Get the free Bank Letter of Guarantee Collier County 3-23-13

Show details

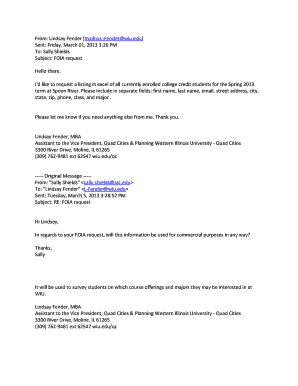

BANK LETTER OF GUARANTEE MUST BE ON YOUR BANKS LETTER HEAD!!! Please ask your bank to complete the following on their Bank Letterhead and forward to Atkinson Realty and Auction, Inc. Atkinson Realty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank letter of guarantee

Edit your bank letter of guarantee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank letter of guarantee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank letter of guarantee online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bank letter of guarantee. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank letter of guarantee

How to fill out bank letter of guarantee:

01

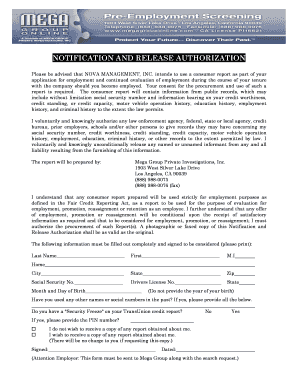

Begin by gathering all necessary documentation and information. This typically includes the name and contact information of the beneficiary (the party who will receive the guarantee), as well as the details of the transaction or project that requires the letter of guarantee.

02

Address the letter to the appropriate banking institution. Include the bank's name, address, and any specific department or contact person if required.

03

Clearly state the purpose of the letter of guarantee. Specify the type of guarantee being issued, whether it is a performance guarantee, payment guarantee, or any other specific type required for the transaction.

04

Provide the necessary details about the beneficiary. This should include their name, address, contact information, and any other relevant identification or reference numbers required by the bank.

05

Outline the terms and conditions of the guarantee. This includes the duration or validity period of the guarantee, the maximum amount covered, any specific conditions or requirements imposed by the bank, and any supporting documents or collateral that may be required.

06

Clearly state the responsibilities and obligations of all parties involved. This should include the obligations of the bank to honor the guarantee when the specified conditions are met, as well as the obligations of the beneficiary to provide any necessary documentation or fulfill their end of the agreed-upon transaction.

07

Review the letter thoroughly for accuracy and completeness. Double-check that all names, figures, and details are correct before finalizing the document.

Who needs a bank letter of guarantee:

01

Businesses involved in international trade often require bank letters of guarantee to ensure payment or performance obligations are met. This includes importers, exporters, and manufacturers engaged in cross-border transactions.

02

Contractors or suppliers participating in government projects may need a bank letter of guarantee to demonstrate their financial stability and ability to complete the project as agreed.

03

Real estate developers or construction companies may need bank letters of guarantee to secure financing or to assure investors that funds will be used appropriately.

04

Individuals or organizations participating in bidding or tender processes may be required to submit a bank letter of guarantee to demonstrate their ability to fulfill the obligations outlined in the contract.

05

Banks themselves often require bank letters of guarantee from customers who are seeking credit or financial services in order to mitigate risk and ensure repayment obligations are met.

In conclusion, the process of filling out a bank letter of guarantee involves gathering necessary information, addressing the letter to the bank, specifying the purpose and type of guarantee, providing details about the beneficiary, outlining terms and conditions, clarifying responsibilities, and reviewing the document for accuracy. Bank letters of guarantee are commonly needed by businesses involved in international trade, contractors, suppliers, real estate developers, individuals participating in bidding processes, and banks themselves.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bank letter of guarantee?

Bank letter of guarantee is a document issued by a bank that promises to pay a certain amount of money to a beneficiary if the applicant fails to fulfill their obligations.

Who is required to file bank letter of guarantee?

Depending on the specific requirements of the transaction or agreement, either the buyer or seller may be required to file a bank letter of guarantee.

How to fill out bank letter of guarantee?

To fill out a bank letter of guarantee, you will need to provide specific details such as the amount guaranteed, the beneficiary's name, the expiration date, and any special conditions.

What is the purpose of bank letter of guarantee?

The purpose of a bank letter of guarantee is to provide security for a transaction or agreement by ensuring that the beneficiary will receive payment if the applicant fails to fulfill their obligations.

What information must be reported on bank letter of guarantee?

The bank letter of guarantee must include details such as the amount guaranteed, the beneficiary's name, the validity period, any special conditions, and the bank's contact information.

How can I modify bank letter of guarantee without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including bank letter of guarantee, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit bank letter of guarantee in Chrome?

bank letter of guarantee can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit bank letter of guarantee on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing bank letter of guarantee.

Fill out your bank letter of guarantee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Letter Of Guarantee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.