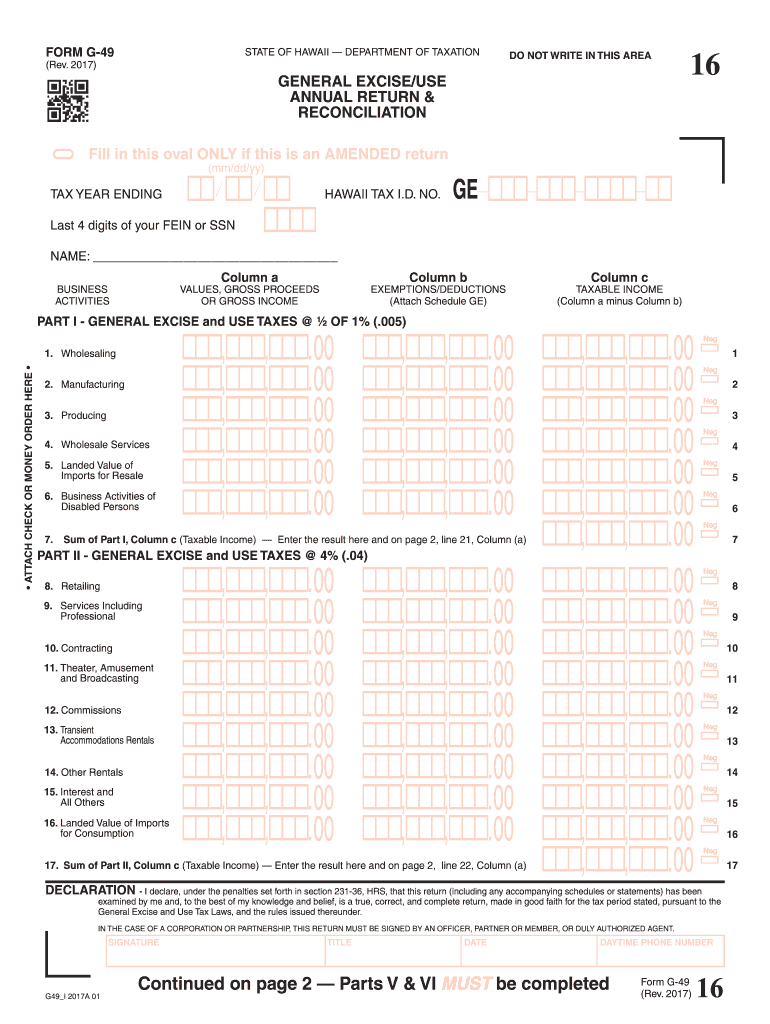

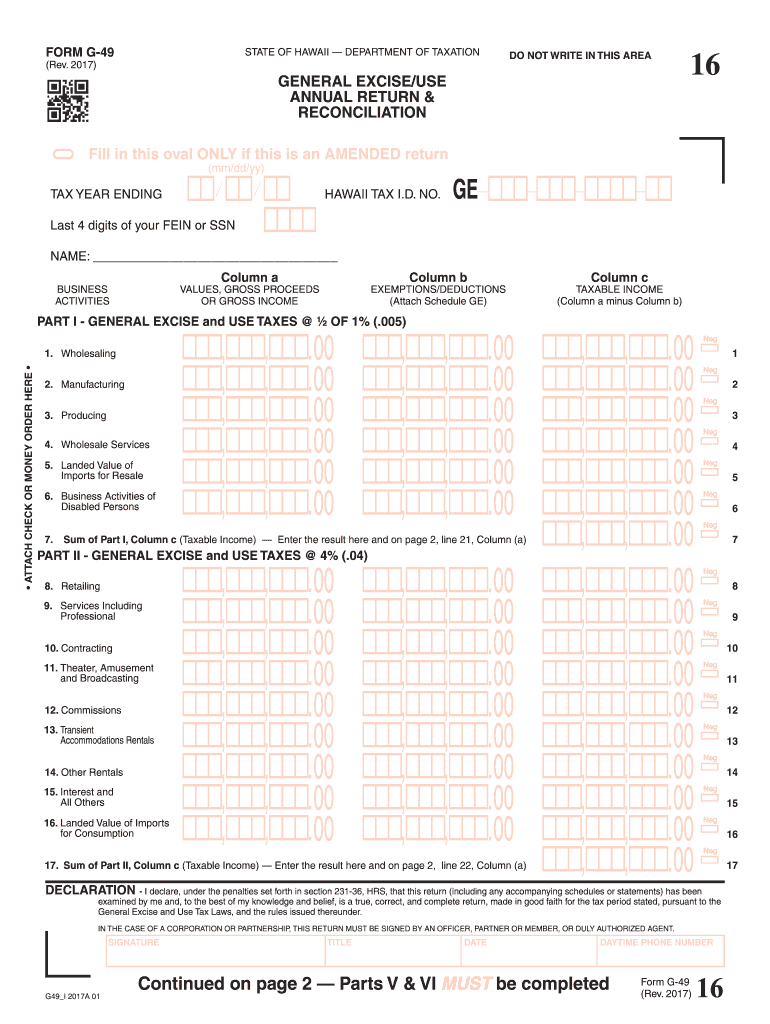

Get the free g49 2016 form

Get, Create, Make and Sign g49 2016 form

Editing g49 2016 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out g49 2016 form

How to fill out g49 2016 form

Who needs g49 2016 form?

Instructions and Help about g49 2016 form

Okay let's talk about filing a g45 electronically type in file from Google evil g45 from there you're going to have a bunch of options so select the services' information option and then select individual filings or payments because you are operating as a sole proprietor you file as an individual so once you selected that there's going to be a login page so for me, I have an F, and so I'm going to log in using my f an of course would probably use your social security number and my password once I'm in it allows you to select your Hawaii tax ID number, so I select my Hawaii tax ID number and I hit continue from this menu there are a bunch of payments that you can make or options that you can select I'm going to select the G 45 which is your general excise or use tax return once I've selected that you're going to see something that looks very similar to your paper g45 what you're going to do is first select your option of your filing frequency for me, I file monthly, so I select this, and maybe I'd go to the August 2016 and scroll down here, and you can enter all of your information so let's let's pretend that I'm a realtor and I made ten thousand dollars in commissions in the last month ten thousand dollars I'm going to type my information here and then what I am going to do is down below I'm going to skip over the insurance Commission's part the Oahu surcharge I'm going to enter the amount that I earned select Oahu and as you're going to see it tells me how much tax I'm going to be required to pay so just follow this go ahead and submit it, and you can file your g45 online this way simple

People Also Ask about

What form do I use for Hawaii estimated taxes?

What is the difference between g45 and g49 taxes in Hawaii?

What is Hawaii tax g49?

What is G-45 Hawaii tax?

How do I get my Hawaii state tax form?

Do I have to file both g45 and g49?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete g49 2016 form online?

Can I create an eSignature for the g49 2016 form in Gmail?

How do I edit g49 2016 form straight from my smartphone?

What is g49 form?

Who is required to file g49 form?

How to fill out g49 form?

What is the purpose of g49 form?

What information must be reported on g49 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.