsh penalties if your return isn’t filed by the due date. It is crucial to file the form on time if you anticipate needing an extension.

What information do you need when you file the form?

When filing the ct-1040 ext state of, you will need your taxpayer identification number, the tax year for which you are seeking an extension, and an estimate of your tax liability. Make sure to gather all necessary income documents to provide an accurate estimate to avoid potential penalties.

Is the form accompanied by other forms?

Typically, the ct-1040 ext state of can be filed as a standalone form, but depending on your state, there may be additional forms required for specific circumstances or to report estimates of tax payments. Always check your state’s tax authority guidance to confirm.

Where do I send the form?

The submission method for the ct-1040 ext state of depends on your state tax authority's requirements. Most states allow submission by mail, and some offer electronic submission options. Always refer to the specific instructions on the form or your state’s official tax website for the correct filing address or submission portal.

See what our users say