Get the free Salary Reduction Agreement - National Benefit Services, LLC

Show details

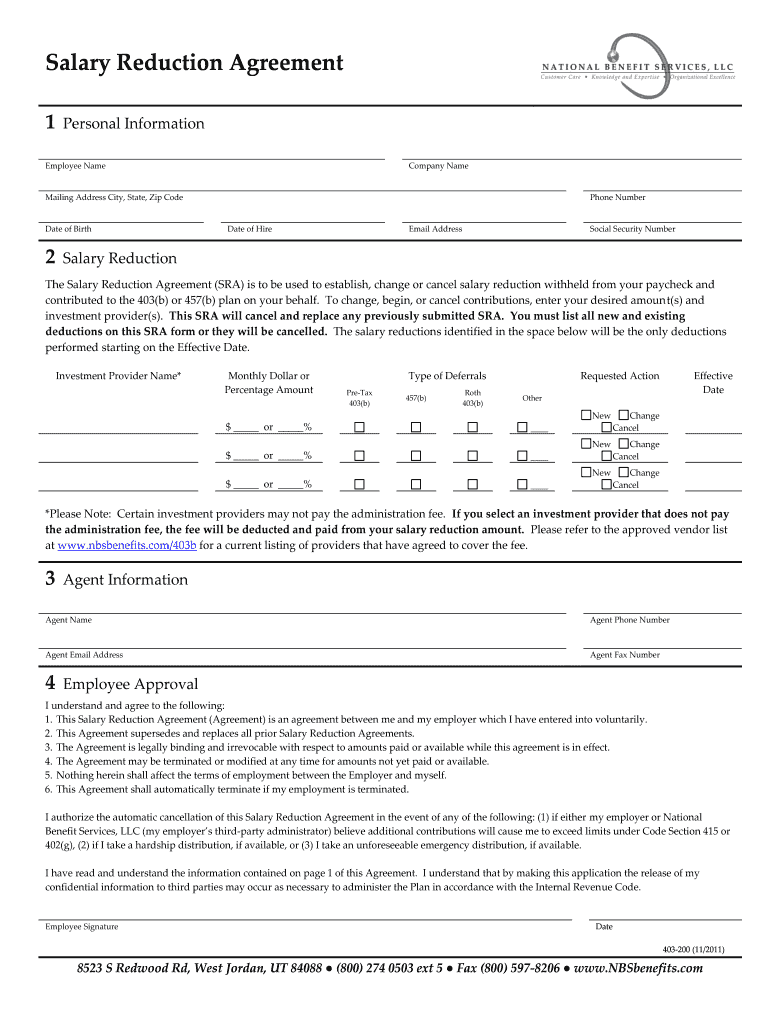

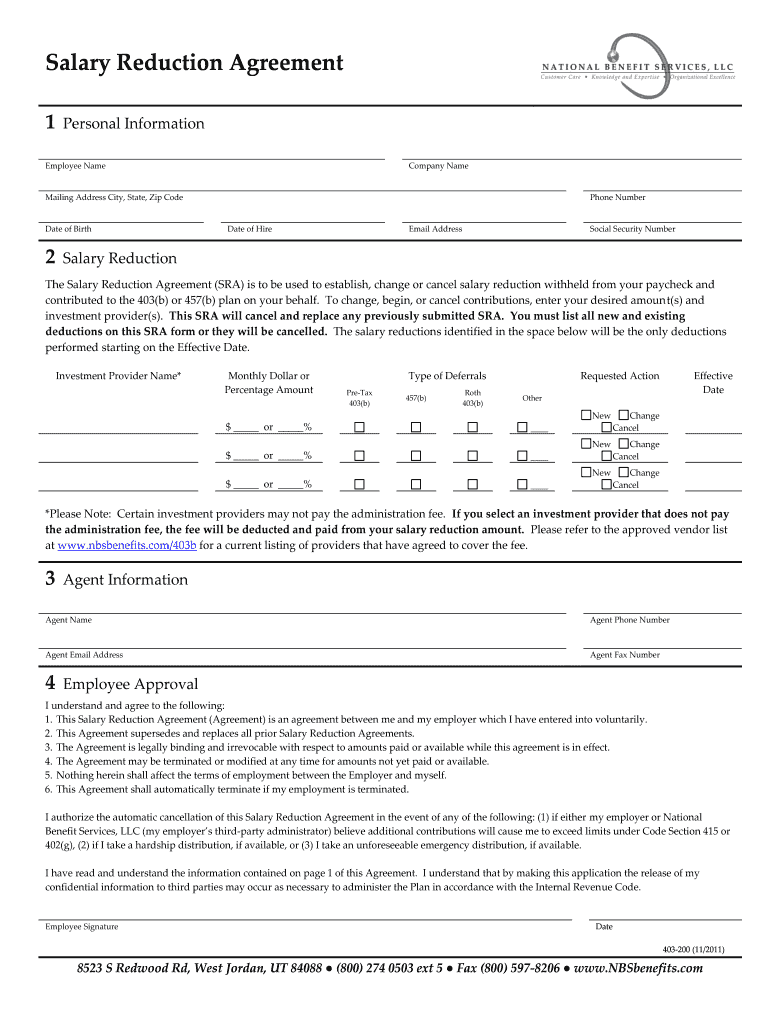

Salary Reduction Agreement 1 Personal Information Employee Name Company Name Mailing Address City, State, Zip Code Date of Birth 2 Phone Number Date of Hire Email Address Social Security Number Salary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary reduction agreement

Edit your salary reduction agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary reduction agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary reduction agreement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit salary reduction agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary reduction agreement

Who needs salary reduction agreement?

01

Employers: Employers may need a salary reduction agreement when they are experiencing financial difficulties or need to make budget cuts. This agreement allows them to reduce their employees' salaries legally and transparently.

02

Employees: Employees who are willing to make temporary sacrifices for the sake of the company's stability or their own job security may also sign a salary reduction agreement. By agreeing to a reduced salary, they help the company avoid layoffs and maintain its operations during challenging times.

03

Labor unions: In some cases, labor unions may negotiate with employers to implement a salary reduction agreement on behalf of their members. This agreement should be in line with the union's collective bargaining agreement and ensure fair treatment for all employees.

How to fill out a salary reduction agreement:

01

Identify the parties involved: Begin the agreement by clearly stating the names and contact details of the employer and the employee(s) who are signing the agreement.

02

Specify the effective date: Clearly indicate the date from which the salary reduction will take effect. It is important to establish a specific timeframe for the reduction, whether it is for a certain number of months, until certain conditions are met, or until further notice.

03

Define the reduction percentage or amount: State the exact reduction percentage or amount that will be deducted from the employee's regular salary. This can be a fixed percentage, a fixed amount, or a combination of both. Ensure that the figures are accurate to avoid any confusion or disputes later on.

04

Outline the purpose: Provide a brief explanation of why the salary reduction is necessary. It could be due to economic downturn, financial difficulties, or the need to maintain the company's workforce during challenging times.

05

Address job security: Emphasize any guarantees or assurances regarding job security. Assure the employee that their position will not be affected solely due to the reduction in salary. This can provide a sense of stability and encourage trust between both parties.

