Get the free Net Profit From Business - Silva's Financial Services

Show details

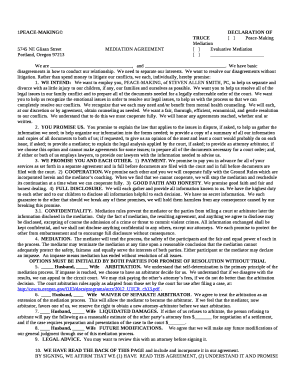

SCHEDULE C-EZ (Form 1040) Department of the Treasury Internal Revenue Service (99) OMB No. 1545-0074 Net Profit From Business (Sole Proprietorship) Partnerships, joint ventures, etc., generally must

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign net profit from business

Edit your net profit from business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your net profit from business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing net profit from business online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit net profit from business. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out net profit from business

How to fill out net profit from business:

01

Start by calculating your total revenue for the accounting period. This includes all income generated from sales, services, or any other sources related to your business.

02

Deduct all direct costs associated with your business operations. These costs may include materials, labor, and other expenses directly tied to producing your goods or delivering your services.

03

Subtract any indirect costs or overhead expenses. These expenses are not directly tied to your business operations but are necessary for running your business, such as rent, utilities, or insurance.

04

Deduct any interest or taxes paid by your business. This may include interest on loans or credit cards, as well as any income taxes owed to the government.

05

After deducting all expenses, you will arrive at your net profit figure. This represents the amount of money your business has earned after all expenses have been accounted for.

Who needs net profit from business:

01

Business owners and entrepreneurs rely on net profit to assess the financial health and profitability of their business. It helps them make informed decisions, such as investing in growth opportunities or identifying areas for cost reduction.

02

Investors and shareholders also need to know the net profit of a business to evaluate its performance and potential return on investment. It provides them with insights into the company's profitability and its ability to generate returns.

03

Lenders and financial institutions often require net profit information when considering business loan applications. It helps them assess the borrower's ability to repay the loan and manage their finances effectively.

04

Government entities and tax authorities may require net profit information to calculate and verify tax obligations. This ensures businesses are accurately reporting their earnings and paying the appropriate taxes.

05

Industry analysts and researchers study net profit figures to analyze market trends, evaluate industry performance, and make forecasts. This information helps them understand the overall economic landscape and make strategic recommendations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my net profit from business in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your net profit from business and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for signing my net profit from business in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your net profit from business right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out net profit from business on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your net profit from business from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your net profit from business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Net Profit From Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.