Get the free What is Debt Consolidation Plan

Show details

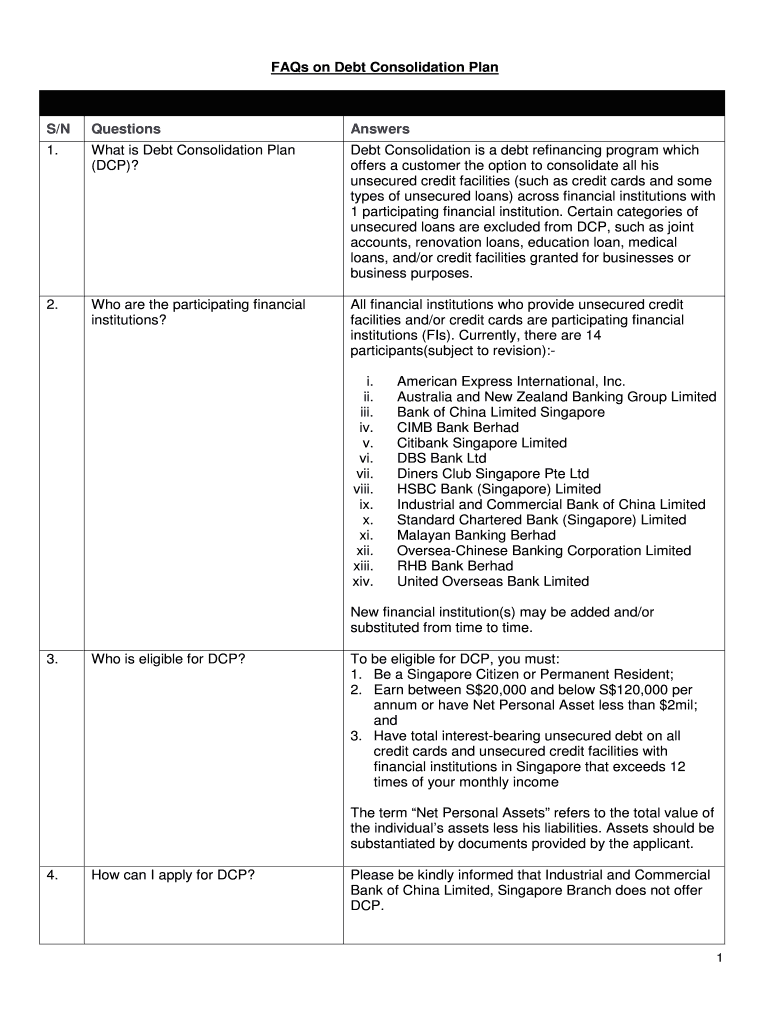

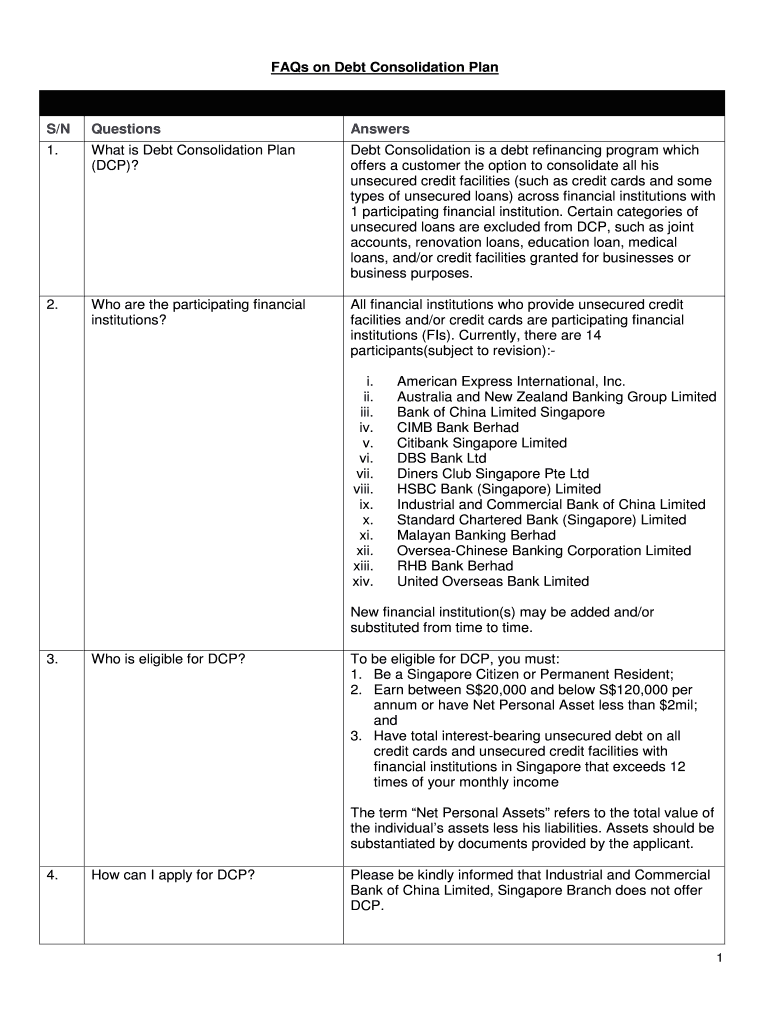

FAQs on Debt Consolidation Plans/NQuestionsAnswers1. What is Debt Consolidation Plan

