Get the free employer statement of income

Show details

This document serves as a statement for employers to provide information regarding an employee's income and work details for the purpose of a Welvista application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer income statement form

Edit your employer statement of income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer statement of income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income statement from employer online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income statement from employer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

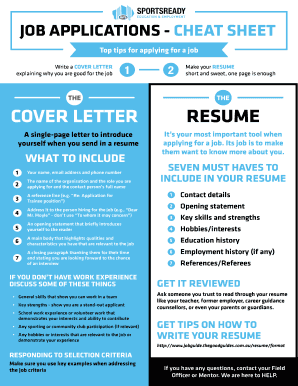

How to fill out employer statement of income

How to fill out employer statement of income

01

Obtain the employer statement of income form from the appropriate source.

02

Fill in the employee's personal details including name, position, and employee ID if applicable.

03

Provide the employer's details including the company name, address, and phone number.

04

State the employee's income, specifying any bonuses, commissions or other types of compensation.

05

Include the employee's duration of employment with the company.

06

If applicable, add information about deductions like taxes or benefits.

07

Have the form signed by an authorized representative of the employer.

08

Submit the completed form by the required deadline.

Who needs employer statement of income?

01

Employees applying for loans or mortgages.

02

Individuals seeking government benefits or assistance.

03

Landlords requiring proof of income for rental applications.

04

Financial institutions conducting background checks on applicants.

Fill

form

: Try Risk Free

People Also Ask about

What is my personal income statement?

Income statement: Your income statement will include your salary, bonuses and commissions. It may also include any dividends and interest earned, gig income or other income. It will also include your income taxes, insurance premiums and other steady cash outflows.

What is proof of income in English?

Applicants can use any number of documents to establish their income, including pay stubs, employment verification letters, and bank statements.

What is the income statement of a company?

An income statement is a financial statement that lays out a company's revenue, expenses, gains, and losses during a set accounting period. It provides valuable insights into various aspects of a business, including its overall profitability and earnings per share.

What is the official income statement?

An income statement (also known as a profit and loss or P&L statement) documents a business' revenue and expenses. Along with a balance sheet, cash flow statement and statement of owner's equity, it's one of the four major financial statements that a business uses to track overall financial health.

What is the income statement of your employer?

W-2 form is an official tax document also known as the Wage and Tax Statement. An employer is obliged to send this document to each employee and the Internal Revenue Service at the end of the year. A W-2 reports the annual wages of employees and the amount of taxes withheld from their paychecks.

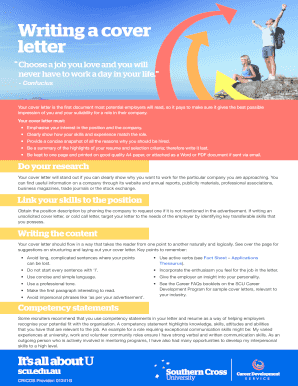

How to write a letter to verify income?

My name is (Employer name) and this letter is to verify the employment of (your name). (Your name) works at (company name) as a (Job title). (He/she) has worked with this company since (Hire date) and works (hours per week). (Your name) earns (Salary) on a (Pay period) basis.

What is the employer's statement?

An employer's statement is a form containing questions about the employment and income of your employee. It is proof of employment. Your employee may need this document to rent a house, to apply for a loan, or when applying for a mortgage to buy a house.

How do I find a company's income statement?

Financial information can be found on the company's web page in Investor Relations where Securities and Exchange Commission (SEC) and other company reports are often kept. The SEC has financial filings electronically available beginning in 1993/1994 free on their website. See EDGAR: Company Filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employer statement of income?

The employer statement of income is a financial document that provides details about the income and earnings of employees within a specific time period. It includes information such as wages, bonuses, and other compensation paid to employees.

Who is required to file employer statement of income?

Employers who have employees and pay them wages or salaries are required to file an employer statement of income. This includes businesses, organizations, and other entities that operate and compensate individuals for their work.

How to fill out employer statement of income?

To fill out the employer statement of income, employers need to gather all relevant payroll information, including total wages paid, withholdings, and other compensation details. They should accurately enter this information into the appropriate sections of the form and ensure it complies with local requirements.

What is the purpose of employer statement of income?

The purpose of the employer statement of income is to report the income paid to employees, facilitate proper tax withholding and reporting, and provide necessary financial information for both employers and employees for taxation and compliance purposes.

What information must be reported on employer statement of income?

The employer statement of income must report information such as employee names, Social Security numbers, total income paid, tax withholdings, deductions, and any other compensation provided during the reporting period.

Fill out your employer statement of income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Statement From Employer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.