Get the free SUMMARY OF SELF EMPLOYMENT INCOME:

Show details

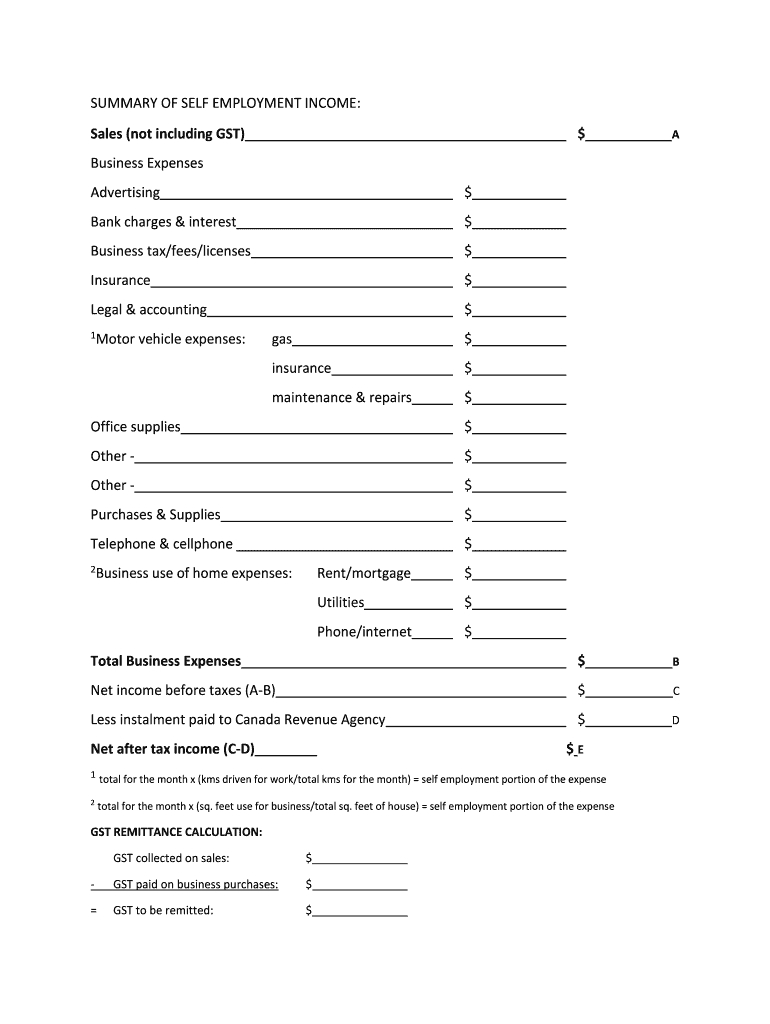

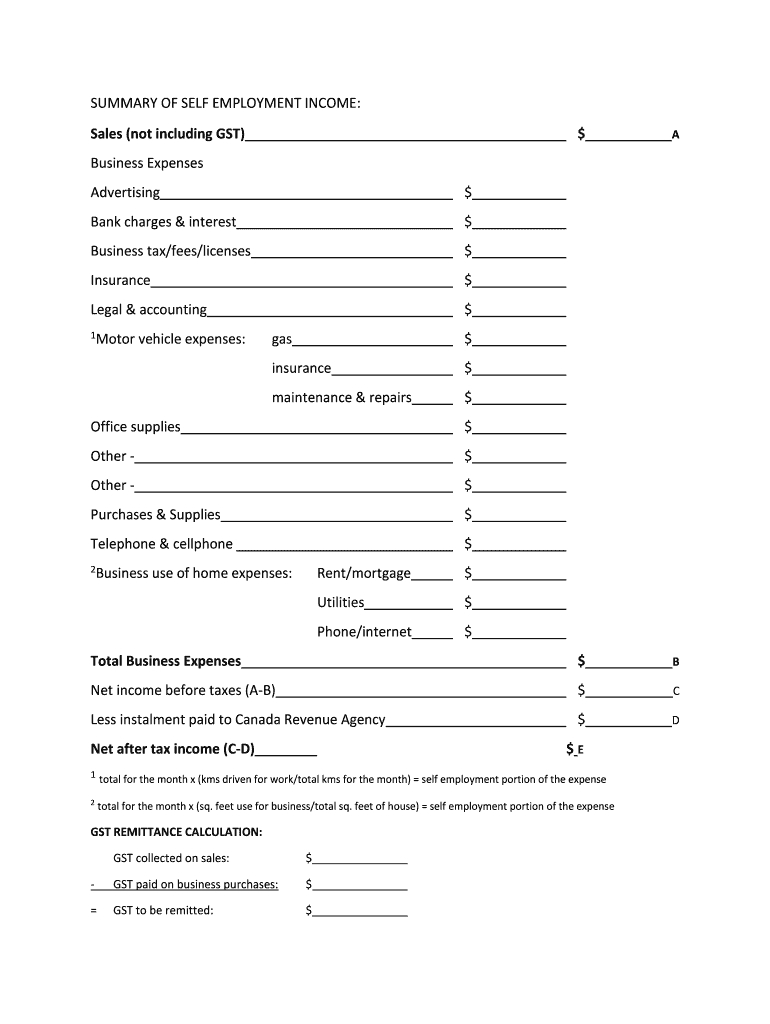

SUMMARY OF SELF EMPLOYMENT INCOME: Sales (not including GST)total Business Expenses×Net income before taxes (AB)class installment paid to Canada Revenue Agency×Business Expenses Advertising×Bank

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign summary of self employment

Edit your summary of self employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your summary of self employment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing summary of self employment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit summary of self employment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out summary of self employment

How to fill out summary of self employment

01

Start by providing your name and contact information at the top of the summary.

02

Add a brief introduction about your self-employment, including the type of work you do and the duration of your self-employment.

03

Mention any relevant achievements or successes in your self-employment.

04

Provide a detailed description of your responsibilities and tasks as a self-employed individual.

05

Include any notable projects or clients you have worked with during your self-employment.

06

Highlight any skills or qualifications that are relevant to your self-employment.

07

Mention any certifications or licenses you have obtained in relation to your self-employment.

08

Summarize the overall impact and value of your self-employment, emphasizing the benefits you have provided to clients or employers.

09

Close the summary by reiterating your contact information and expressing your availability for further discussion or opportunities.

Who needs summary of self employment?

01

Freelancers or independent contractors who want to showcase their self-employment experience to potential clients or employers.

02

Entrepreneurs or small business owners who want to provide a summary of their self-employment history for funding or partnership opportunities.

03

Individuals who are transitioning from self-employment to traditional employment and want to highlight their previous experience.

04

Job seekers with a significant period of self-employment who need to explain their career history in a concise manner.

05

Professionals in creative fields, such as artists, writers, or designers, who want to showcase their self-employed projects and accomplishments.

06

Consultants or coaches who want to demonstrate their expertise and track record in self-employment to attract clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send summary of self employment for eSignature?

When you're ready to share your summary of self employment, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit summary of self employment on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share summary of self employment from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out summary of self employment on an Android device?

Use the pdfFiller mobile app to complete your summary of self employment on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is summary of self employment?

Summary of self-employment is a document that reports income and expenses from self-employment activities.

Who is required to file summary of self employment?

Individuals who are self-employed or have income from freelance work are required to file a summary of self-employment.

How to fill out summary of self employment?

You can fill out a summary of self-employment by listing your income, expenses, and any other relevant information related to your self-employment activities.

What is the purpose of summary of self employment?

The purpose of a summary of self-employment is to report accurate financial information related to self-employment activities for tax purposes.

What information must be reported on summary of self employment?

Income, expenses, and other financial details related to self-employment activities must be reported on a summary of self-employment.

Fill out your summary of self employment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Summary Of Self Employment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.