Get the free Education expenses

Show details

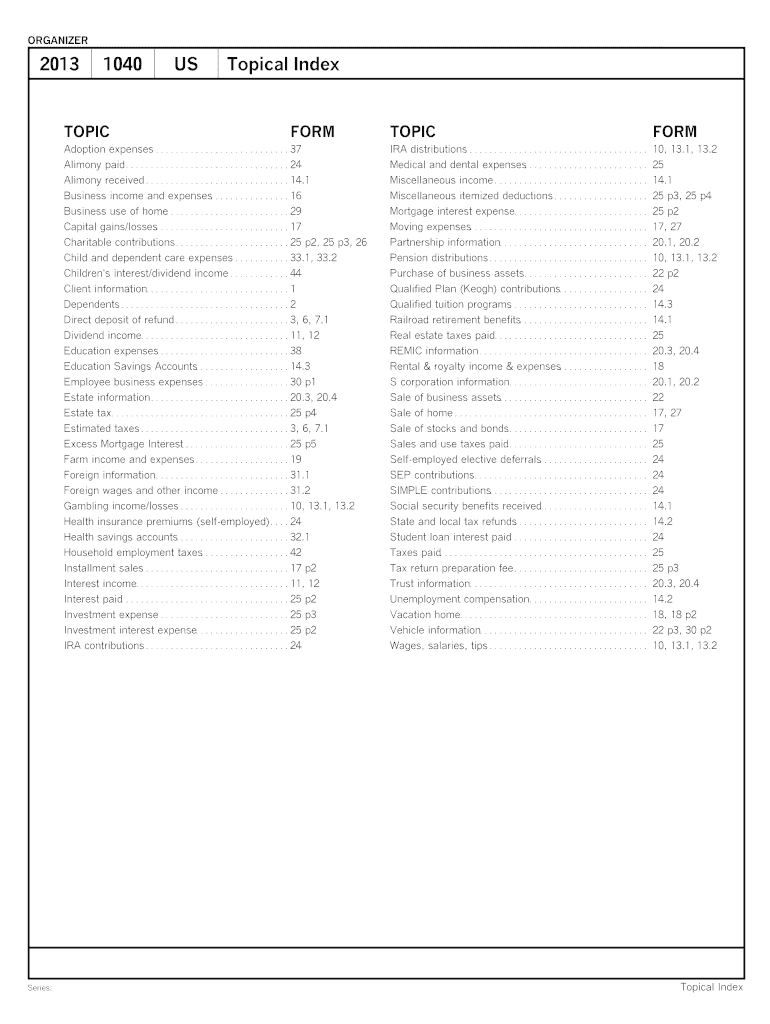

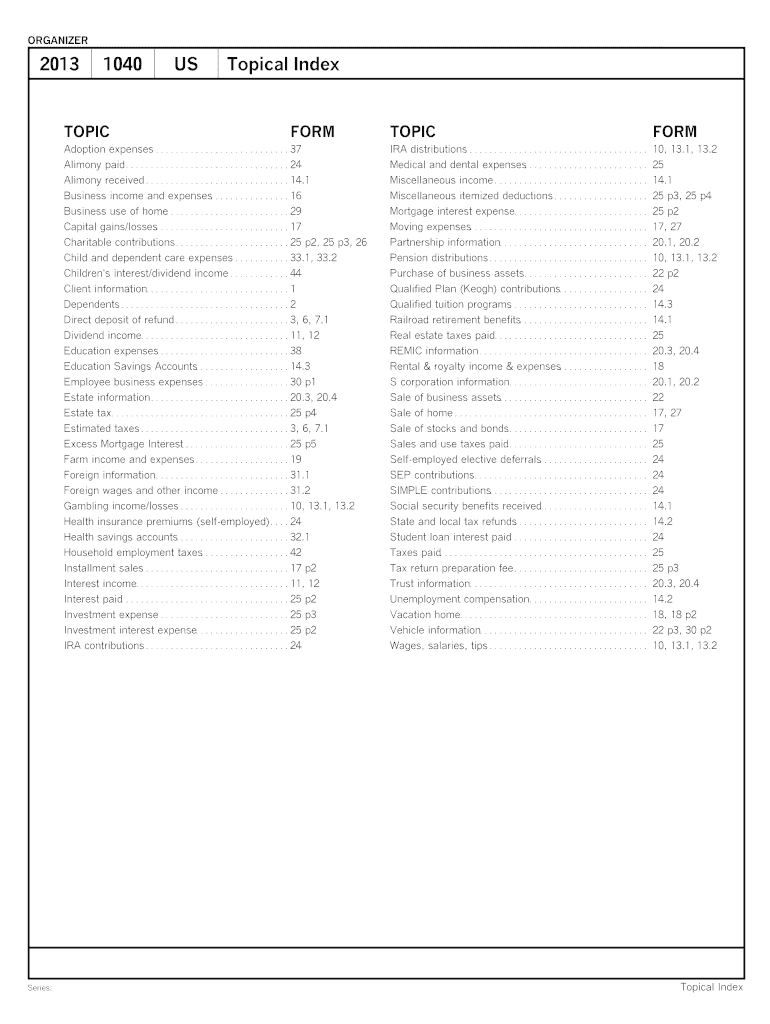

ORGANIZER 2013 1040 Topics US Topical Index FORM Adoption expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . 37 Alimony paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign education expenses

Edit your education expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your education expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit education expenses online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit education expenses. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out education expenses

How to fill out education expenses?

01

Begin by gathering all relevant documentation such as receipts, invoices, and proof of payments related to your education expenses. This may include tuition fees, textbooks, school supplies, and transportation costs.

02

Familiarize yourself with the tax laws and regulations regarding education expenses in your country. Different jurisdictions may have different rules, so it is important to understand what qualifies as a deductible expense and what documentation is required.

03

If you are filling out a tax return, locate the section or form specifically dedicated to education expenses. This could be labeled as "Education Deductions" or "Tuition and Fees Deduction," depending on your tax system.

04

Fill in the required information accurately, ensuring you enter the correct amounts for each expense. Double-check all calculations and verify that you are claiming only eligible expenses.

05

If you are unsure about any aspect of filling out education expenses, consider seeking guidance from a tax professional or utilizing educational resources provided by your tax authority. They can assist you in understanding the specific requirements and ensure your form is correctly completed.

Who needs education expenses?

01

Students: Education expenses are often necessary for students pursuing higher education, whether at a university, college, or vocational school. This includes undergraduate and graduate students who incur costs for tuition, books, supplies, and possibly even living expenses.

02

Parents: In many cases, parents or guardians claim education expenses for their dependent children. This could range from primary and secondary school expenses, such as uniforms and transportation, to higher education costs like tuition and housing.

