Get the free Legacy Gift Opportunities - City of Naperville

Show details

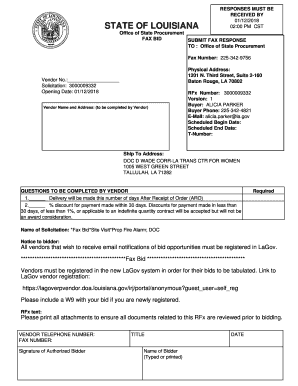

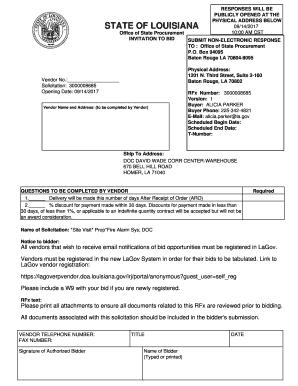

Gift Opportunities create a legacy for generations to come! Have a lasting presence on Naperville s pre-eminent treasure. The Naperville River walk Legacy Gift Opportunities honor a friend remember

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign legacy gift opportunities

Edit your legacy gift opportunities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your legacy gift opportunities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit legacy gift opportunities online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit legacy gift opportunities. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out legacy gift opportunities

How to fill out legacy gift opportunities:

01

Research and understand the organization: Before filling out any legacy gift opportunities, it is important to research and understand the goals, mission, and values of the organization you are considering leaving a legacy gift to. This will help ensure that your gift aligns with their mission and will be used effectively.

02

Determine your objectives: Consider what your objectives are for leaving a legacy gift. Are you looking to support a specific program or project? Do you want to create a lasting impact in a particular area? Understanding your own objectives will help guide your decision-making process.

03

Consult with professionals: Legacy gift opportunities can have complex legal and financial implications. It is advisable to consult with professionals such as an estate planning attorney, financial advisor, or accountant to ensure that your gift is structured in a way that maximizes benefits for both you and the organization.

04

Choose the type of gift: There are various types of legacy gifts, including bequests through a will or trust, beneficiary designations on retirement accounts or life insurance policies, charitable gift annuities, charitable remainder trusts, and more. Consider which option best suits your circumstances and objectives.

05

Determine the amount or percentage: Decide on the amount or percentage of your estate that you would like to leave as a legacy gift. This can be a personal decision based on your financial situation and philanthropic goals.

06

Communicate your intentions: Once you have made the decision to include a legacy gift opportunity in your estate plans, it is essential to communicate your intentions to the organization. This allows them to include you in their legacy society or recognition programs, and ensures that they are aware of your wishes for the gift.

Who needs legacy gift opportunities?

01

Individuals who want to make a lasting impact: Legacy gift opportunities are ideal for individuals who want to leave a lasting impact and support causes or organizations that they care about. By leaving a legacy gift, individuals have the opportunity to make a difference even after they are gone.

02

Donors looking for tax advantages: Legacy gift opportunities can also provide tax advantages for the donor. Depending on the type of gift and the tax laws in your country, you may be eligible for deductions or exemptions that can reduce your estate tax liability.

03

Supporters of organizations with a mission they believe in: Legacy gift opportunities are beneficial for individuals who are passionate about supporting organizations with a mission they believe in. By leaving a legacy gift, you can help ensure the long-term sustainability and success of these organizations.

04

Individuals with significant assets: Legacy gifts often involve donating a portion of one's estate or assets. Therefore, individuals with significant assets or wealth may find legacy gift opportunities a meaningful way to give back and leave a philanthropic legacy.

05

Individuals interested in creating a personal legacy: Leaving a legacy gift allows individuals to create a personal legacy that reflects their values and beliefs. It is a way to be remembered and continue making a difference in the world.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is legacy gift opportunities?

Legacy gift opportunities refers to donations or inheritances left to an organization or individual in a will or estate plan.

Who is required to file legacy gift opportunities?

Any organization or individual who receives a legacy gift must file legacy gift opportunities.

How to fill out legacy gift opportunities?

Legacy gift opportunities can be filled out by providing details of the gift, the donor, and any relevant information about the estate or will.

What is the purpose of legacy gift opportunities?

The purpose of legacy gift opportunities is to track and report any donations or inheritances received through a will or estate plan.

What information must be reported on legacy gift opportunities?

Information such as the amount of the gift, the donor's details, and any conditions or restrictions attached to the gift must be reported on legacy gift opportunities.

How can I modify legacy gift opportunities without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your legacy gift opportunities into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for signing my legacy gift opportunities in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your legacy gift opportunities and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the legacy gift opportunities form on my smartphone?

Use the pdfFiller mobile app to complete and sign legacy gift opportunities on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your legacy gift opportunities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Legacy Gift Opportunities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.