Get the free To take the CPA exam as a California candidate, applicants must:

Show details

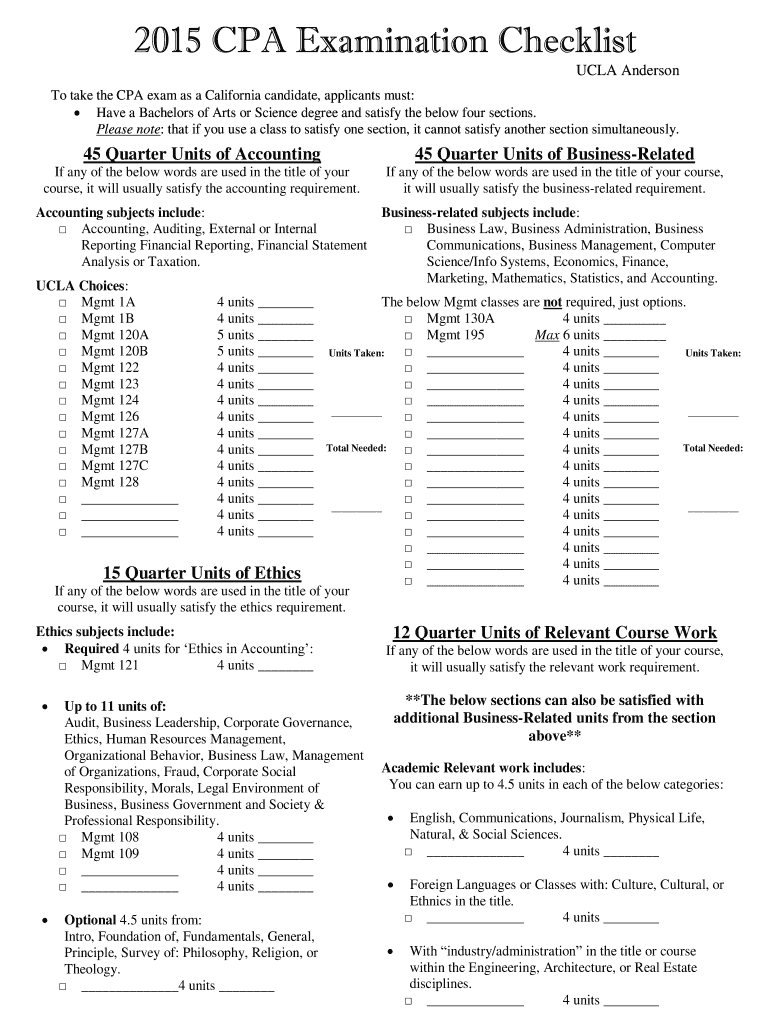

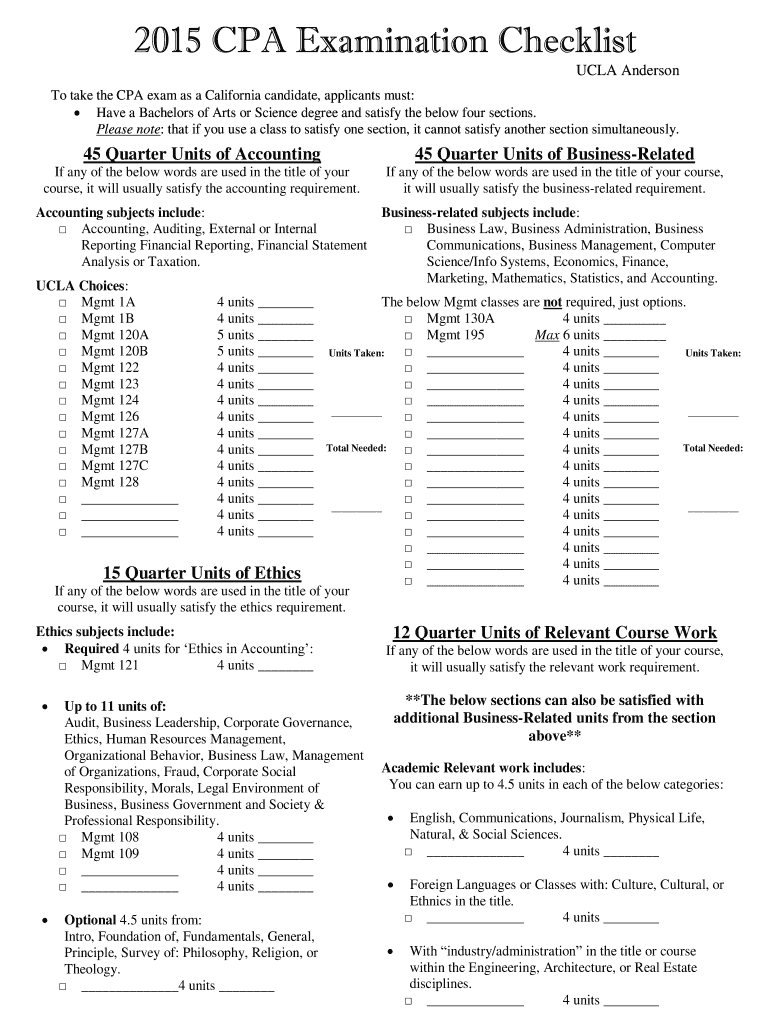

2015 CPA Examination Checklist UCLA Anderson To take the CPA exam as a California candidate, applicants must: Have a Bachelors of Arts or Science degree and satisfy the below four sections. Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to take form cpa

Edit your to take form cpa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to take form cpa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing to take form cpa online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit to take form cpa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out to take form cpa

How to fill out to take form cpa

01

To fill out Form CPA (Certified Public Accountant), you need to follow these steps:

02

Begin by gathering all the necessary information and documents, such as your personal identification details, employment history, educational qualifications, and any relevant certifications or licenses.

03

Start by completing the basic personal information section, including your name, contact details, and social security number.

04

Provide details about your educational background, including the schools or colleges you attended, degrees or qualifications obtained, and any relevant coursework or specialization.

05

Fill in the employment history section, listing your previous employers, job roles and responsibilities, duration of employment, and any notable achievements or contributions.

06

Indicate any professional certifications or licenses you hold that are relevant to the CPA field.

07

Provide information about your previous experience in accounting or related fields, showcasing your expertise and skills.

08

If applicable, mention any additional training or continuing education you have undergone to enhance your accounting knowledge or stay updated with industry standards.

09

Finally, review the filled form for any errors or omissions, making sure all the information provided is accurate and complete.

10

Once you are confident that the form is correctly filled, submit it according to the specified instructions, whether online or through traditional mail.

11

Remember to consult the official guidelines or seek professional advice if you have any doubts or need further assistance with filling out Form CPA.

Who needs to take form cpa?

01

