Form 652 ADOR 11017 2014-2026 free printable template

Show details

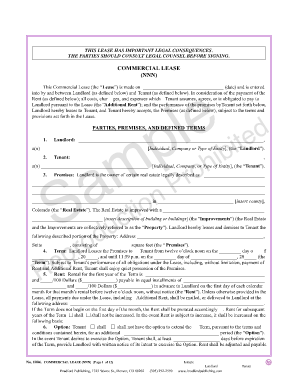

ARIZONA FORM 652 Arizona Department of Revenue Unclaimed Property Section REPORT OF ABANDONED PROPERTY Schedules Schedule A must accompany a Form 650A or 650B and should be utilized ONLY if your report

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Form 652 ADOR 11017

Edit your Form 652 ADOR 11017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Form 652 ADOR 11017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Form 652 ADOR 11017 online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Form 652 ADOR 11017. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Form 652 ADOR 11017

How to fill out Form 652 ADOR 11017

01

Start by downloading Form 652 ADOR 11017 from the official website or obtain a physical copy from your local tax office.

02

Begin with filling out your personal information at the top of the form, including your name, address, and Social Security number.

03

Proceed to the section that requires you to indicate the type of application you're submitting.

04

Follow the instructions for reporting your income and deductions carefully, ensuring all figures are accurate.

05

If applicable, include any necessary attachments or schedules as indicated in the form instructions.

06

Review your completed form for any errors or omissions.

07

Sign and date the form in the designated areas.

08

Submit the form by mail or electronically as directed in the instructions.

Who needs Form 652 ADOR 11017?

01

Form 652 ADOR 11017 is required for individuals and businesses seeking to report certain tax information to the state.

02

It may be needed by taxpayers who are claiming specific credits or exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Can a landlord enter without permission in Washington state?

State law requires both landlords and renters to be reasonable about seeking and granting access to a rental unit (RCW 59.18. 150 ). A landlord cannot enter a renter's home without the occupant's consent.

How do I write a letter to a tenant for late rent?

To date, we have not received your full monthly rent payment. Please understand that failure to pay rent is the most frequent cause for tenants to lose their housing, and we are concerned about the balance due from you. Presently, you have an amount due of $. Please pay this amount immediately.

How much notice does a landlord have to give to enter property in California?

The landlord must give you 24-hour advance written notice before entering. The notice should state a specific time of entry, which must be during normal business hours.

What is a notice to enter form in Texas?

A Texas notice to enter allows a landlord to get tenant consent to enter a rental unit for an authorized reason. Texas state law does not require landlords to obtain permission or provide notice of entry, but general practice calls for landlords to give reasonable notice to tenants based on the condition for access.

How do I write a notice letter to a tenant?

Please accept this letter as three weeks notice of my/our intention to vacate the property at [your address] on [date], as required by clause 88 of our tenancy agreement. I/we will be vacating the above premises and returning the keys on [date].

How do I write a quick notice letter to my tenant?

How to Write a Letter of Notice to a Tenant Determine the notice period. Before you start writing the notice letter, you first have to determine the notice period. Indicate the date of issuance. Write complete addresses. Write salutation. Begin with an introduction. Provide more details in the body. Conclude the letter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Form 652 ADOR 11017?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Form 652 ADOR 11017 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit Form 652 ADOR 11017 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Form 652 ADOR 11017. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit Form 652 ADOR 11017 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Form 652 ADOR 11017 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Form 652 ADOR 11017?

Form 652 ADOR 11017 is a tax form used by the Arizona Department of Revenue for reporting certain tax information.

Who is required to file Form 652 ADOR 11017?

Individuals or businesses that meet specific criteria set by the Arizona Department of Revenue, such as those engaged in certain transactions or activities, are required to file Form 652 ADOR 11017.

How to fill out Form 652 ADOR 11017?

To fill out Form 652 ADOR 11017, gather the necessary documentation, complete the required fields accurately, and ensure that all information is correct before submission.

What is the purpose of Form 652 ADOR 11017?

The purpose of Form 652 ADOR 11017 is to collect specific tax information from taxpayers to ensure compliance with Arizona tax laws.

What information must be reported on Form 652 ADOR 11017?

Information such as taxpayer identification details, income, deductions, and relevant financial data must be reported on Form 652 ADOR 11017.

Fill out your Form 652 ADOR 11017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 652 ADOR 11017 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.