Get the free Apply for Debt Consolidation Plan

Show details

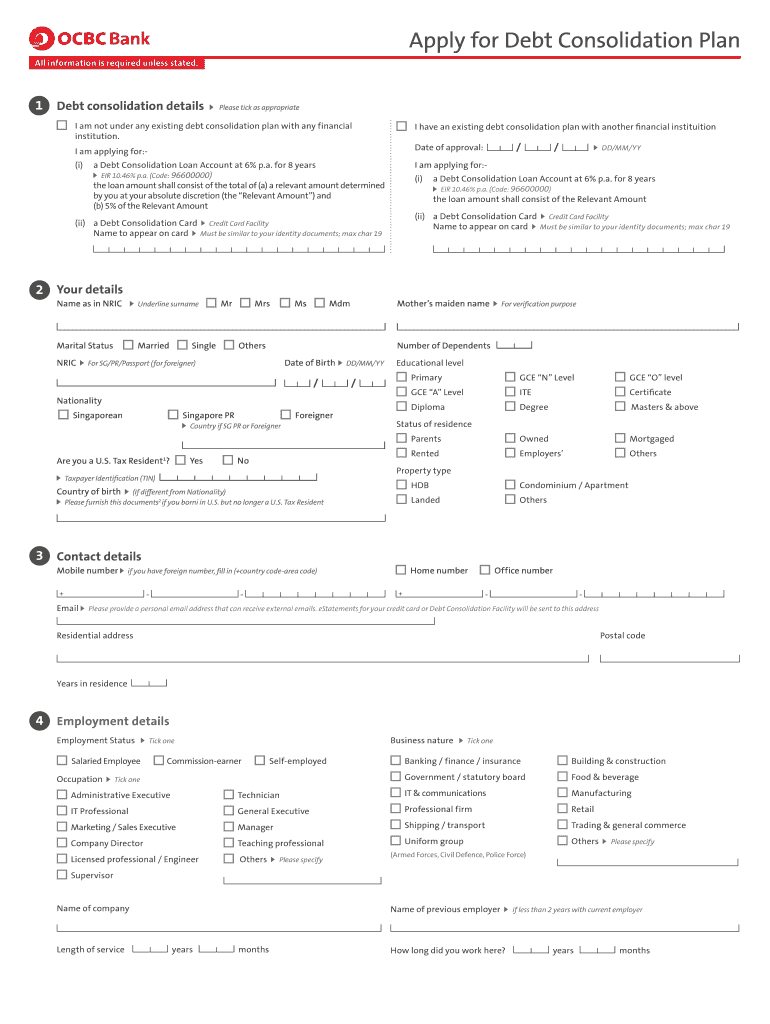

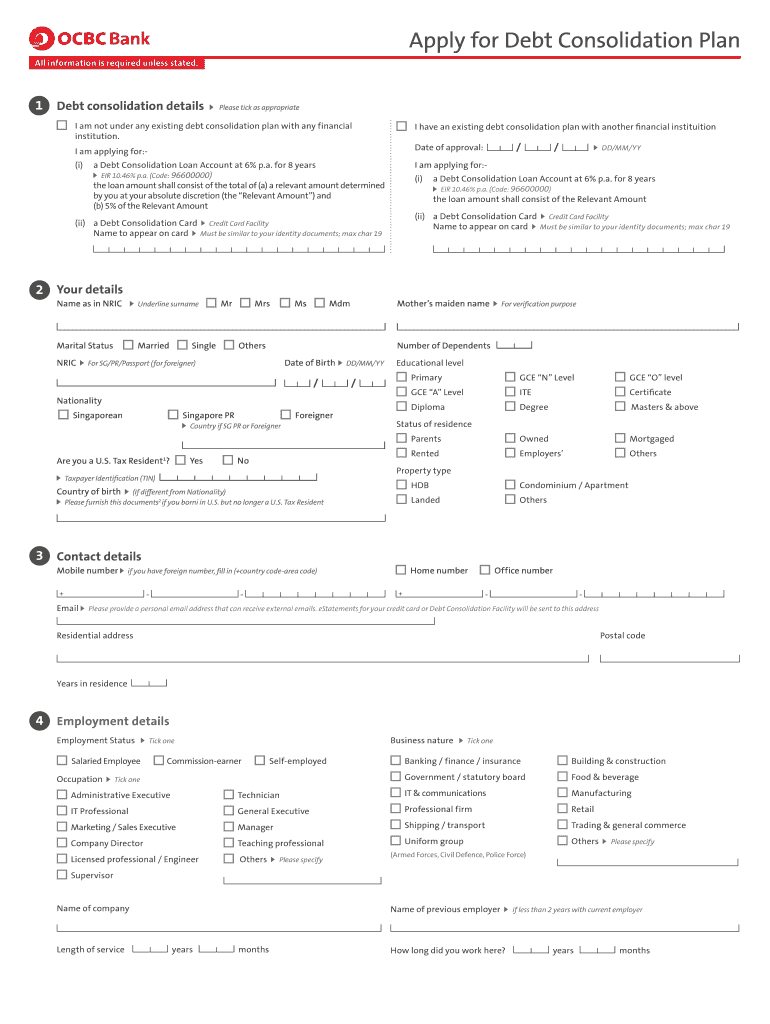

Apply for Debt Consolidation Plan

All information is required unless stated.1 Debt consolidation detailsPlease tick as appropriate am not under any existing debt consolidation plan with any financial

institution.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apply for debt consolidation

Edit your apply for debt consolidation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apply for debt consolidation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing apply for debt consolidation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit apply for debt consolidation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out apply for debt consolidation

How to fill out apply for debt consolidation:

01

Start by gathering all your financial information, including debts, loan balances, interest rates, and monthly payments.

02

Research and compare different debt consolidation options such as balance transfer credit cards, personal loans, or debt consolidation loans.

03

Determine the eligibility criteria and requirements for each option. This may include factors such as credit score, income, and debt-to-income ratio.

04

Choose the debt consolidation option that best suits your needs and preferences.

05

Contact the chosen financial institution or lender to begin the application process.

06

Provide all the necessary information and documentation as requested by the lender. This may include identification proof, proof of income, recent bank statements, and details of your existing debts.

07

Fill out the application form accurately and completely, paying close attention to all the details.

08

Review the application thoroughly before submitting it to ensure accuracy and completeness.

09

Submit the application either online, by mail, or in-person as directed by the lender.

10

Wait for the lender to process your application and communicate their decision to you.

Who needs to apply for debt consolidation:

01

Individuals or families with multiple debts, such as credit card debts, personal loans, or medical bills.

02

Those struggling to keep track of multiple debt payments and due dates.

03

