Canada Form 3 Beneficiary free printable template

Show details

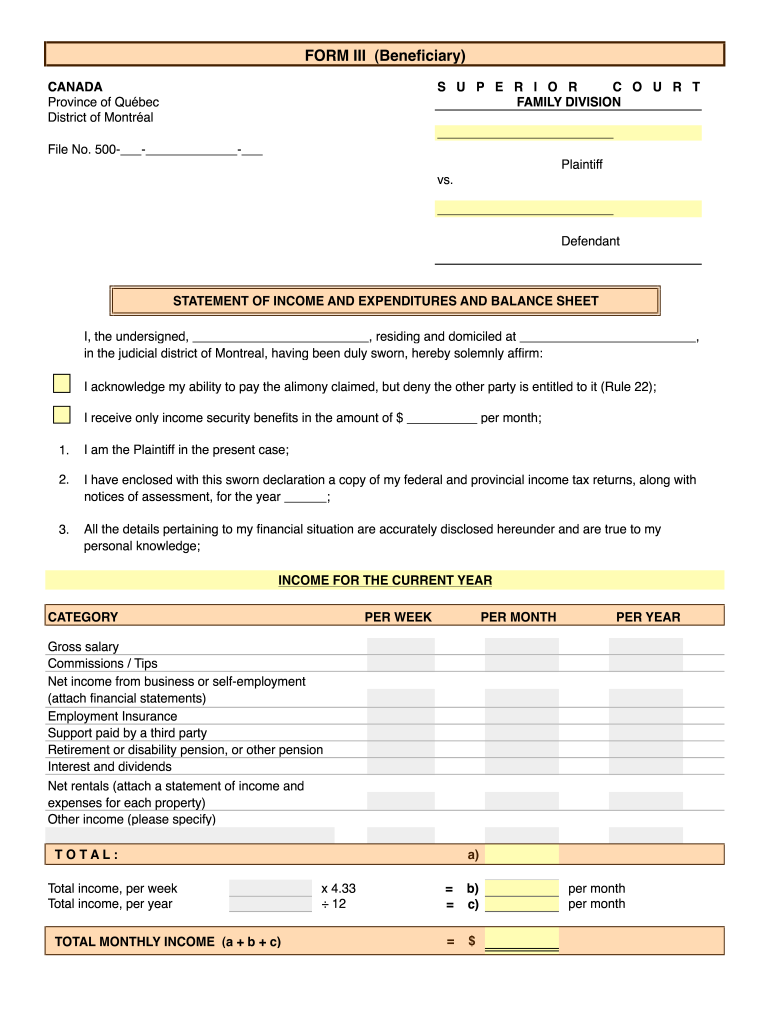

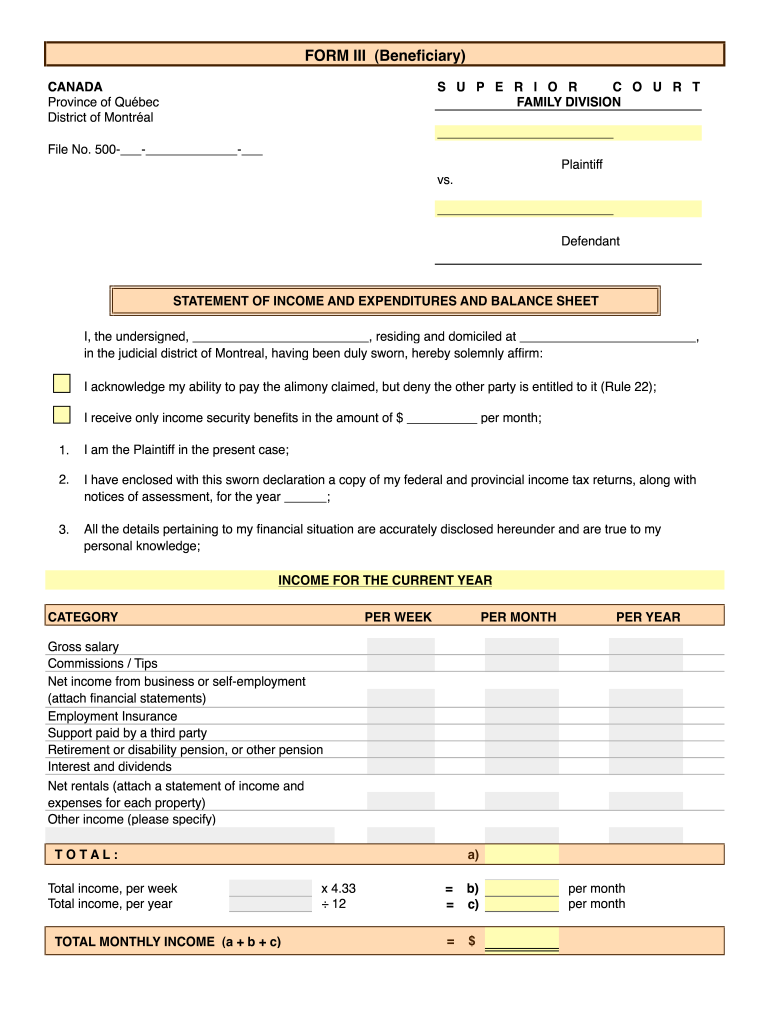

FORM III (Been?diary) CANADA Province of EU BEC District of Month all S U P E R I O R C O U R T FAMILY DIVISION File No. 500- - - Plaintiff vs. Defendant STATEMENT OF INCOME AND EXPENDITURES AND BALANCE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form court

