TX Comptroller 96-1321 2017 free printable template

Show details

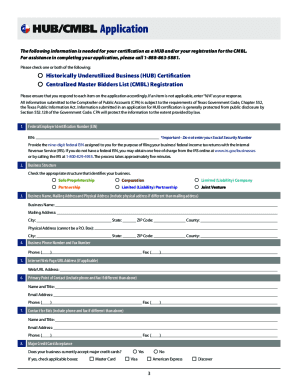

Texas. gov/purchasing/vendor/cmbl/ to immediately be included on the list. Thank you for your interest in the state of Texas HUB Program and CMBL. If you have any questions or need assistance completing the application please contact a program representative toll-free at 1-888-863-5881. 201. Business entities who achieve the size standards for four consecutive years are assumed to have reached a competitive status in overcoming the effects of discrimination. HUB/CMBL Application The following...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 96-1321

Edit your TX Comptroller 96-1321 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 96-1321 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 96-1321 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller 96-1321. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 96-1321 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 96-1321

How to fill out TX Comptroller 96-1321

01

Obtain the TX Comptroller 96-1321 form from the Texas Comptroller's website or local office.

02

Fill in the name and address of the seller at the top of the form.

03

Provide the name and address of the purchaser.

04

Indicate the date of the sale.

05

Specify the type of property being sold.

06

Complete any additional required sections, such as the exemption claim if applicable.

07

Sign and date the form to certify the information is accurate.

08

Submit the completed form to the Texas Comptroller's office or retain for your records according to instructions.

Who needs TX Comptroller 96-1321?

01

Any individual or business making purchases in Texas that qualify for a sales tax exemption.

02

Sellers who wish to document exempt sales to buyers in Texas.

03

Purchasers claiming an exemption from sales tax for qualifying items.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact Texas hub?

For help, please contact the Statewide HUB Program or call 888-863-5881.

What is the number for historically underutilized business state of Texas certification?

HUB Local Line: 512-463-5872 Please review the HUB Frequently Asked Questions.

What is the Texas Hub program?

The Historically Underutilized Business. Program. was created to promote full and equal procurement opportunities for small, minority- and women-owned businesses. Companies interested in doing business with the state are encouraged to become HUB certified.

What does hub mean in construction?

Areas of dense construction are defined as "Construction Hubs" and are actively managed to ensure mobility and access to and through work zones.

What is hub historically underutilized business?

A Historically Underutilized Business (HUB) is a corporation, sole proprietorship, partnership or a joint venture formed for the purpose of making a profit in which at least 51 percent ownership of the business is by a woman, minority and/or service-disabled veteran.

What is a hub business?

A Historically Underutilized Business (HUB) is a corporation, sole proprietorship, partnership or a joint venture formed for the purpose of making a profit in which at least 51 percent ownership of the business is by a woman, minority and/or service-disabled veteran.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX Comptroller 96-1321 to be eSigned by others?

Once you are ready to share your TX Comptroller 96-1321, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the TX Comptroller 96-1321 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your TX Comptroller 96-1321 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out TX Comptroller 96-1321 on an Android device?

Use the pdfFiller mobile app and complete your TX Comptroller 96-1321 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is TX Comptroller 96-1321?

TX Comptroller 96-1321 is a form used in the state of Texas for reporting and remitting certain taxes or fees as mandated by the Texas Comptroller's office.

Who is required to file TX Comptroller 96-1321?

Businesses and individuals who are subject to the specific taxes or fees outlined on the form are required to file TX Comptroller 96-1321.

How to fill out TX Comptroller 96-1321?

To fill out TX Comptroller 96-1321, one must provide accurate information regarding their taxable sales, deductions, and calculate the total tax due, following the instructions provided on the form.

What is the purpose of TX Comptroller 96-1321?

The purpose of TX Comptroller 96-1321 is to ensure compliance with Texas tax laws by collecting information on sales and the corresponding taxes owed to the state.

What information must be reported on TX Comptroller 96-1321?

The information that must be reported on TX Comptroller 96-1321 includes total taxable sales, exemptions or deductions claimed, and the total tax due for the reporting period.

Fill out your TX Comptroller 96-1321 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 96-1321 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.