Get the free Financial Literacy And Income Tax Understanding b...b - BizEd Logic - irs

Show details

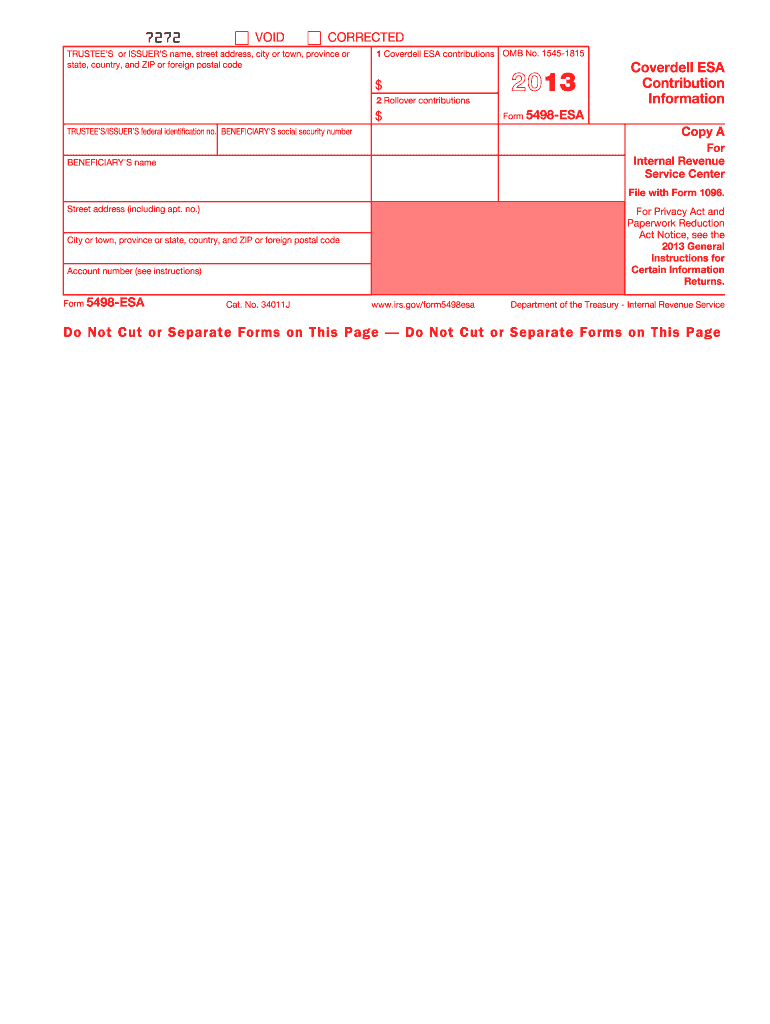

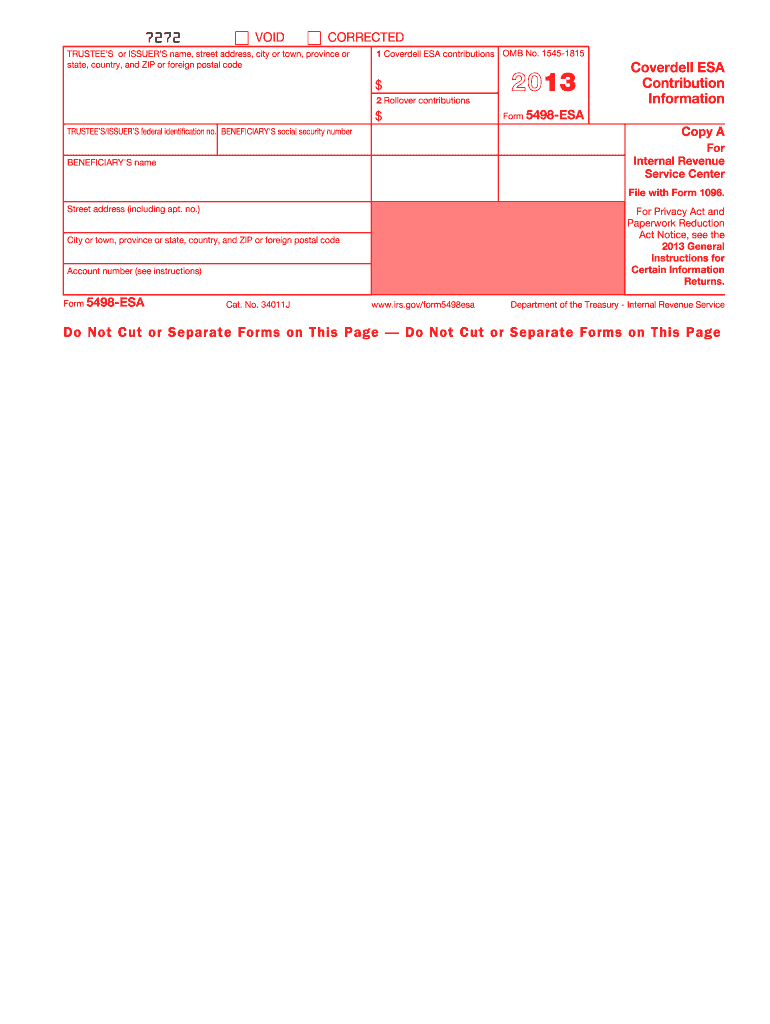

... their future post-secondary education. Conditions apply. See http://www.irs.gov /pub/ irs-pdf/f5498e 13.pdf and http://www.irs.gov/pub/irs-pdf/ f1099q 13.pdf.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial literacy and income

Edit your financial literacy and income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial literacy and income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial literacy and income online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial literacy and income. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial literacy and income

How to fill out financial literacy and income?

01

Start by assessing your current financial situation. Take stock of your income, expenses, and debts. This will give you a clear picture of where you stand financially.

02

Create a budget. Determine your monthly income and allocate it towards different categories such as rent/mortgage, food, transportation, savings, and debt repayment. This will help you manage your money effectively and ensure that you're not spending more than you earn.

03

Educate yourself about personal finance. Learn about basic financial concepts such as budgeting, saving, investing, and debt management. There are many resources available online, such as financial blogs, books, and podcasts, that can provide valuable information to enhance your financial literacy.

04

Set financial goals. Whether it's saving for retirement, buying a house, or paying off debt, having clear financial goals will motivate you to make better financial decisions. Break down your goals into smaller, achievable steps and track your progress regularly.

05

Establish an emergency fund. Aim to save three to six months' worth of living expenses in case of unexpected events like job loss or medical emergencies. Having a financial safety net will provide peace of mind and protect you from falling into debt.

06

Minimize and manage your debt. Prioritize paying off high-interest debts, such as credit card balances, as soon as possible. Consider debt consolidation or refinancing options to lower interest rates and make repayment more manageable.

07

Invest in your financial future. Explore different investment options such as stocks, bonds, mutual funds, or real estate. Consult with a financial advisor to understand the risk and return associated with each investment and build a diversified portfolio that aligns with your financial goals.

Who needs financial literacy and income?

01

Young adults entering the workforce: Establishing good financial habits early on can set the foundation for a secure financial future. Learning about budgeting, saving, and investing will help young adults make informed decisions about their income and manage their finances effectively.

