PA REV-346 EX 2006 free printable template

Show details

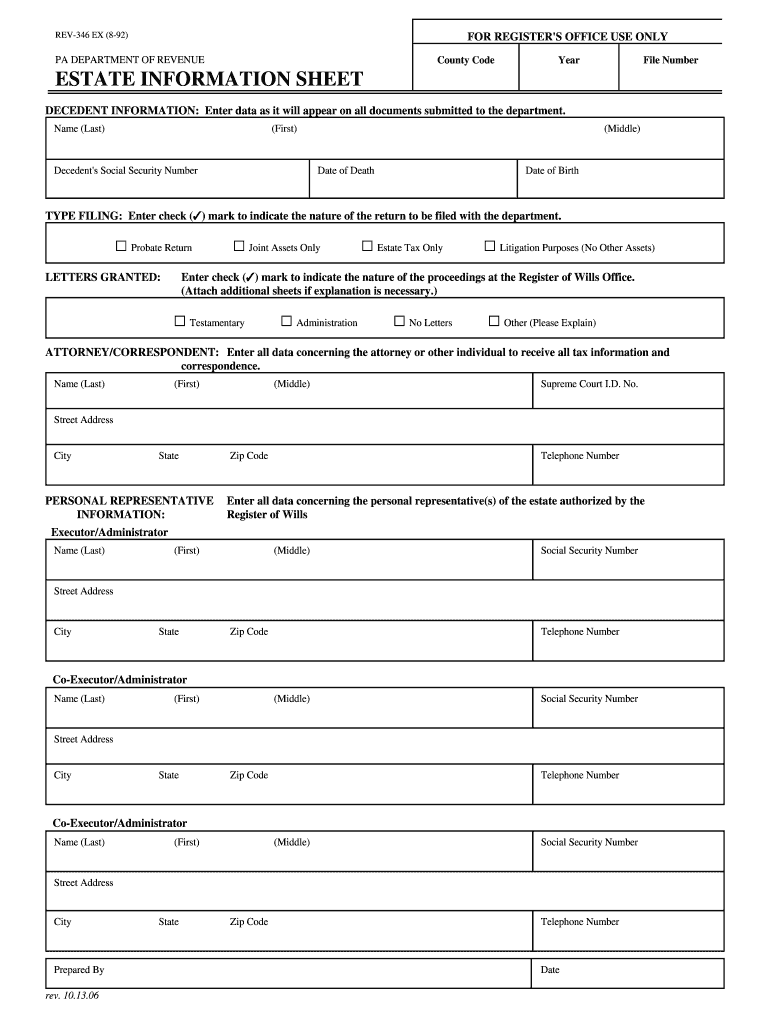

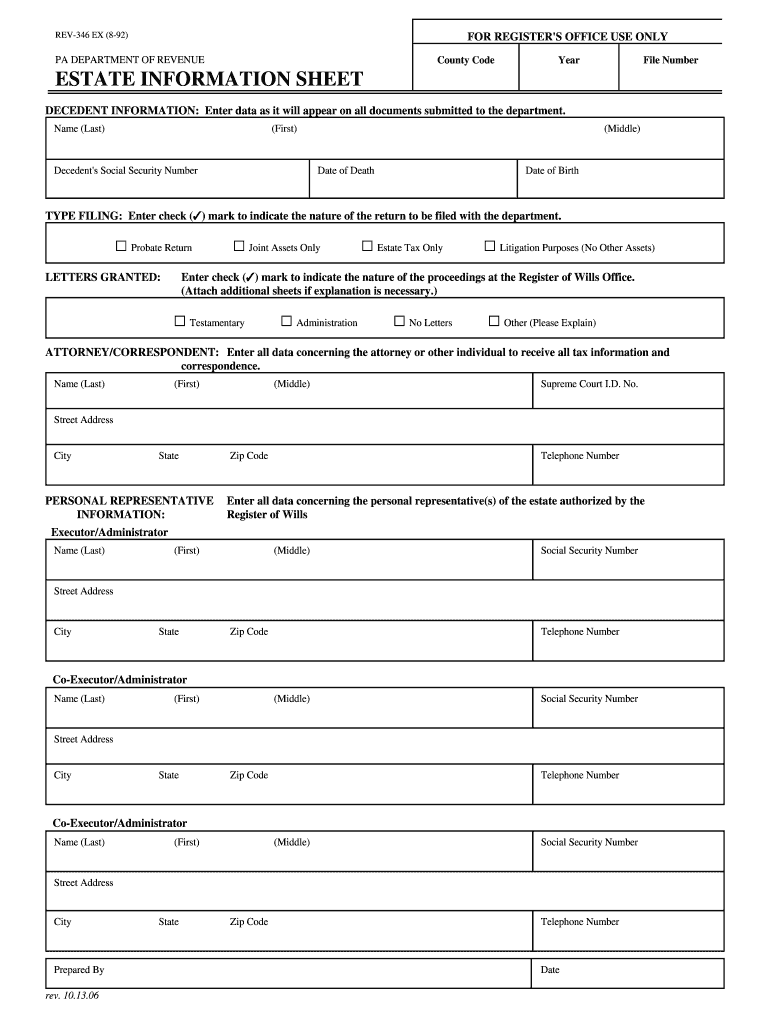

REV-346 EX (8-92) FOR REGISTER'S OFFICE USE ONLY PA DEPARTMENT OF REVENUE County Code Year File Number ESTATE INFORMATION SHEET DECEDENT INFORMATION: Enter data as it will appear on all documents

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-346 EX

Edit your PA REV-346 EX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-346 EX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA REV-346 EX online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA REV-346 EX. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-346 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-346 EX

How to fill out PA REV-346 EX

01

Obtain the PA REV-346 EX form from the Pennsylvania Department of Revenue website or your local tax office.

02

Fill in the taxpayer's name, address, and identification number at the top of the form.

03

Provide details related to the property, including its address and type.

04

Indicate the reason for the exemption by checking the appropriate box.

05

Complete any additional sections that apply to your situation, such as income information or supporting documentation requirements.

06

Sign and date the form at the bottom.

07

Submit the form by mailing it to the appropriate county office or local tax authority as specified on the form.

Who needs PA REV-346 EX?

01

Property owners in Pennsylvania who are claiming a property tax exemption or exclusion.

02

Individuals or organizations that qualify for specific exemptions outlined by Pennsylvania tax laws.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to open an estate in PA?

Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.

Do you have to probate a will in PA?

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

What is a letter of administration for an estate in Pennsylvania?

Letters Testamentary will be granted (or Letters of Administration in the case of intestacy), which Letters give the personal representative the authority to act on behalf of the estate. These Letters are typically advertised promptly, in order to discover and give notice to any estate creditors.

How do I open an estate for a deceased person in Pennsylvania?

To open an estate and proceed with this, a personal representative must file a Petition for Grant of Letters and the decedent's death certificate with the local Register of Wills. It is recommended that they work with estate attorneys in Pennsylvania to prepare the Petition and file it appropriately.