(DCP)? Debt Consolidation is a debt refinancing program which

offers a customer the option to consolidate all his

unsecured

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is debt consolidation

Edit your what is debt consolidation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is debt consolidation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is debt consolidation online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit what is debt consolidation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is debt consolidation

How to fill out what is debt consolidation:

01

Start by understanding the concept of debt consolidation. Debt consolidation involves combining multiple debts into one larger loan or credit line in order to simplify payments and potentially lower interest rates.

02

Research different debt consolidation options. There are several methods for consolidating debt, including taking out a consolidation loan, using a balance transfer credit card, or utilizing a debt management program. Each option has its own pros and cons, so it's important to compare them and choose the one that best fits your needs.

03

Calculate your total debt. Before applying for any debt consolidation method, it's crucial to have a clear picture of your overall debt. Gather all your loan statements, credit card bills, and other outstanding balances to determine your total debt amount.

04

Assess your financial situation. Look at your income, expenses, and spending habits to determine if debt consolidation is the right solution for you. Consider your ability to make regular payments and whether consolidating your debts will improve your financial situation in the long run.

05

Apply for debt consolidation. Once you have chosen a debt consolidation method, follow the application process outlined by the lender or service provider. This may involve submitting personal and financial information, such as your income, expenses, and credit history.

06

Understand the terms and conditions. Before finalizing any debt consolidation agreement, thoroughly read and understand the terms and conditions of the loan or program. Pay attention to interest rates, repayment period, fees, and any potential consequences of missing payments.

07

Make a repayment plan. Develop a realistic budget and repayment plan that takes into account your consolidated debt. Consider making extra payments when possible to reduce your debt faster and save on interest.

08

Seek professional advice if needed. If you are unsure about which debt consolidation option is best for you or if you need assistance in creating a repayment plan, consider consulting with a financial advisor or credit counselor. They can provide personalized guidance based on your specific financial situation.

Who needs what is debt consolidation:

01

Individuals with multiple debts: Debt consolidation is beneficial for individuals who have multiple debts, such as credit card debt, personal loans, or medical bills. Consolidating these debts can simplify payments and make it easier to manage and track your progress.

02

Those struggling with high interest rates: If you are burdened by high interest rates on your existing debts, consolidating them into a lower-interest loan or credit line can potentially save you money in the long run.

03

Individuals looking for financial stability: Debt consolidation can provide a sense of financial stability by streamlining your debts into one manageable payment. It can also help you regain control of your finances and improve your credit score over time.

04

People seeking to simplify their finances: Keeping track of multiple due dates, interest rates, and monthly payments can be overwhelming. By consolidating your debts, you can simplify your financial life and focus on a single payment each month.

05

Individuals committed to financial discipline: Debt consolidation can be a useful tool for those who are committed to improving their financial habits. It requires discipline to make regular payments and avoid falling back into old spending patterns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send what is debt consolidation for eSignature?

When you're ready to share your what is debt consolidation, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute what is debt consolidation online?

With pdfFiller, you may easily complete and sign what is debt consolidation online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out what is debt consolidation on an Android device?

Use the pdfFiller app for Android to finish your what is debt consolidation. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is debt consolidation?

Debt consolidation is the process of combining multiple debts into a single loan or payment plan, often with the goal of securing a lower interest rate or more manageable monthly payments.

Who is required to file for debt consolidation?

Individuals or businesses looking to simplify their debt repayment process or reduce their overall debt burden may choose to pursue debt consolidation, but there is no specific requirement to file as it is a voluntary financial strategy.

How to fill out debt consolidation applications?

To fill out debt consolidation applications, gather necessary financial information such as outstanding debts, income, and personal details. Complete the application by providing accurate information and details about your current financial situation.

What is the purpose of debt consolidation?

The purpose of debt consolidation is to streamline debt repayment, lower monthly payments, reduce interest rates, and improve overall financial management.

What information must be reported on debt consolidation applications?

Debt consolidation applications typically require information including personal identification, income details, list of existing debts, monthly expenses, and any relevant financial obligations.

Fill out your what is debt consolidation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Debt Consolidation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.