Get the free Reducing New-Account Fraud - training cuna

Show details

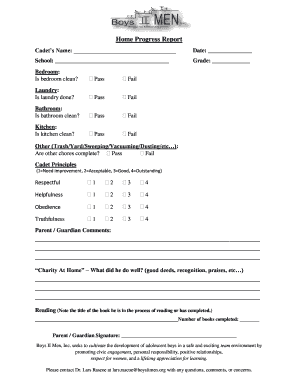

Chapter 1Reducing Account Fraud Stealthy Fraudster

Many frauds are

perpetrated by

criminals who

join your credit

union under false

pretenses. Locks, alarms, cameras, and a safe

or vault protect credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reducing new-account fraud

Edit your reducing new-account fraud form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reducing new-account fraud form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reducing new-account fraud online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reducing new-account fraud. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reducing new-account fraud

How to fill out reducing new-account fraud

01

To fill out reducing new-account fraud, follow these steps:

02

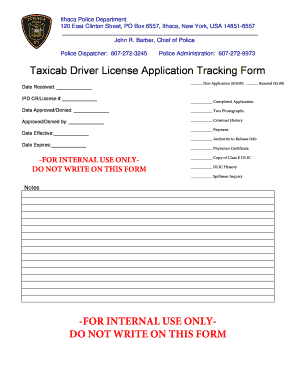

Use strong authentication methods: Implement multi-factor authentication to verify the identity of the account holder.

03

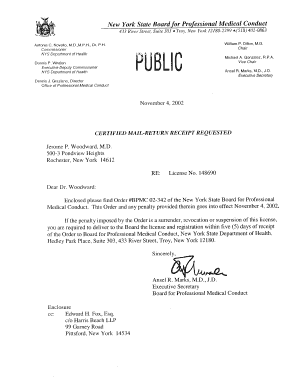

Implement fraud detection tools: Utilize advanced fraud detection systems to identify suspicious activities and prevent fraudulent account creations.

04

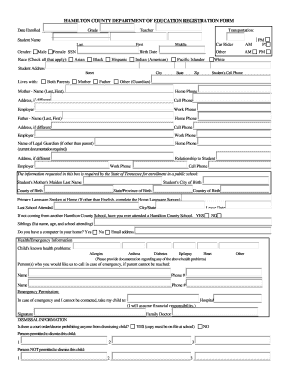

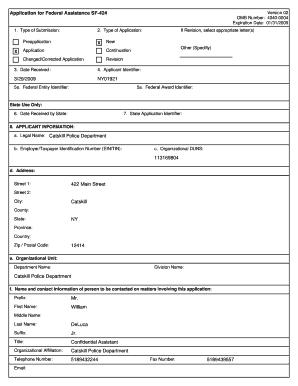

Verify customer information: Collect and validate necessary information from customers, such as identification documents or proof of address.

05

Monitor account activity: Keep a close eye on account activities and transaction patterns to detect any unusual behavior that might indicate potential fraud.

06

Educate customers: Raise awareness among customers regarding common fraud techniques and provide guidance on how to protect their accounts.

07

Regularly update security measures: Stay up to date with the latest security technologies and implement them to safeguard against new fraud techniques.

08

Collaborate with industry partners: Share information and collaborate with other organizations in the industry to stay ahead of new fraud trends.

09

Conduct regular risk assessments: Evaluate the effectiveness of existing fraud prevention measures and identify areas for improvement.

10

Continuously analyze data: Use data analytics to identify patterns and trends that can help in detecting and preventing new-account fraud.

11

Train employees: Provide comprehensive training to employees on fraud prevention strategies and how to identify and handle potential fraud cases.

Who needs reducing new-account fraud?

01

Reducing new-account fraud is crucial for any organization that deals with customer accounts or sensitive information.

02

This includes banks and financial institutions, online marketplaces, e-commerce platforms, healthcare organizations, telecommunication companies, and any business that collects personal and financial data from their customers.

03

Effectively reducing new-account fraud helps protect both the organization and its customers from financial loss, reputational damage, and potential legal consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in reducing new-account fraud without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing reducing new-account fraud and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit reducing new-account fraud straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing reducing new-account fraud, you can start right away.

How do I fill out reducing new-account fraud using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign reducing new-account fraud and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is reducing new-account fraud?

Reducing new-account fraud involves implementing strategies and technologies to prevent unauthorized individuals from opening fraudulent accounts.

Who is required to file reducing new-account fraud?

Financial institutions and businesses that offer new accounts are required to file reducing new-account fraud.

How to fill out reducing new-account fraud?

Reducing new-account fraud can be filled out by providing detailed information on the strategies and technologies implemented to prevent fraud.

What is the purpose of reducing new-account fraud?

The purpose of reducing new-account fraud is to protect consumers and businesses from financial losses due to fraudulent account openings.

What information must be reported on reducing new-account fraud?

Information regarding the specific fraud prevention measures taken, number of fraudulent accounts prevented, and any relevant statistics must be reported on reducing new-account fraud.

Fill out your reducing new-account fraud online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reducing New-Account Fraud is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.