Get the free ASSET Scoring Profile - TestCentral

Show details

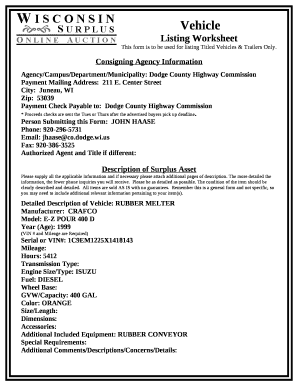

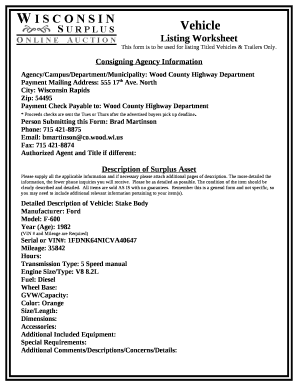

ASSET TM An Organizational Stress Screening Tool DEZVOLTAT DE CARY COOPER is SUSAN CARTWRIGHT REPORT INDIVIDUAL PREGNANT PE NTRU: JANE SAMPLE (Sex: FEMININE) QUESTIONER APICAL SUB LICENSE DE: Psychology:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign asset scoring profile

Edit your asset scoring profile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your asset scoring profile form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing asset scoring profile online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit asset scoring profile. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out asset scoring profile

To fill out an asset scoring profile, follow these steps:

01

Start by gathering all the necessary information about the assets you want to score. This includes details such as the type of asset, its current condition, any maintenance records, and relevant financial information.

02

Once you have collected the required information, open the asset scoring profile template or software tool you will be using. This could be a spreadsheet, an online platform, or a specialized software program designed for asset management.

03

Begin by entering the basic details of the asset, such as its name, identification number, location, and any other relevant identifying information.

04

Next, assess the condition of the asset. Consider factors such as age, wear and tear, functionality, and any recent repairs or upgrades. Assign a score or rating to each of these factors based on the scoring criteria provided.

05

Evaluate the financial aspects of the asset. This may include its market value, depreciation, lifetime costs, and any potential revenue generation. Again, assign appropriate scores or ratings based on the predefined criteria.

06

Take into account any qualitative aspects of the asset. This could include its historical significance, sentimental value, or unique features. Assign scores or ratings based on the importance of these factors to the overall scoring process.

07

Consider any external factors that may influence the score of the asset. For example, regulatory requirements, industry standards, or market conditions. Adjust the scores or ratings accordingly.

08

Review and finalize the asset scoring profile, ensuring all the necessary information and scores have been entered accurately. Make sure to save the completed profile for future reference and analysis.

Who needs an asset scoring profile?

An asset scoring profile can be beneficial for various individuals or organizations, including:

01

Asset managers: These professionals use asset scoring profiles to gain insights into the overall condition and financial performance of their assets. It helps them prioritize maintenance or replacement activities and make informed decisions about asset allocation.

02

Investors: Investors may use asset scoring profiles when evaluating potential investment opportunities. It allows them to assess the risk and return potential of assets and make informed investment decisions.

03

Insurance companies: Insurance companies can use asset scoring profiles to determine the insurability of assets and set appropriate insurance premiums. It helps them mitigate risk and assess the potential for claims.

04

Maintenance teams: Maintenance teams can benefit from asset scoring profiles as they provide a clear overview of asset condition and maintenance history. It helps them plan and prioritize maintenance tasks effectively.

05

Auditors or regulators: Auditors and regulators may use asset scoring profiles to assess an organization's compliance with industry standards or regulatory requirements. It provides them with a standardized framework to evaluate the assets' quality and financial performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is asset scoring profile?

The asset scoring profile is a document that assesses the creditworthiness of an individual or entity based on their assets and liabilities.

Who is required to file asset scoring profile?

Individuals or entities seeking credit or loans are required to file asset scoring profiles.

How to fill out asset scoring profile?

To fill out an asset scoring profile, individuals or entities must provide detailed information about their assets, liabilities, income, and expenses.

What is the purpose of asset scoring profile?

The purpose of an asset scoring profile is to help lenders determine the creditworthiness of an individual or entity and assess the risk of extending credit or loans.

What information must be reported on asset scoring profile?

The information that must be reported on an asset scoring profile includes details about assets, liabilities, income, expenses, and any other relevant financial information.

How can I edit asset scoring profile from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your asset scoring profile into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for the asset scoring profile in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your asset scoring profile in minutes.

Can I edit asset scoring profile on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign asset scoring profile right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your asset scoring profile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Asset Scoring Profile is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.