Get the free Streamlined bSalesb and Use bTaxb Certificate of Exemption - SmartPay - newjersey

Show details

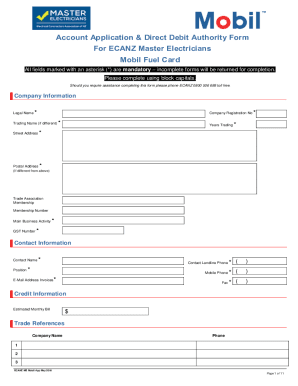

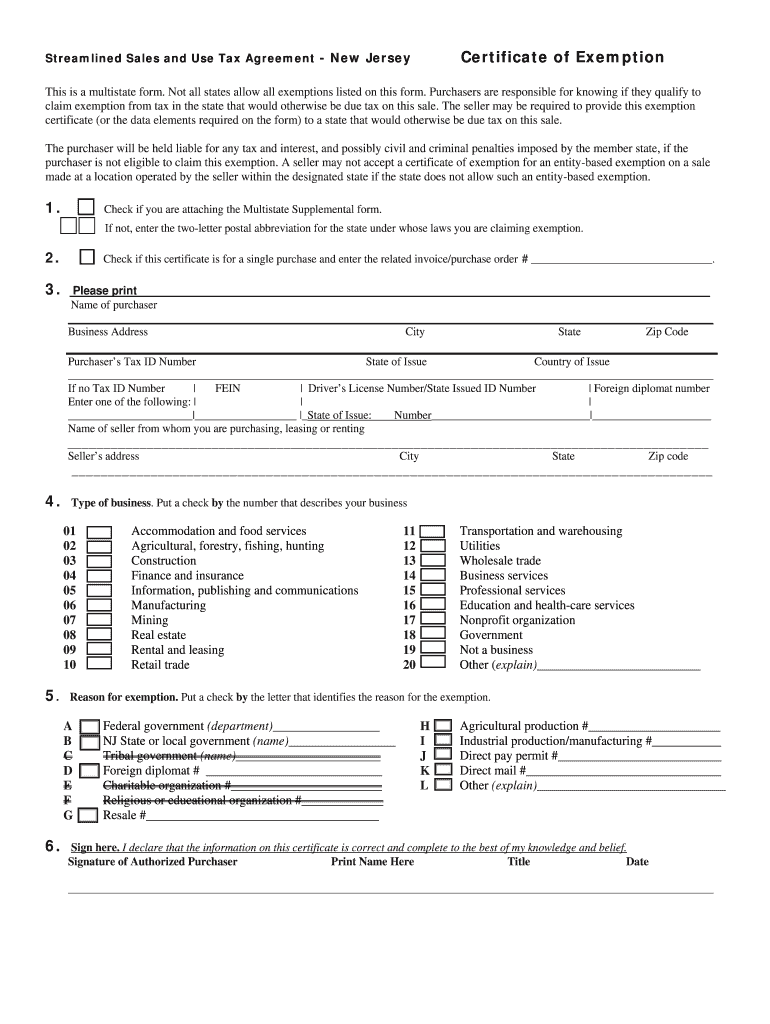

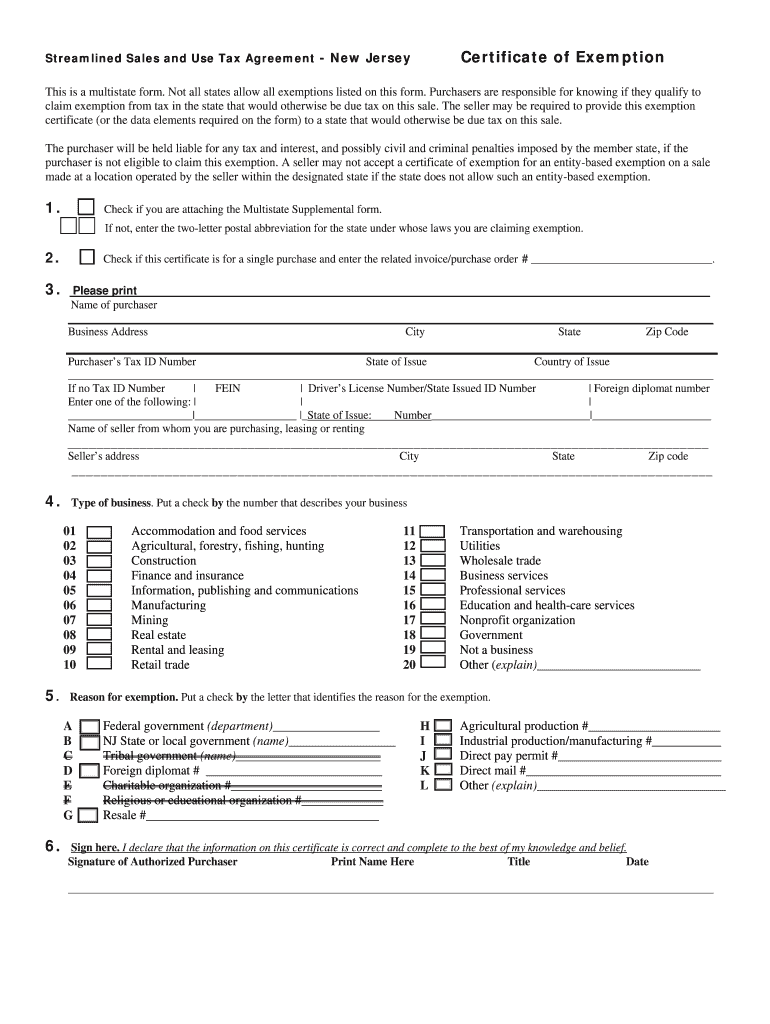

Streamlined Sales and Use Tax Agreement New Jersey. Certificate of ... claim exemption from tax in the state that would otherwise be due tax on this sale. The seller may .... 5-SB, ST-4 (BRAG), or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign streamlined bsalesb and use

Edit your streamlined bsalesb and use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your streamlined bsalesb and use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing streamlined bsalesb and use online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit streamlined bsalesb and use. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out streamlined bsalesb and use

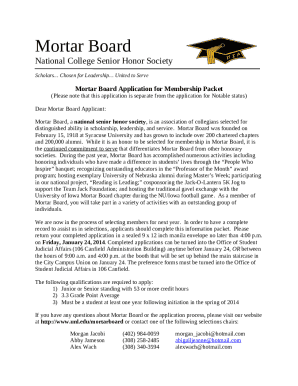

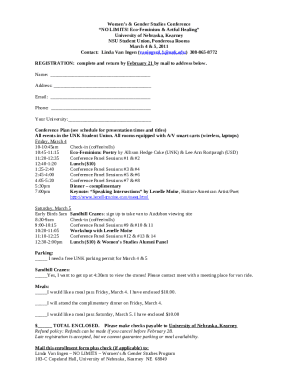

How to Fill Out Streamlined Sales and Use Tax Agreement and Who Needs It:

01

The first step in filling out the streamlined sales and use tax agreement is to gather all the necessary information. This includes your business's name, address, contact information, and any relevant tax identification numbers.

02

Next, carefully review the agreement form and make sure you understand all the terms and requirements. It is important to familiarize yourself with the specific rules and regulations of your state as they may vary slightly.

03

Fill out the agreement form accurately and completely. Provide all the requested information, including details about your business activities and the categories of products or services you offer.

04

Once you have completed the form, review it carefully for any errors or missing information. It is important to ensure that all the details are correct before submitting the agreement.

05

After filling out the streamlined sales and use tax agreement, you may need to submit it to the appropriate tax authority. This may vary depending on your state, so check with your local government to determine where you should send the form.

Who needs streamlined sales and use tax agreement?

01

Businesses that engage in interstate sales: The streamlined sales and use tax agreement is particularly relevant for businesses that conduct sales across state lines. It helps businesses comply with the various tax laws and regulations of different states, making it easier to handle tax obligations.

02

Online sellers: As e-commerce continues to grow, businesses that sell products or services online may also be required to comply with the streamlined sales and use tax agreement. This ensures that online sellers collect and remit the appropriate sales taxes for customers located in different states.

