Get the free Contestingtaxassessments;filingaffidavitofillegality;bond;trialinsuperiorcourt;

Show details

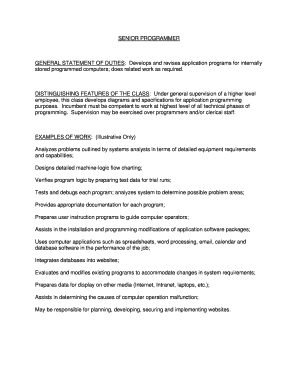

GEORGIA DEPARTMENT OF

REVENUE

LOCAL GOVERNMENT SERVICES

Divisionalization of

Manufactured Housing

Workshop

ForEducationalPurposesOnly:

Thematerialwithinisintendedtogivethecourseparticipantasolidunderstandingofgeneralprinciplesinthesubjectarea.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt

Edit your contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt online

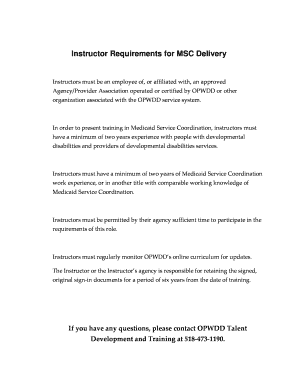

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt

How to fill out contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt

01

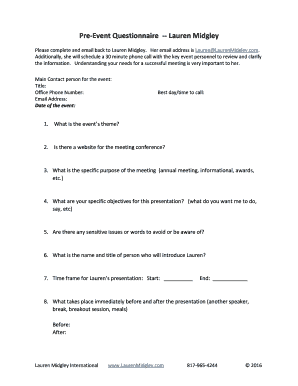

Gather all relevant information about the tax assessment that you are contesting.

02

Download or obtain a copy of the contesting tax assessments filing affidavit form.

03

Read the instructions on the form carefully to understand the requirements.

04

Fill in your personal information accurately, including your name, address, and contact details.

05

Provide details about the tax assessment in question, including the assessment number, tax year, and property details.

06

Clearly state the reasons for contesting the tax assessment and why you believe it is illegal.

07

Attach any supporting documents or evidence that strengthen your case, such as tax records, property appraisals, or expert opinions.

08

Review the completed affidavit form for accuracy and completeness.

09

Sign the affidavit in the presence of a notary public or authorized court official.

10

File the affidavit with the appropriate court or authority, specifically the Superior Court in this case.

11

Pay any applicable filing fees or follow the court's instructions regarding fee waivers.

12

Keep a copy of the filed affidavit and any receipts for future reference.

13

Attend the bond trial in Superior Court as scheduled and present your case effectively.

14

Follow any further instructions or procedures provided by the court during the trial.

15

Await the court's decision and adhere to any actions or payments required based on the outcome.

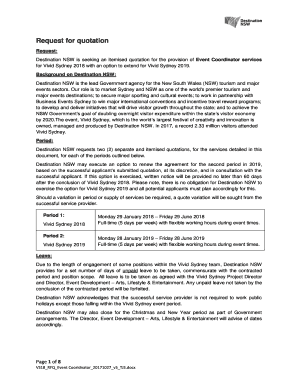

Who needs contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

01

Individuals or entities who believe their tax assessments are incorrect or illegal may need to file an affidavit to contest the assessment and initiate a bond trial in Superior Court. This can include property owners, business owners, or any taxpayer who believes there has been an error or violation in their tax assessment. It is advisable to consult with a tax professional or legal expert to determine eligibility and understand the specific requirements for contesting tax assessments in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

With pdfFiller, it's easy to make changes. Open your contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

Contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt is a legal process of challenging tax assessments by filing an affidavit of illegality and bond trial in superior court.

Who is required to file contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

Property owners who wish to dispute their tax assessments are required to file contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt.

How to fill out contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

To fill out contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt, you will need to provide relevant information about the property, the reason for contesting the assessment, and details of the affidavit and bond trial.

What is the purpose of contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

The purpose of contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt is to challenge the accuracy and legality of tax assessments imposed on a property.

What information must be reported on contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt?

On contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt, you must report details of the property, reasons for disagreement with the tax assessment, and information about the affidavit and bond trial.

Fill out your contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contestingtaxassessmentsfilingaffidavitofillegalitybondtrialinsuperiorcourt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.