Get the free Letters of Credit (LC)

Show details

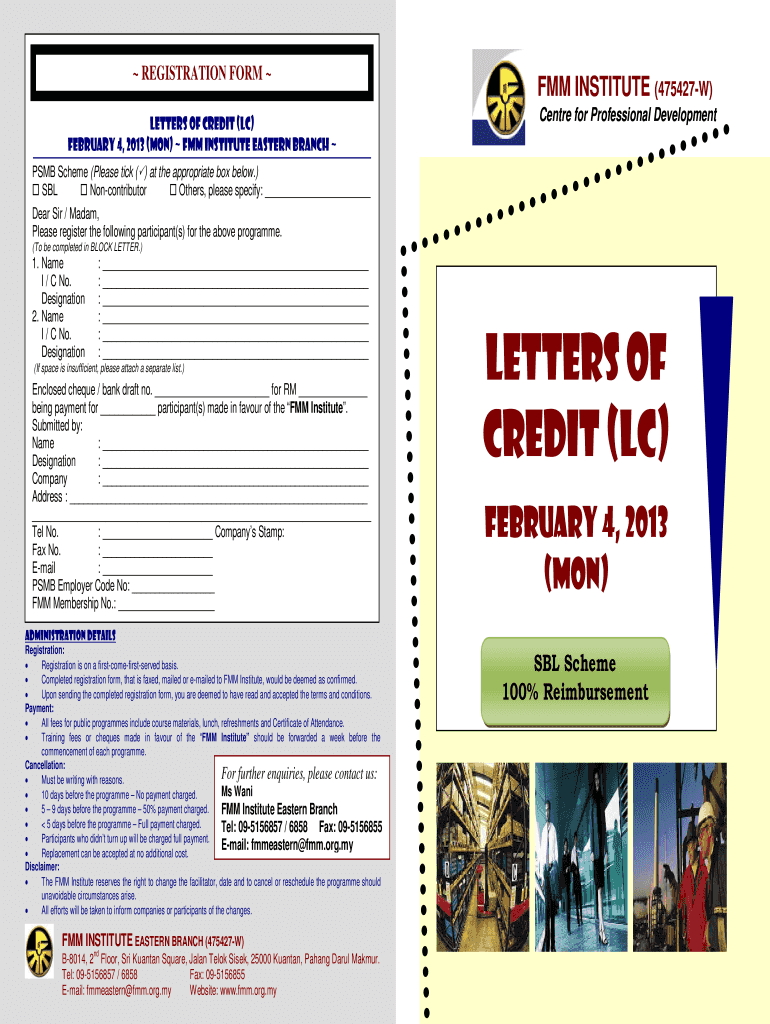

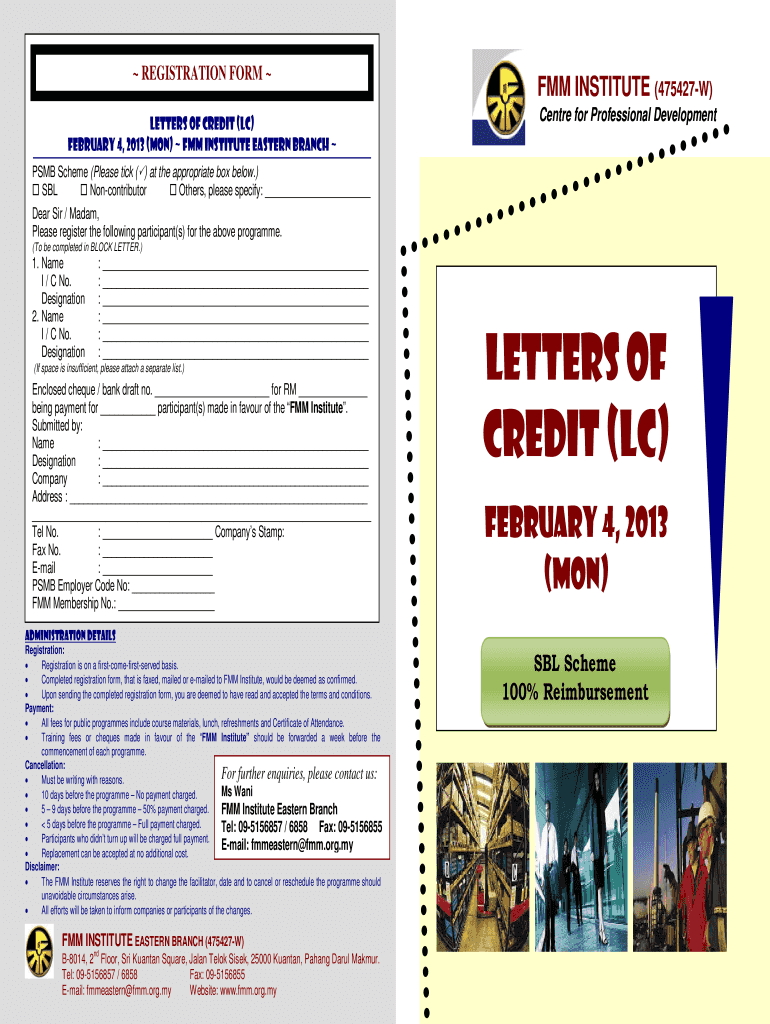

REGISTRATION FORM Letters of Credit (LC) FEBRUARY 4, 2013 (MON) FMM Institute Eastern Branch FMM INSTITUTE (475427W) Center for Professional Development PSB Scheme (Please tick () at the appropriate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letters of credit lc

Edit your letters of credit lc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letters of credit lc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing letters of credit lc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit letters of credit lc. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letters of credit lc

How to fill out letters of credit lc:

01

Gather necessary information: Start by collecting all the essential details required for the letter of credit. This includes the buyer's and seller's information, the amount and currency of the transaction, the shipping terms, and any specific instructions or conditions.

02

Choose the appropriate type of letter of credit: There are various types of letters of credit, such as documentary letters of credit, standby letters of credit, and revolving letters of credit. Select the one that suits your needs and the nature of the transaction.

03

Select the issuing bank: Decide on the issuing bank, which is usually the buyer's bank. Ensure that the chosen bank has the capability and experience in handling letters of credit.

04

Draft the letter of credit: Prepare the letter of credit according to the bank's format and guidelines. Include all the necessary information mentioned in step 1, ensuring accuracy and clarity.

05

Review and double-check: Go through the letter of credit multiple times to ensure accuracy and completeness. Mistakes or missing information can lead to delays or complications in the transaction.

06

Submit the letter of credit: Send the completed letter of credit to the issuing bank. This can be done either physically or through electronic means, depending on the bank's requirements.

Who needs letters of credit lc:

01

Importers and exporters: Letters of credit are commonly used by importers and exporters involved in international trade. It provides a secure payment method and helps mitigate risks, ensuring smooth transactions between parties in different countries.

02

Banks and financial institutions: Banks play a crucial role in issuing and advising letters of credit. They act as intermediaries and provide financial security by guaranteeing payment to the exporter upon meeting the specified conditions.

03

