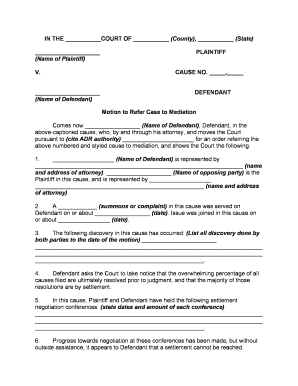

Get the free affidavit of no mortgage

Show details

THIS AFFIDAVIT WHEN COMPLETED IS TO BE SIGNED AND NOTARIZED. BEFORE RETURNING, BE SURE TO COMPLETE ALL THE REQUIRED INFORMATION TO ENABLE THIS COMPANY TO PROPERLY PROCESS THE TRANSACTION PRESENTLY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign affidavit of no mortgage

Edit your affidavit of no mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit of no mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit of no mortgage online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit affidavit of no mortgage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit of no mortgage

How to fill out an affidavit of no mortgage:

01

Begin by gathering all relevant information about the property in question, including the address, legal descriptions, and any other identifying details.

02

Clearly state your relationship to the property, such as being the owner, tenant, or potential buyer. Specify your intent for filling out the affidavit, whether it is for a legal transaction or for personal record-keeping purposes.

03

Provide your full legal name, address, and contact information. If applicable, include any co-owners or co-signers and their information as well.

04

In the affidavit, clearly and truthfully declare that there are no outstanding mortgages or liens on the property. Include details on any past mortgages that have been fully paid off or discharged, if applicable.

05

Sign and date the affidavit in the presence of a notary public or other authorized person. Make sure to have the affidavit properly notarized, as this will validate the document and make it legally binding.

Who needs an affidavit of no mortgage:

01

Property owners or potential buyers who want to assert or confirm that the property in question does not have any existing mortgages or liens.

02

Individuals involved in legal transactions, such as real estate agents, lawyers, or property developers, who require a certified statement of the property's mortgage-free status.

03

Financial institutions or lenders that need assurance that a property is free of any existing mortgages before issuing a new loan or line of credit secured by the property.

Remember, it is essential to consult with a lawyer or legal professional for specific guidance and to ensure that the affidavit of no mortgage meets all necessary requirements according to your jurisdiction.

Fill

form

: Try Risk Free

People Also Ask about

What is a deed of trust vs mortgage?

A mortgage has just two parties: the borrower and the lender. A deed of trust, however, has an additional third party, called a "trustee" who holds onto the title of the home until the loan is repaid.

What is the difference between a deed and a deed of trust?

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

What is the difference between a promissory note and a deed of trust?

While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt. A borrower signs the promissory note in favor of a lender. The promissory note includes the loan's terms, such as payment obligations and the loan's interest rate.

What is the purpose of deed of trust?

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

What is the disadvantage of a deed of trust?

This can mean a larger degree of risk to the borrower. Bankruptcy is likely the most dreaded consequence of the trust deed, which can affect credit for years to follow, and even cause a family to be homeless. Another disadvantage to buyers is that trust deeds do result in a higher purchase cost of real estate.

Why would someone use a deed of trust?

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send affidavit of no mortgage for eSignature?

When you're ready to share your affidavit of no mortgage, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete affidavit of no mortgage online?

Easy online affidavit of no mortgage completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit affidavit of no mortgage on an iOS device?

Create, modify, and share affidavit of no mortgage using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is affidavit of no mortgage?

An affidavit of no mortgage is a legal document that states a property is free of any mortgages or liens at the time it is executed.

Who is required to file affidavit of no mortgage?

Typically, the property owner or seller is required to file an affidavit of no mortgage when transferring ownership or during a title search.

How to fill out affidavit of no mortgage?

To fill out an affidavit of no mortgage, the individual must provide their name, property details, a statement declaring there are no mortgages, and sign in front of a notary public.

What is the purpose of affidavit of no mortgage?

The purpose of an affidavit of no mortgage is to assure potential buyers or lenders that the property is not encumbered by any debt, thereby facilitating a clear title transfer.

What information must be reported on affidavit of no mortgage?

The affidavit must typically include the property owner's name, property address, a statement confirming no existing mortgages or liens, and details regarding the signing party.

Fill out your affidavit of no mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Of No Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.