IRS 2848 2018 free printable template

Show details

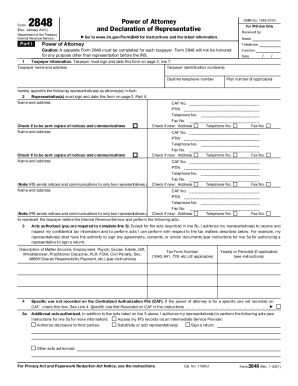

Form Rev. January 2018 Department of the Treasury Internal Revenue Service Part I OMB No. 1545-0150 Power of Attorney and Declaration of Representative For IRS Use Only Received by Go to www.irs.gov/Form2848 for instructions and the latest information. Name Telephone Caution A separate Form 2848 must be completed for each taxpayer. Form 2848 will not be honored for any purpose other than representation before the IRS. Function Date / Taxpayer information. Taxpayer must sign and date this form...on page 2 line 7. Cat. No. 11980J Form 2848 Rev.1-2018 Page 2 b Specific acts not authorized. My representative s is are not authorized to endorse or otherwise negotiate any check including directing or accepting payment by any means electronic or otherwise into an account owned or controlled by the representative s or any firm or other entity with whom the representative s is are associated issued by the government in respect of a federal tax liability. List any other specific deletions to the...acts otherwise authorized in this power of attorney see instructions for line 5b Retention/revocation of prior power s of attorney. If the power of attorney is for a specific use not recorded on CAF check this box. See the instructions for Line 4. Specific Use Not Recorded on CAF. 5a Additional acts authorized. In addition to the acts listed on line 3 above I authorize my representative s to perform the following acts see instructions for line 5a for more information Access my IRS records via an...Intermediate Service Provider Authorize disclosure to third parties Substitute or add representative s Sign a return Other acts authorized For Privacy Act and Paperwork Reduction Act Notice see the instructions. Cat. No. 11980J Form 2848 Rev.1-2018 Page 2 b Specific acts not authorized. My representative s is are not authorized to endorse or otherwise negotiate any check including directing or accepting payment by any means electronic or otherwise into an account owned or controlled by the...representative s or any firm or other entity with whom the representative s is are associated issued by the government in respect of a federal tax liability. YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT. IF NOT COMPLETED SIGNED AND DATED THE IRS WILL RETURN THIS POWER OF ATTORNEY TO THE TAXPAYER. Signature Print Name Title if applicable Print name of taxpayer from line 1 if other than individual Declaration of Representative Under penalties of perjury by my...signature below I declare that I am not currently suspended or disbarred from practice or ineligible for practice before the Internal Revenue Service I am subject to regulations contained in Circular 230 31 CFR Subtitle A Part 10 as amended governing practice before the Internal Revenue Service I am authorized to represent the taxpayer identified in Part I for the matter s specified there and I am one of the following a c d e Attorney a member in good standing of the bar of the highest court of...the jurisdiction shown below. Certified Public Accountant a holder of an active license to practice as a certified public accountant in the jurisdiction shown below. Enrolled Agent enrolled as an agent by the Internal Revenue Service per the requirements of Circular 230. H Unenrolled Return Preparer Authority to practice before the IRS is limited. An unenrolled return preparer may represent provided the preparer 1 prepared and signed the return or claim for refund or prepared if there is no...signature space on the form 2 was eligible to sign the return or claim for refund 3 has a valid PTIN and 4 possesses the required Annual Filing Season Program Record of Completion s. See Special Rules and Requirements for Unenrolled Return Preparers in the instructions for additional information. k Qualifying Student receives permission to represent taxpayers before the IRS by virtue of his/her status as a law business or accounting student working in an LITC or STCP. See instructions for Part...II for additional information and requirements. r Enrolled Retirement Plan Agent enrolled as a retirement plan agent under the requirements of Circular 230 the authority to practice before the IF THIS DECLARATION OF REPRESENTATIVE IS NOT COMPLETED SIGNED AND DATED THE IRS WILL RETURN THE POWER OF ATTORNEY. If signed by a corporate officer partner guardian tax matters partner partnership on behalf of the taxpayer. YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT. IF...NOT COMPLETED SIGNED AND DATED THE IRS WILL RETURN THIS POWER OF ATTORNEY TO THE TAXPAYER. Signature Print Name Title if applicable Print name of taxpayer from line 1 if other than individual Declaration of Representative Under penalties of perjury by my signature below I declare that I am not currently suspended or disbarred from practice or ineligible for practice before the Internal Revenue Service I am subject to regulations contained in Circular 230 31 CFR Subtitle A Part 10 as amended...governing practice before the Internal Revenue Service I am authorized to represent the taxpayer identified in Part I for the matter s specified there and I am one of the following a c d e Attorney a member in good standing of the bar of the highest court of the jurisdiction shown below. Certified Public Accountant a holder of an active license to practice as a certified public accountant in the jurisdiction shown below. If you do not want to revoke a prior power of attorney check here....Signature of taxpayer. If a tax matter concerns a year in which a joint return was filed each spouse must file a separate power of attorney even if they are appointing the same representative s. If signed by a corporate officer partner guardian tax matters partner partnership on behalf of the taxpayer. YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT. IF NOT COMPLETED SIGNED AND DATED THE IRS WILL RETURN THIS POWER OF ATTORNEY TO THE TAXPAYER. Signature Print Name...Title if applicable Print name of taxpayer from line 1 if other than individual Declaration of Representative Under penalties of perjury by my signature below I declare that I am not currently suspended or disbarred from practice or ineligible for practice before the Internal Revenue Service I am subject to regulations contained in Circular 230 31 CFR Subtitle A Part 10 as amended governing practice before the Internal Revenue Service I am authorized to represent the taxpayer identified in Part...I for the matter s specified there and I am one of the following a c d e Attorney a member in good standing of the bar of the highest court of the jurisdiction shown below.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2848

