Get the free TANGIBLE PERSONAL PROPERTY & OTHER ... - Renaissance Inc.

Show details

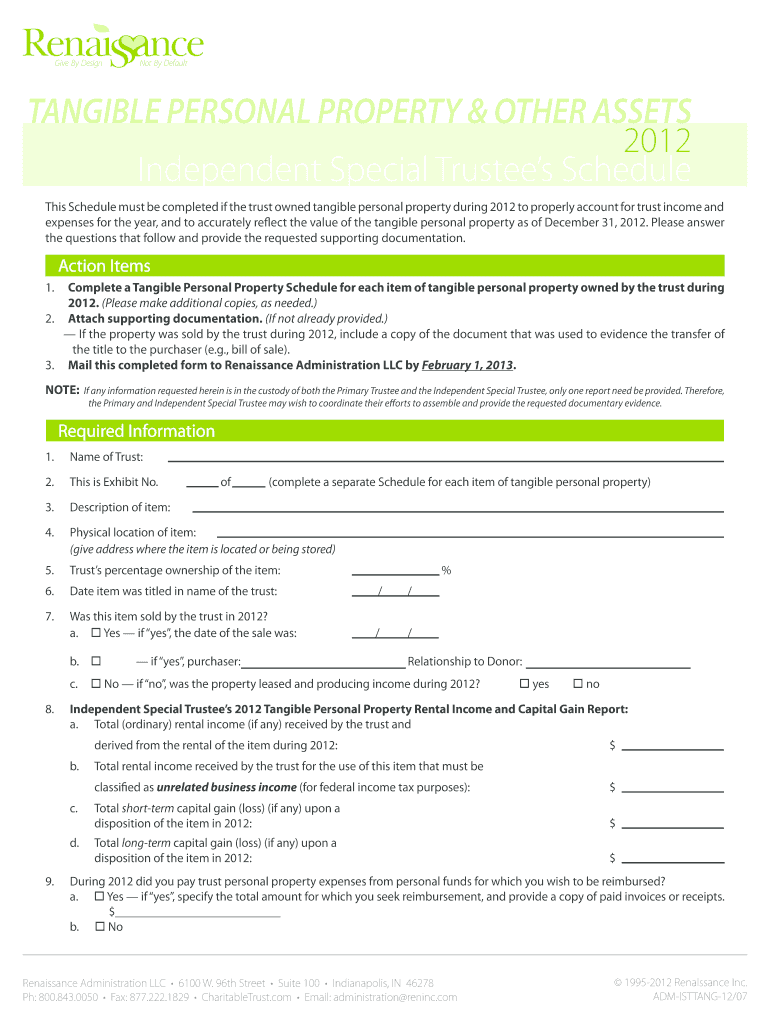

TANGIBLE PERSONAL PROPERTY & OTHER ASSETS 2012 Independent Special Trustee s Schedule This Schedule must be completed if the trust owned tangible personal property during 2012 to properly account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tangible personal property amp

Edit your tangible personal property amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tangible personal property amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tangible personal property amp online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tangible personal property amp. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tangible personal property amp

How to fill out a tangible personal property amp:

01

Start by gathering all necessary information and documentation related to your tangible personal property. This may include receipts, invoices, appraisals, and any other relevant paperwork.

02

Begin by filling out the basic information at the top of the form, such as your name, address, and contact details. Make sure to provide accurate and up-to-date information.

03

Proceed to the section requesting details about the specific property. Include a thorough description of each item, including its value, purchase date, and any other relevant details.

04

If you have multiple items to report, it may be helpful to organize them by category or type to make the process more organized and easier to follow.

05

In case you have any property that is exempt from taxation, make sure to indicate it on the form, following the instructions provided.

06

Double-check all the information you have entered before submitting the form to ensure accuracy and completeness. Any mistakes or missing details could potentially lead to delays or complications.

07

Once you have completed the form, review the instructions for any additional steps that may be required, such as attaching supporting documents or mailing the form to a specific address.

08

If you have any questions or concerns while filling out the form, it is advisable to seek professional advice from an accountant or tax expert to ensure compliance with relevant regulations and maximize your benefits.

Who needs tangible personal property amp:

01

Individuals who own tangible personal property with significant value or those who are required to report such property for taxation purposes.

02

Business owners who possess tangible assets used for business operations, such as machinery, equipment, or inventory.

03

Executors or administrators handling the estate of a deceased person, as they may need to report and evaluate the tangible personal property held by the deceased individual.

It is important to note that the specific requirements for filing a tangible personal property amp may vary depending on your jurisdiction. Therefore, it is recommended to consult with local tax authorities or seek professional advice to ensure compliance with relevant regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tangible personal property amp for eSignature?

When you're ready to share your tangible personal property amp, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get tangible personal property amp?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tangible personal property amp in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit tangible personal property amp on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tangible personal property amp, you need to install and log in to the app.

What is tangible personal property amp?

Tangible personal property amp refers to physical items that can be touched or seen, such as equipment, machinery, furniture, and vehicles.

Who is required to file tangible personal property amp?

Businesses or individuals who own tangible personal property exceeding certain thresholds set by local tax authorities are required to file tangible personal property amp.

How to fill out tangible personal property amp?

Tangible personal property amp forms can typically be obtained from local tax authorities and must be filled out with accurate information regarding the itemized list of tangible personal property owned.

What is the purpose of tangible personal property amp?

The purpose of tangible personal property amp is to assess and tax physical assets owned by businesses or individuals, in order to generate revenue for local governments.

What information must be reported on tangible personal property amp?

Information such as the description, value, and location of tangible personal property must be reported on the tangible personal property amp form.

Fill out your tangible personal property amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tangible Personal Property Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.