Get the free (CREDITS) AND DEPOSIT REVERSAL (DEBIT)

Show details

Marlboro County School District

Direct Deposit Request

AUTHORIZATION AGREEMENT FOR AUTOMATIC DEPOSITS

(CREDITS) AND DEPOSIT REVERSAL (DEBIT)

I authorize THE SCHOOL DISTRICT OF MARLBORO COUNTY hereinafter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credits and deposit reversal

Edit your credits and deposit reversal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credits and deposit reversal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credits and deposit reversal online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credits and deposit reversal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credits and deposit reversal

How to fill out credits and deposit reversal:

01

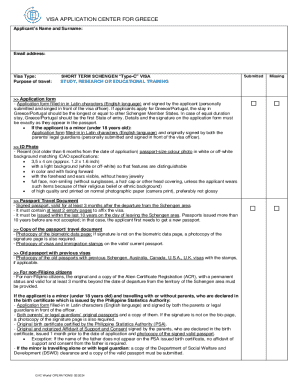

Gather all necessary information: Before starting the process, collect all relevant documents and information such as the account details, transaction dates, amounts, and any supporting documents related to the credit or deposit reversal.

02

Contact your financial institution: Reach out to your bank or credit card issuer through their dedicated customer service line or visit your nearest branch. Inform them about the need for a credit or deposit reversal and ask for their guidance on the necessary steps to take.

03

Follow the instructions provided: The financial institution will provide you with specific instructions on how to fill out the necessary forms for the credit or deposit reversal. Pay close attention to their requirements and guidelines to ensure accurate and prompt processing.

04

Complete the required forms: Fill out the provided forms diligently and ensure accurate information is recorded. Include all required details, such as your account information, the transaction details, and the reason for the credit or deposit reversal request. Double-check the forms for any errors before submitting.

05

Attach supporting documents: If applicable, provide any supporting documentation that substantiates your request for a credit or deposit reversal. This can include receipts, invoices, or any other relevant proof of the error or discrepancy.

06

Review and submit: Once you have completed the forms and attached any necessary documents, carefully review everything for accuracy. Make sure all required fields are filled out, cross-check the information, and confirm that you haven't missed any critical steps. Once you are satisfied, submit the forms and documents as instructed by your financial institution.

Who needs credits and deposit reversal:

01

Individuals who have experienced unauthorized charges: If you notice suspicious activity on your account, such as unauthorized charges or deposits, you may need a credit or deposit reversal. These actions can help you recover any lost funds and rectify the situation.

02

Customers with billing errors: In case of billing errors, such as double charges, overcharges, or incorrect amounts, a credit or deposit reversal may be necessary to correct the discrepancy and ensure accurate financial records.

03

Merchants or businesses processing incorrect transactions: If a merchant or business has processed an incorrect transaction, resulting in an incorrect credit or deposit, they may need to initiate a reversal to correct the error and ensure proper accounting.

Overall, anyone who has encountered a mistake in their credit or deposit transactions should consider filling out a credit or deposit reversal to rectify the error and ensure accurate financial records. It is essential to follow the specific instructions provided by your financial institution for a smooth and efficient resolution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credits and deposit reversal?

Credits and deposit reversal is a process where funds are returned to the original source from which they were received.

Who is required to file credits and deposit reversal?

Any entity or individual who received funds that need to be returned is required to file credits and deposit reversal.

How to fill out credits and deposit reversal?

To fill out credits and deposit reversal, you will need to provide details about the original transaction, the reason for the reversal, and any other relevant information.

What is the purpose of credits and deposit reversal?

The purpose of credits and deposit reversal is to ensure that funds are returned to the correct recipient and to correct any errors in the original transaction.

What information must be reported on credits and deposit reversal?

The information that must be reported on credits and deposit reversal includes the amount of funds being reversed, the reason for the reversal, and any other relevant details.

Where do I find credits and deposit reversal?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the credits and deposit reversal in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute credits and deposit reversal online?

Completing and signing credits and deposit reversal online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the credits and deposit reversal electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your credits and deposit reversal in seconds.

Fill out your credits and deposit reversal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credits And Deposit Reversal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.