03

Individuals seeking professional development: Education expenses can also be relevant for individuals seeking to improve their skills or advance within their careers. This includes professionals who attend workshops, seminars, or courses to gain new knowledge or qualifications.

04

Employers: Some employers may provide education benefits to their employees as a form of professional development or as part of a work-related training program. These expenses might be reimbursed by the employer or claimed as a deduction by the company.

05

Lifelong learners: Education expenses are not limited to traditional students or employees. Individuals who engage in lifelong learning or pursue personal interests by attending classes or workshops may also have eligible education expenses they can claim.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit education expenses from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your education expenses into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in education expenses?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your education expenses to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my education expenses in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your education expenses and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is education expenses?

Education expenses refer to the amount of money spent on educational pursuits such as tuition, books, supplies, and other related expenses.

Who is required to file education expenses?

Individuals who have incurred eligible education expenses and wish to claim them as deductions on their taxes are required to file education expenses.

How to fill out education expenses?

Education expenses can be filled out on relevant tax forms provided by the tax authority, ensuring all necessary information is accurately reported.

What is the purpose of education expenses?

The purpose of education expenses is to allow individuals to receive tax benefits for the money spent on furthering their education.

What information must be reported on education expenses?

Information such as the total amount spent on education expenses, the educational institution attended, and any scholarships or grants received must be reported on education expenses.

Fill out your education expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Education Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.