06

Address potential return to regular salary: If there is a possibility of returning to the employee's regular salary in the future (e.g., once the company's financial situation improves), clearly state the conditions and criteria for such adjustments.

07

Signatures and witnesses: Conclude the agreement by ensuring that both parties, the employer and the employee(s), sign and date the document. It is also advisable to have witnesses present who can attest to the agreement's authenticity.

It is important to note that the structure and content of a salary reduction agreement may vary depending on the specific circumstances and legal requirements applicable in different jurisdictions. Therefore, it is recommended to seek legal advice or consult with an employment specialist when drafting or finalizing such agreements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify salary reduction agreement without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your salary reduction agreement into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send salary reduction agreement to be eSigned by others?

Once your salary reduction agreement is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for signing my salary reduction agreement in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your salary reduction agreement and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is salary reduction agreement?

A salary reduction agreement is a legal document that allows an employee to voluntarily reduce their salary in exchange for certain benefits, such as retirement contributions or other tax-deferred savings.

Who is required to file salary reduction agreement?

Employers are required to offer salary reduction agreements to their employees, but it is up to the employee to decide whether or not to participate.

How to fill out salary reduction agreement?

To fill out a salary reduction agreement, the employee must review the terms and conditions, indicate the amount or percentage of their salary to be reduced, and sign the document to acknowledge their agreement.

What is the purpose of salary reduction agreement?

The purpose of a salary reduction agreement is to allow employees to save for retirement or other financial goals on a tax-deferred basis, while also potentially saving the employer money on payroll taxes.

What information must be reported on salary reduction agreement?

The salary reduction agreement should include the employee's name, the amount or percentage of salary being reduced, the effective date of the reduction, and any benefits or contributions being made in exchange for the salary reduction.

Fill out your salary reduction agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Reduction Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.