Government organizations: Government agencies often require letters of credit for various purposes like procurement of goods and services, international contracts, or obtaining guarantees from foreign entities.

04

Large corporations and small businesses: Both large corporations and small businesses utilize letters of credit to facilitate trade and establish trust between parties. It offers assurance to sellers that they will receive payment and protection to buyers that the goods or services will be delivered as agreed.

05

Individuals involved in international transactions: Individuals who engage in international business activities, such as freelancers, consultants, or entrepreneurs, may also find letters of credit beneficial. It provides a secure and reliable way to ensure payment for their services or products.

In conclusion, understanding how to fill out letters of credit lc and recognizing the different entities that benefit from utilizing them is vital for successful international trade and financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out letters of credit lc using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign letters of credit lc and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit letters of credit lc on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign letters of credit lc right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out letters of credit lc on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your letters of credit lc. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is letters of credit lc?

Letters of credit (LC) is a financial tool used in international trade to ensure that the seller will receive payment for goods or services provided to the buyer.

Who is required to file letters of credit lc?

Both the buyer and the seller involved in the international trade transaction are required to use letters of credit.

How to fill out letters of credit lc?

To fill out a letter of credit, both parties must agree on the terms and conditions, and a financial institution must issue the letter of credit based on these terms.

What is the purpose of letters of credit lc?

The purpose of letters of credit is to reduce the risk of non-payment for goods or services in international trade transactions.

What information must be reported on letters of credit lc?

Letters of credit must include details such as the names of the buyer and the seller, the amount of the transaction, the goods or services being provided, and the terms of payment.

Fill out your letters of credit lc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letters Of Credit Lc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.