PA REV-346 EX 2015 free printable template

Show details

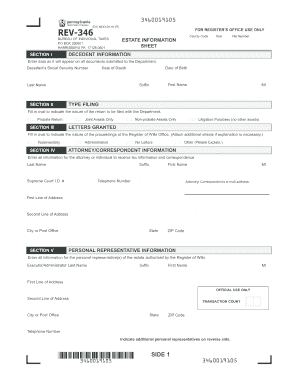

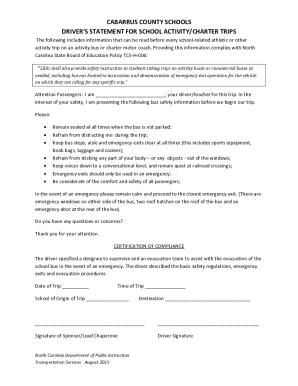

3460015105 FORREGISTERSOFFICEUSEONLY County Code Year REV346 EX (1115) ESTATEINFORMATION SHEET File Number 1 DECEDENTINFORMATION: Enterdataasitwillappearonall START Decedents Social Security Number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-346 EX

Edit your PA REV-346 EX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-346 EX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA REV-346 EX online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA REV-346 EX. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-346 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-346 EX

How to fill out PA REV-346 EX

01

Obtain the PA REV-346 EX form from the Pennsylvania Department of Revenue's official website or your local office.

02

Fill in your personal information in the designated fields, including your name, address, and taxpayer identification number.

03

Provide details about the property in question, including the property address and any relevant identification numbers.

04

Indicate the reason for the exemption by selecting the appropriate option from the provided choices.

05

Attach any required documentation that supports your claim for exemption.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form to the appropriate county or local taxing authority by the designated deadline.

Who needs PA REV-346 EX?

01

Property owners who believe their property qualifies for a tax exemption in Pennsylvania need the PA REV-346 EX form.

02

Individuals or entities seeking a reduction in their property tax liability due to specific exemptions as outlined by state regulations.

03

Organizations such as non-profits or charitable entities that own property and wish to apply for an exemption must complete this form.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to open an estate in PA?

Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.

Do you have to probate a will in PA?

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

What is a letter of administration for an estate in Pennsylvania?

Letters Testamentary will be granted (or Letters of Administration in the case of intestacy), which Letters give the personal representative the authority to act on behalf of the estate. These Letters are typically advertised promptly, in order to discover and give notice to any estate creditors.

How do I open an estate for a deceased person in Pennsylvania?

To open an estate and proceed with this, a personal representative must file a Petition for Grant of Letters and the decedent's death certificate with the local Register of Wills. It is recommended that they work with estate attorneys in Pennsylvania to prepare the Petition and file it appropriately.

How long does it take to probate a will in PA?

On average, the probate process will take about a year and a half from the date of a loved one's death to be complete in Pennsylvania. However, in circumstances where there are more complex issues involved in the estate or unique family dynamics, this process can take even longer.

What do I need to open an estate in Pennsylvania?

Along with the petition for grant of letters, the petitioner must generally provide the following documents to open an estate in Pennsylvania: Original will or codicil. Death certificate. Estate information sheet. Bond. Renunciations. Witness affidavits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA REV-346 EX in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your PA REV-346 EX and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find PA REV-346 EX?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific PA REV-346 EX and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out PA REV-346 EX using my mobile device?

Use the pdfFiller mobile app to complete and sign PA REV-346 EX on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is PA REV-346 EX?

The PA REV-346 EX is a form used by taxpayers in Pennsylvania to claim an exemption from the Pennsylvania personal income tax for certain types of income.

Who is required to file PA REV-346 EX?

Individuals or entities claiming an exemption for specific income types, such as certain retirement and disability income, are required to file the PA REV-346 EX.

How to fill out PA REV-346 EX?

To fill out the PA REV-346 EX, download the form from the Pennsylvania Department of Revenue's website, complete the required sections, including personal information and the income details for which the exemption is being claimed, and submit it as directed.

What is the purpose of PA REV-346 EX?

The purpose of the PA REV-346 EX is to provide taxpayers a means to report and claim certain exemptions from state income tax, helping to ensure that only taxable income is reported.

What information must be reported on PA REV-346 EX?

The PA REV-346 EX must include the taxpayer's name, address, Social Security number, details of the income being exempted, and any supporting documentation that verifies eligibility for the exemption.

Fill out your PA REV-346 EX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-346 EX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.