02

Individuals with debt: Financial literacy is essential for those dealing with debt. Learning how to manage and reduce debt can help individuals regain control of their finances and work towards a debt-free life.

03

Small business owners: Understanding financial literacy is crucial for small business owners. It allows them to make informed decisions about managing business finances, optimizing cash flow, and planning for future growth.

04

Retirees and pre-retirees: As individuals approach retirement, financial literacy becomes increasingly important. Planning for retirement income, managing pensions and investments, and making informed decisions about healthcare costs are essential to ensure a comfortable retirement.

05

Everyone else: Financial literacy is beneficial for everyone, regardless of age or income level. It empowers individuals to make informed financial decisions, save for the future, and avoid common financial pitfalls.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial literacy and income for eSignature?

When your financial literacy and income is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my financial literacy and income in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your financial literacy and income right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit financial literacy and income on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share financial literacy and income on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is financial literacy and income?

Financial literacy refers to the ability to understand and manage various aspects of personal finances, while income is the money that an individual receives through work or investments.

Who is required to file financial literacy and income?

Individuals who earn income and are required to pay taxes are typically required to file financial literacy and income.

How to fill out financial literacy and income?

Financial literacy and income can be filled out by providing accurate information about your sources of income, expenses, assets, and liabilities.

What is the purpose of financial literacy and income?

The purpose of financial literacy and income is to provide a comprehensive overview of an individual's financial situation and help them make informed decisions about their money.

What information must be reported on financial literacy and income?

Information such as sources of income, expenses, assets, liabilities, and any other relevant financial details must be reported on financial literacy and income forms.

Fill out your financial literacy and income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Literacy And Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.