How long does it take to probate a will in PA?

On average, the probate process will take about a year and a half from the date of a loved one's death to be complete in Pennsylvania. However, in circumstances where there are more complex issues involved in the estate or unique family dynamics, this process can take even longer.

What do I need to open an estate in Pennsylvania?

Along with the petition for grant of letters, the petitioner must generally provide the following documents to open an estate in Pennsylvania: Original will or codicil. Death certificate. Estate information sheet. Bond. Renunciations. Witness affidavits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find PA REV-346 EX?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the PA REV-346 EX. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out PA REV-346 EX using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign PA REV-346 EX. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit PA REV-346 EX on an Android device?

You can make any changes to PDF files, like PA REV-346 EX, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is PA REV-346 EX?

PA REV-346 EX is a form used in Pennsylvania for reporting certain tax-exempt transactions and is typically associated with the state's sales and use tax.

Who is required to file PA REV-346 EX?

Individuals or businesses that engage in tax-exempt transactions in Pennsylvania, such as purchases for resale or non-profit organizations, are required to file PA REV-346 EX.

How to fill out PA REV-346 EX?

To fill out PA REV-346 EX, provide the seller's information, your name and address, details of the transaction, and the reason for exemption, along with any supporting documentation.

What is the purpose of PA REV-346 EX?

The purpose of PA REV-346 EX is to document and validate tax-exempt sales and purchases for compliance with Pennsylvania's sales and use tax laws.

What information must be reported on PA REV-346 EX?

The information that must be reported on PA REV-346 EX includes the buyer's and seller's names and addresses, the nature of the transaction, the specific reason for exemption, and any relevant dates or transaction details.

Fill out your PA REV-346 EX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-346 EX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.