Get the free Regular Premium payment - SBI LIFE

Show details

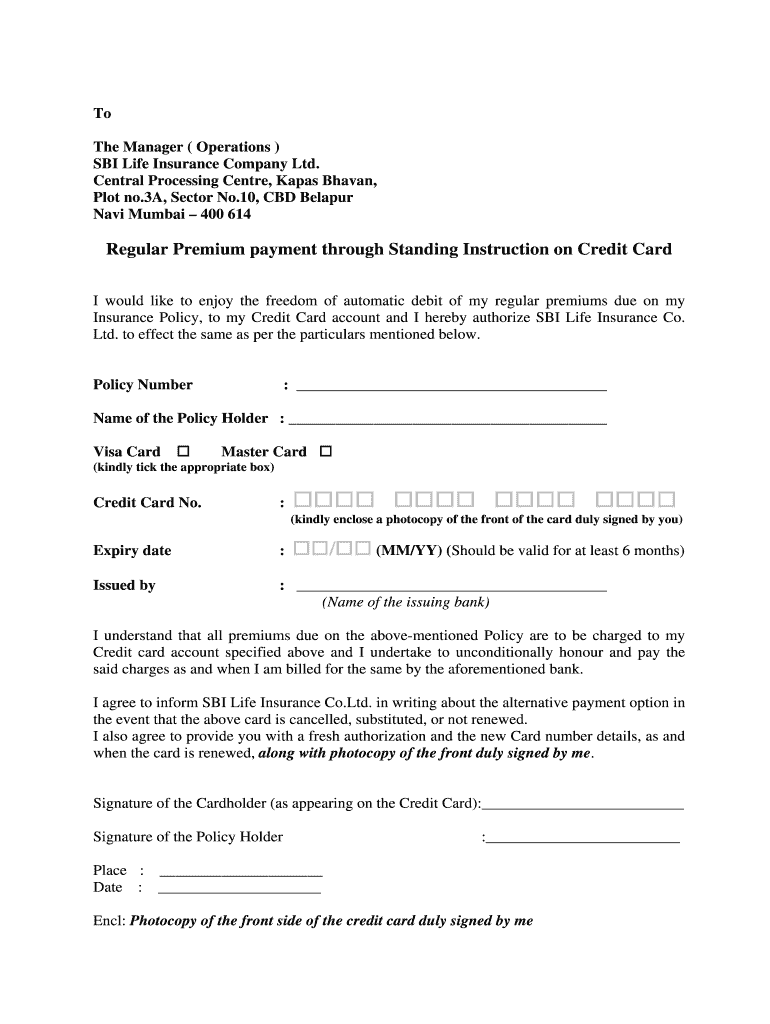

To The Manager (Operations) SBI Life Insurance Company Ltd. Central Processing Center, Keypad Haven, Plot no.3A, Sector No.10, CBD Belarus Navi Mumbai 400 614 Regular Premium payment through Standing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regular premium payment

Edit your regular premium payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regular premium payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit regular premium payment online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit regular premium payment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

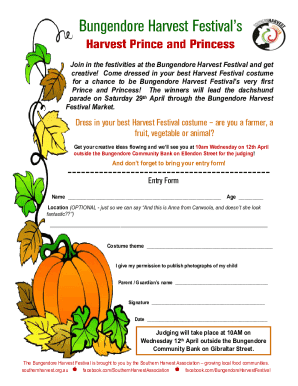

How to fill out regular premium payment

How to fill out regular premium payment:

01

Gather necessary documents: Make sure you have all the required documents with you, such as policy information, payment details, and your personal identification.

02

Choose a payment method: Determine the most convenient payment method for you. It can be through online banking, automatic bank draft, credit card, or by sending a check or money order.

03

Set up automatic payments: If you prefer a hassle-free approach, consider setting up automatic payments with your insurance provider. This ensures that your premium gets deducted from your account on a regular basis without you having to manually make the payment each time.

04

Confirm payment frequency: Regular premium payments can be made monthly, quarterly, semi-annually, or annually. Decide the payment frequency that suits your financial situation and aligns with your budget.

05

Double-check payment amount: Verify the amount you need to pay as your regular premium. Review your policy and any recent correspondence from your insurance provider to ensure accuracy. If there are any discrepancies, contact your insurance company to resolve them.

06

Make the payment: Complete the payment process according to your chosen method. Ensure that you enter accurate information and follow any specific instructions provided by your insurance provider.

07

Keep records: It's essential to keep a record of your premium payments for future reference. Save copies of your payment confirmations, receipts, or any other documentation to maintain a clear payment history.

Who needs regular premium payment?

01

Individuals with insurance policies: Regular premium payments are typically required for various types of insurance policies, such as life insurance, health insurance, auto insurance, and homeowners insurance.

02

Policyholders looking to maintain coverage: Paying regular premiums ensures that you maintain your insurance coverage. This means that in the event of a claim, you'll be entitled to the benefits and protection outlined in your policy.

03

Those seeking financial security: Regular premium payments contribute to your financial security by providing insurance coverage in case of unforeseen events. It helps mitigate the financial impact on you or your loved ones in difficult situations.

04

People who want peace of mind: By regularly paying your premiums, you can have peace of mind knowing that you and your assets are protected. Insurance provides a safety net, and regular payments are necessary to uphold that security.

05

Individuals looking to comply with insurance contracts: Most insurance contracts stipulate that regular premium payments must be made to maintain coverage. By adhering to these terms, you ensure that your policy remains active and valid.

Remember, it's always advisable to consult with your insurance provider regarding specific payment details or any queries you may have concerning regular premium payment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send regular premium payment for eSignature?

When your regular premium payment is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my regular premium payment in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your regular premium payment right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit regular premium payment on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing regular premium payment.

What is regular premium payment?

Regular premium payment is a fixed amount of money paid at consistent intervals, typically monthly, quarterly, or annually, for an insurance policy or investment.

Who is required to file regular premium payment?

Individuals or businesses who have purchased an insurance policy or investment that requires regular premium payments are required to file them.

How to fill out regular premium payment?

Regular premium payments can be filled out by submitting the required payment amount by the specified due date through various payment methods provided by the insurance company or investment firm.

What is the purpose of regular premium payment?

The purpose of regular premium payment is to ensure that the insurance policy or investment remains active and in force, providing coverage and benefits as outlined in the terms of the contract.

What information must be reported on regular premium payment?

The information required to be reported on regular premium payment includes the policyholder's name, policy number, payment amount, payment date, and any other relevant details specified by the insurance company or investment firm.

Fill out your regular premium payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regular Premium Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.