How to edit IRS 2848

How to fill out IRS 2848

Instructions and Help about IRS 2848

How to edit IRS 2848

To edit IRS Form 2848, use a PDF editing tool that allows for form signature, text changes, and reformatting. With pdfFiller, you can easily make updates to the fields of the form, ensuring that the details are accurate before submission. Save the changes and prepare the form for final review before filing it with the IRS.

How to fill out IRS 2848

Filling out IRS Form 2848 requires you to provide specific information about the taxpayer and the tax matters for which an agent is authorized. Follow these steps to complete the form:

01

Begin by entering the taxpayer's name, address, and taxpayer identification number (TIN).

02

Indicate the name and address of the authorized representative.

03

Specify the types of tax and years or periods for which authority is being granted.

04

Ensure that signatures and dates are included from both the taxpayer and the representative.

About IRS 2 previous version

What is IRS 2848?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2 previous version

What is IRS 2848?

IRS Form 2848, known as the Power of Attorney and Declaration of Representative, allows a taxpayer to designate an individual to represent them before the IRS. This can be beneficial when dealing with tax matters, appeals, or audits, as it provides legal authority to the representative to act on behalf of the taxpayer.

What is the purpose of this form?

The purpose of IRS Form 2848 is to grant authority to a representative to perform acts on behalf of the taxpayer in dealings with the IRS. This includes obtaining information, filing documents, and making oral or written presentations. It ensures that the representative is properly authorized to act, streamlining communication between the IRS and the designated agent.

Who needs the form?

Taxpayers who wish to appoint someone to manage their tax issues need IRS Form 2848. This includes individuals or businesses with complex tax situations or those facing audits, appeals, or other tax-related communications. By filling out this form, taxpayers can ensure that their chosen representative has the appropriate legal authority to handle these matters.

When am I exempt from filling out this form?

Exemptions from filling out IRS Form 2848 apply to certain situations, such as when individuals are representing themselves without the need for a formal power of attorney. Additionally, some organizations may not require this form when they have established authority through other means. Always verify if your specific situation requires this form for representation.

Components of the form

IRS Form 2848 consists of several sections including taxpayer information, representative details, and the scope of authority granted. Each section requires specific information to be filled out accurately to ensure compliance with IRS regulations. Key components include the name, address, and identification numbers of both the taxpayer and authorized representative, along with the tax matters involved.

What are the penalties for not issuing the form?

Failing to issue IRS Form 2848 when necessary can lead to complications in communication with the IRS. If a representative acts without proper authorization, the IRS may refuse to provide them with confidential taxpayer information. Additionally, taxpayers may face delays in resolving their tax matters, which could incur further penalties or interest if issues remain unresolved.

What information do you need when you file the form?

When filing IRS Form 2848, essential information includes the taxpayer's name, address, taxpayer identification number, and representative details. The taxpayer must also specify the types of tax and the years or periods the representation covers. This information is crucial to ensure that the authorized representative can act effectively on behalf of the taxpayer.

Is the form accompanied by other forms?

IRS Form 2848 does not need to be accompanied by other forms in general; however, it may be beneficial to consult with an advisor about specific situations that require additional documentation. If you are resolving a particular tax issue, other forms may need to be submitted as part of the overall process.

Where do I send the form?

The completed IRS Form 2848 should be submitted to the appropriate IRS office, depending on the type of tax and the reason for the representation. It's advisable to review the IRS website or contact the IRS directly for the correct submission address and any related instructions for your specific situation.

See what our users say