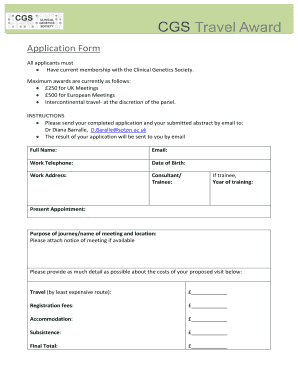

AU MO015 2014-2025 free printable template

Show details

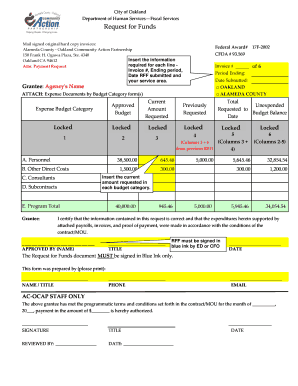

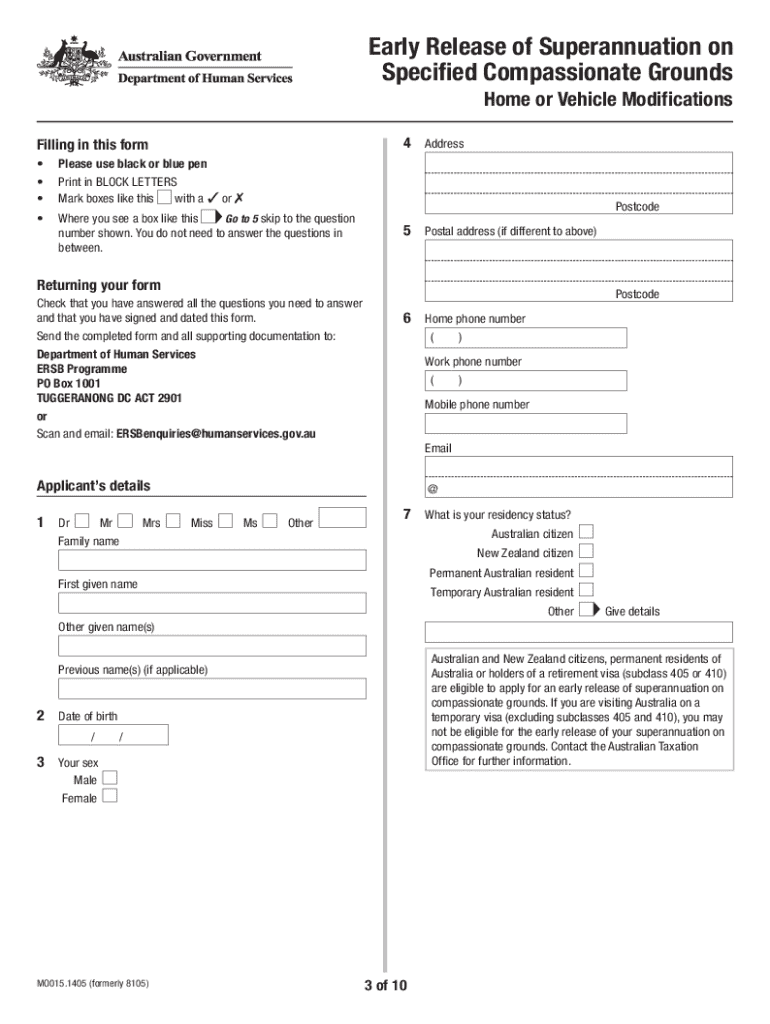

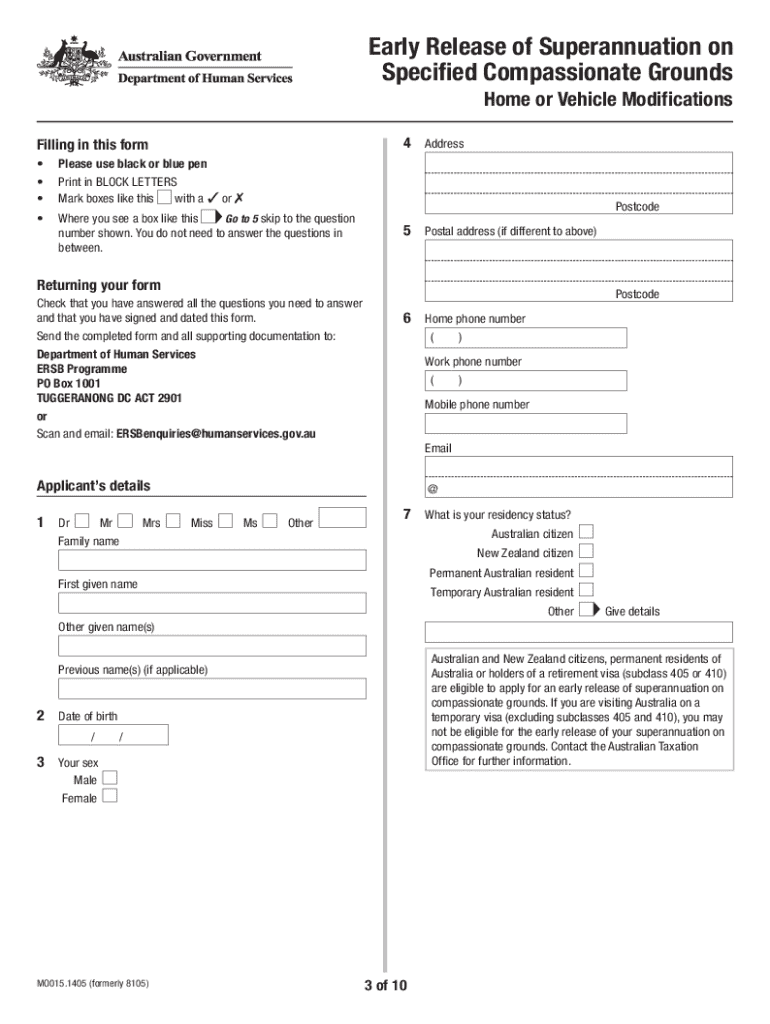

Quotes can be no older than 6 months from the date of this application. Unpaid invoices can be no older than 30 days from the date of this application. vehicle you must provide you or your dependant for a medical condition which states MO015. Early Release of Superannuation on Specified Compassionate Grounds Home or Vehicle Modifications Purpose of this form Documentation for disability aids Use this form to advise the Australian Government Department of Human Services Human Services if you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign centrelink superannuation release form

Edit your centrelink superannuation release form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your centrelink superannuation release form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing centrelink superannuation release form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit centrelink superannuation release form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out centrelink superannuation release form

How to fill out AU MO015

01

Review the form AU MO015 to understand its purpose and components.

02

Provide your personal details in the designated sections, including name and contact information.

03

Fill in any required identification numbers, such as your Social Security Number or Tax ID.

04

Complete the sections related to your financial information or any other relevant data requested.

05

Double-check all entries for accuracy to avoid any delays in processing.

06

Sign and date the form where indicated.

07

Submit the completed form according to the provided instructions (e.g., via mail, online submission, or in person).

Who needs AU MO015?

01

Individuals who are applying for a specific government service or benefit that requires the completion of AU MO015.

02

Organizations or entities that need to provide their information in relation to the service or benefit.

Fill

form

: Try Risk Free

People Also Ask about

Can I transfer my super to my bank account?

Benefits of a bank account in retirement If you transfer your super to a bank account, your balance only changes if you spend money or earn interest. Knowing your balance will remain steady can offer a sense of financial control.

How much can you withdraw from super after 60?

There are absolutely no restrictions to accessing your Super Benefit when aged between 60 and 64 after you are retired. There are two ways you can access your Super; either as a lump-sum payment or as a pension.

How do I claim super severe financial hardship?

Access due to severe financial hardship. Severe financial hardship is not administered by the ATO. You need to contact your super provider to request access to your super due to severe financial hardship. You may be able to withdraw some of your super if you are experiencing severe financial hardship.