Form CPA is typically needed by individuals who aspire to become Certified Public Accountants or who already hold an accounting degree and want to obtain the CPA designation.

02

Some common individuals who may need to take Form CPA include:

03

- Accounting graduates or professionals seeking to enhance their career prospects in the accounting field.

04

- Students pursuing the CPA qualification as part of their academic or professional development.

05

- Professionals already working in accounting-related roles who wish to attain higher recognition and credibility.

06

- Individuals wanting to comply with regulatory requirements or maintain their professional standing as a Certified Public Accountant.

07

It is important to note that the specific requirements and eligibility criteria for taking Form CPA may vary based on the jurisdiction or country where the individual intends to practice as a CPA. Therefore, it is advisable to refer to the relevant regulatory bodies or official guidelines for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find to take form cpa?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the to take form cpa. Open it immediately and start altering it with sophisticated capabilities.

Can I create an eSignature for the to take form cpa in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your to take form cpa and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete to take form cpa on an Android device?

Use the pdfFiller app for Android to finish your to take form cpa. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is to take form cpa?

To take form cpa is a document that must be filed by individuals or businesses to apply for a Certified Public Accountant (CPA) license.

Who is required to file to take form cpa?

Individuals or businesses seeking to obtain a CPA license are required to file to take form cpa.

How to fill out to take form cpa?

To fill out to take form cpa, applicants need to provide personal information, education and work experience details, and pass the required exams.

What is the purpose of to take form cpa?

The purpose of to take form cpa is to apply for a CPA license and demonstrate the qualifications necessary to practice as a CPA.

What information must be reported on to take form cpa?

Applicants must report their personal information, educational background, work history, and exam results on to take form cpa.

Fill out your to take form cpa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To Take Form Cpa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.