Edit your Canada Form 3 Beneficiary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Form 3 Beneficiary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada Form 3 Beneficiary online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada Form 3 Beneficiary. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Canada Form 3 Beneficiary

How to fill out Canada Form 3 Beneficiary

01

Obtain a copy of Canada Form 3 Beneficiary from the official website or through a local office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including your name, address, and contact details in the specified sections.

04

Identify the deceased individual for whom you are claiming benefits by providing their name and relevant details.

05

Indicate your relationship to the deceased individual in the appropriate section.

06

Provide any required documentation to support your claim, such as proof of your relationship or identification.

07

Review the form for accuracy and completeness.

08

Sign and date the form to validate your claim.

09

Submit the completed form to the designated address provided in the instructions.

Who needs Canada Form 3 Beneficiary?

01

Canada Form 3 Beneficiary is needed by individuals who are claiming death benefits or other entitlements from the Canada Pension Plan or other similar programs related to a deceased person.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a beneficiary form?

The beneficiary designation forms allow you to name primary and secondary beneficiaries. Your “primary beneficiaries” are the first people or entities that you want to receive your benefit after you die.

Are beneficiary forms required?

Must I complete designation of beneficiary forms? No, these forms are not required.

Who can be a beneficiary in Canada?

Designated beneficiaries can include a survivor who has not been named as a successor holder, former spouses or common-law partners, children, a designated subsequent survivor holder who is the new spouse or common-law partner of the successor holder, and qualified donees.

Do you need to fill out a beneficiary form?

If you get married or divorced, or have children or other life changes, standard sequence will follow those life changes. If you never file a beneficiary designation, your benefit will be paid ing to standard sequence at the time of your death.

What is a beneficiary form?

Your original designation remains in force whether it still reflects your wishes or not, until you submit another form to cancel prior designations or to designate a new beneficiary. A designation of beneficiary form outlines your desire to have the funds due upon your death paid out in a particular way.

Can the successor and beneficiary be the same person?

It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common. EXAMPLE: Mildred names her only child, Allison, as both sole beneficiary of her living trust and successor trustee of the living trust.

Does a beneficiary have to live in Canada?

Country – A common misconception is that your beneficiary needs to live in the same country as you. However, this is not the case, your beneficiary can live in another country when the life insurance claim is filed.

What is a successor holder in Canada?

The successor holder, after taking over ownership of the deceased holder's TFSA, can make tax‑free withdrawals from that account. The successor holder can also make new contributions to that account, depending on their own unused TFSA contribution room.

What is the difference between a beneficiary and a successor Canada?

The main difference between the two designations is that a beneficiary will receive the assets from the TFSA, but the successor holder will receive the TFSA account itself. For example, if a TFSA worth $80,000 was passed to the beneficiary, they would receive $80,000, but the TFSA would be shut down.

What is a beneficiary in Canada?

Designated beneficiaries can include a survivor who has not been named as a successor holder, former spouses or common-law partners, children, a designated subsequent survivor holder who is the new spouse or common-law partner of the successor holder, and qualified donees.

Who do I put as my beneficiary?

Before deciding who to put as a beneficiary on your life insurance policy, consider your decision's implications. Choosing a beneficiary for life insurance affects your legacy and makes a statement to those left behind. You should choose someone who would benefit the most from the money.

How do I fill out a beneficiary?

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Canada Form 3 Beneficiary in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your Canada Form 3 Beneficiary and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out the Canada Form 3 Beneficiary form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Canada Form 3 Beneficiary and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit Canada Form 3 Beneficiary on an Android device?

You can make any changes to PDF files, like Canada Form 3 Beneficiary, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is Canada Form 3 Beneficiary?

Canada Form 3 Beneficiary is a tax form used to report the income and distributions received by a beneficiary from a trust or estate in Canada.

Who is required to file Canada Form 3 Beneficiary?

Beneficiaries of a trust or estate that received distributions or income are required to file Canada Form 3 Beneficiary.

How to fill out Canada Form 3 Beneficiary?

To fill out Canada Form 3 Beneficiary, provide personal information, details of the trust or estate, the amount of income received, and any applicable deductions.

What is the purpose of Canada Form 3 Beneficiary?

The purpose of Canada Form 3 Beneficiary is to report income received by beneficiaries from trusts and estates for tax purposes.

What information must be reported on Canada Form 3 Beneficiary?

The information that must be reported includes the beneficiary's name and address, the trust or estate's name, income received, expenses, and any tax withheld.

Fill out your Canada Form 3 Beneficiary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Form 3 Beneficiary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.