How do I get superannuation when I leave Australia?

You need to complete the Application for departing Australia superannuation payment form (NAT 7204) and send one to each of your super funds to apply for your DASP. Paper applications to super funds may incur a cost depending on the value of your super money.

Can I withdraw my super if I move overseas?

If you're an Australian permanent resident or citizen heading overseas, your super remains subject to the same rules, even if you are leaving Australia permanently. This means your super must remain in your super fund/s until you reach preservation age and are eligible to access it.

Can I withdraw my super if I leave Australia permanently?

If you're an Australian citizen leaving permanently, the same rules apply to your super, as if you were living in Australia. This means your super must stay in your super fund(s) until you are eligible to access it.

What age can you withdraw from superannuation?

You can withdraw your super if you're. 65 years or over, whether you keep working or not. 60 or over and change employers or temporarily stop working. Under 60 and have permanently stopped working, and you've met your preservation age.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete centrelink superannuation release form online?

Filling out and eSigning centrelink superannuation release form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the centrelink superannuation release form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your centrelink superannuation release form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete centrelink superannuation release form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your centrelink superannuation release form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is AU MO015?

AU MO015 is a form used for reporting certain tax-related information to the Australian Taxation Office (ATO).

Who is required to file AU MO015?

Entities that have specific obligations under Australian tax law are required to file AU MO015, including businesses and individuals subject to certain taxation requirements.

How to fill out AU MO015?

To fill out AU MO015, gather the necessary information, complete the form by entering the required details accurately, review the entries, and submit the form electronically or as prescribed.

What is the purpose of AU MO015?

The purpose of AU MO015 is to collect information related to tax compliance and ensure that taxpayers meet their obligations under Australian tax law.

What information must be reported on AU MO015?

Information required on AU MO015 typically includes taxpayer identification details, income and expenditure data, and any relevant adjustments or claims for the reporting period.

Fill out your centrelink superannuation release form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Centrelink Superannuation Release Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.