03

Small businesses: The streamlined sales and use tax agreement can be beneficial for small businesses that may not have the resources or expertise to navigate the complex landscape of state tax laws. By participating in the agreement, small businesses can streamline their tax compliance processes and reduce the risk of penalties or fines.

In conclusion, filling out the streamlined sales and use tax agreement involves gathering the necessary information, understanding the requirements, completing the form accurately, and submitting it to the appropriate tax authority. This agreement is particularly important for businesses engaged in interstate sales, online sellers, and small businesses looking to simplify their tax compliance processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in streamlined bsalesb and use?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your streamlined bsalesb and use to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit streamlined bsalesb and use in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your streamlined bsalesb and use, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out streamlined bsalesb and use using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign streamlined bsalesb and use and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is streamlined bsalesb and use?

Streamlined sales and use tax is a program designed to simplify and modernize sales and use tax collection and administration across states.

Who is required to file streamlined bsalesb and use?

Retailers who make sales in multiple states that are part of the Streamlined Sales and Use Tax Agreement (SSUTA) are required to file streamlined sales and use tax.

How to fill out streamlined bsalesb and use?

Retailers can fill out streamlined sales and use tax by registering with the Streamlined Sales Tax Governing Board and following the guidelines set forth by the board.

What is the purpose of streamlined bsalesb and use?

The purpose of streamlined sales and use tax is to make it easier for retailers to collect and remit sales tax across multiple states, ultimately simplifying the tax administration and compliance process.

What information must be reported on streamlined bsalesb and use?

Retailers must report sales made in participating states, amount of sales tax collected, and any exemptions or exclusions claimed.

Fill out your streamlined bsalesb and use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Streamlined Bsalesb And Use is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.