Get the free publication 915 2017 form

Instructions and Help about IRS Publication 915

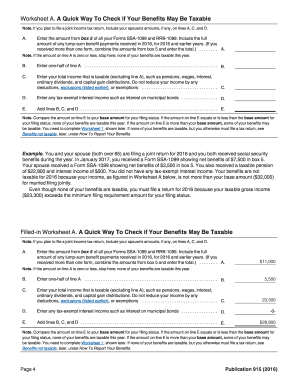

How to edit IRS Publication 915

How to fill out IRS Publication 915

About IRS Publication previous version

What is IRS Publication 915?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about publication 915 2017 form

How can I get [SKS]?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific [SKS] and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in [SKS] without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your [SKS], which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit [SKS] on an iOS device?

Create, modify, and share [SKS] using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is IRS Publication 915?

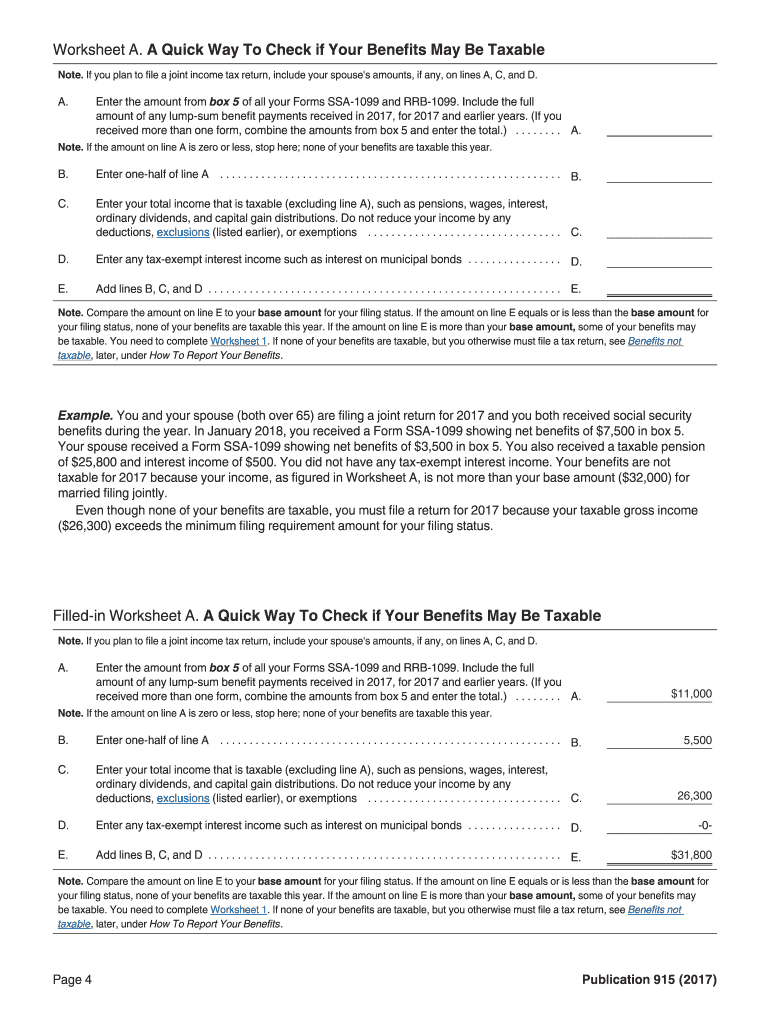

IRS Publication 915 provides guidance on the tax treatment of Social Security and equivalent railroad retirement benefits.

Who is required to file IRS Publication 915?

Individuals who receive Social Security benefits and need to report these benefits on their tax returns may be required to use IRS Publication 915.

How to fill out IRS Publication 915?

To fill out IRS Publication 915, follow the instructions provided in the publication, which include determining the portion of your Social Security benefits that is taxable and reporting it on your tax return.

What is the purpose of IRS Publication 915?

The purpose of IRS Publication 915 is to inform taxpayers about the reporting requirements and the tax implications of receiving Social Security and equivalent retirement benefits.

What information must be reported on IRS Publication 915?

The information that must be reported includes the total amount of Social Security benefits received, the portion that is taxable, and any adjustments based on other income.