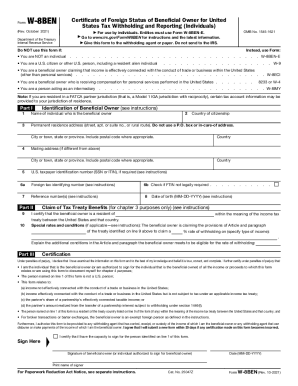

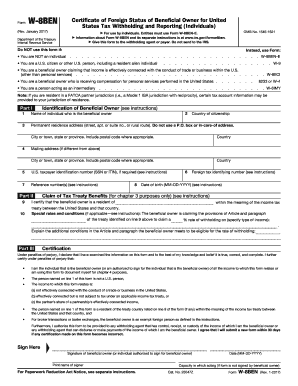

Who Fills out Form W-8BEN?

This US Internal Revenue Service form is fully called the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). It must be filled out by foreign individuals for documenting their foreign status and claiming any applicable treaty benefits for the purposes described in chapter 3. Yet, it must be mentioned that the form is applicable only in case a tax treaty between the foreigner’s country of origin and the United Stated has been signed. A tax treaty guarantees a reduced rate or exemption from withholding of all or certain items of income if the (payer) of the income is properly notified.

Is Form W-8BEN Accompanied by any other Documents?

So far as the form is filled out when a withholding agent asks the foreign individual about it, the accompanying documents can be requested at their discretion. Typically, form W-8BEN is submitted along with form W-8 (Certificate of Foreign Status).

When is Form W-8BEN Due?

As it has been mentioned, the form is filled out only upon request, which is always made prior to the payment.

How do I Fill out Form W-8BEN?

The IRS provides comprehensive instructions on filling out the form at their website that can be referred to in case you face any difficulties with the fillable document.

In any case, the one-page form is very straightforward and asks for the following details:

- Personal information about the owner (name, citizenship, residence address, SSN or ITIN, DOB, etc.);

- Claim of tax treaty benefits;

- Certification (the date, name and signature of the beneficial owner).

Where do I file Form W-8BEN?

The filled out document must be directed to the requestor of the form.