Get the free Arizona Form 140PY Part-Year Resident Personal Income Tax Return 2017

Show details

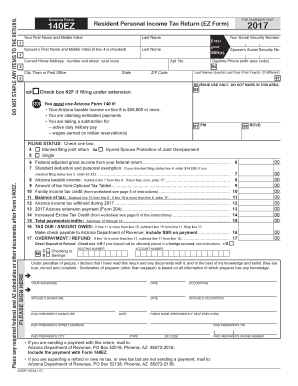

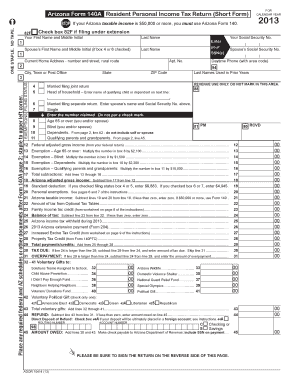

140PYCheck box 82F if filing under extension82FOR FISCAL YEAR BEGINNINGSpouses First Name and Middle Initial (if box 4 or 6 checked)Last Name AND ENDING1 Current Home Address number and street, rural

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona form 140py part-year

How to edit arizona form 140py part-year

How to fill out arizona form 140py part-year

Instructions and Help about arizona form 140py part-year

How to edit arizona form 140py part-year

You can edit the Arizona Form 140PY part-year Tax Form using pdfFiller's editing tools. Simply upload the form PDF to the platform, and you can fill in fields, add signatures, or make any necessary adjustments. Once edited, you can save the changes or directly submit the form as required.

How to fill out arizona form 140py part-year

To fill out the Arizona Form 140PY, follow these steps:

01

Download the form from the Arizona Department of Revenue website or access it via pdfFiller.

02

Enter your personal information at the top of the form, including name, address, and Social Security number.

03

Indicate your filing status in Part 1 of the form.

04

In Part 2, report your income earned within Arizona for the year you are filing.

05

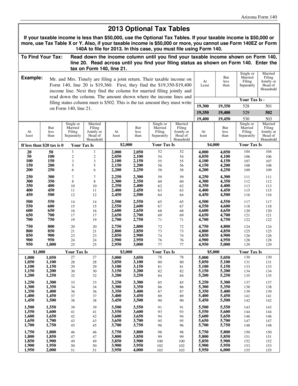

Calculate your deductions and credits in the subsequent sections of the form.

06

Review your entries for accuracy before submitting.

Latest updates to arizona form 140py part-year

Latest updates to arizona form 140py part-year

Stay updated on any changes to the Arizona Form 140PY by regularly checking the Arizona Department of Revenue's official website. This ensures you have the latest information regarding any revisions to the form or filing process.

All You Need to Know About arizona form 140py part-year

What is arizona form 140py part-year?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona form 140py part-year

What is arizona form 140py part-year?

The Arizona Form 140PY part-year is a tax return specifically designed for individuals who lived in Arizona for only part of the year. This form allows them to report income earned during their residency in the state while ensuring they comply with Arizona tax laws.

What is the purpose of this form?

The primary purpose of the Arizona Form 140PY is to calculate the state income tax for part-year residents. It allows taxpayers to accurately report the portion of their income subject to Arizona tax and claim any applicable deductions or credits available to part-year residents.

Who needs the form?

Individuals who have moved into or out of Arizona during the tax year should use the Arizona Form 140PY. This includes those who have changed their primary residence and need to report only the income earned while a resident of Arizona.

When am I exempt from filling out this form?

You may be exempt from filing the Arizona Form 140PY if your gross income is below the filing threshold set by the state for part-year residents. Additionally, if you have no Arizona-source income while a resident, you may not need to file this form.

Components of the form

The Arizona Form 140PY includes several sections that taxpayers must complete, including personal information, income reporting, deductions, and tax calculations. Specific areas also require declarations of credits that may lower total tax liability. Ensuring all components are accurately filled can impact the final tax owed or refund received.

What are the penalties for not issuing the form?

Failure to file the Arizona Form 140PY when required can result in penalties and interest charges on unpaid taxes. Arizona may enforce a minimum penalty based on your tax due, which underscores the importance of timely and accurate filing.

What information do you need when you file the form?

When filing the Arizona Form 140PY, gather the following information:

01

Your Social Security number and personal identification details.

02

Income documents, including W-2 forms, 1099s, or other income statements.

03

Records of any deductions or credits you plan to claim, such as medical expenses or contributions to an IRA.

04

Previous year's tax return for reference if applicable.

Is the form accompanied by other forms?

Depending on your tax situation, the Arizona Form 140PY may be filed alongside additional forms, such as the Arizona Schedule A for itemized deductions or the tax credit forms relevant to your qualifications. Always check that you have the necessary accompanying documentation when submitting your return.

Where do I send the form?

The completed Arizona Form 140PY should be sent to the Arizona Department of Revenue. Ensure it is mailed to the appropriate address based on whether you are expecting a refund or if you owe taxes. Visit their website for the most accurate and updated mailing addresses.

See what our users say