People with high-interest debts who want to reduce their overall interest payments and make their debts more manageable.

04

Individuals looking to simplify their finances and have a single monthly payment for their debts.

05

Those who want to potentially save money by securing lower interest rates through debt consolidation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in apply for debt consolidation?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your apply for debt consolidation to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the apply for debt consolidation in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your apply for debt consolidation right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete apply for debt consolidation on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your apply for debt consolidation. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is apply for debt consolidation?

Applying for debt consolidation involves requesting a new loan or financial product designed to combine multiple debts into a single payment, usually at a lower interest rate.

Who is required to file apply for debt consolidation?

Individuals with multiple outstanding debts who wish to simplify their payments or lower their interest rates are typically required to file for debt consolidation.

How to fill out apply for debt consolidation?

To fill out an application for debt consolidation, gather your financial information, including details about your debts, income, and expenses, then complete the application form provided by the lender or financial institution.

What is the purpose of apply for debt consolidation?

The purpose of applying for debt consolidation is to reduce the number of payments to manage, lower the overall interest rate on debts, and ultimately streamline the process of paying off debts.

What information must be reported on apply for debt consolidation?

The information that must be reported typically includes personal identification details, total outstanding debts, monthly income, expenses, and any other relevant financial information requested by the lender.

Fill out your apply for debt consolidation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Apply For Debt Consolidation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.