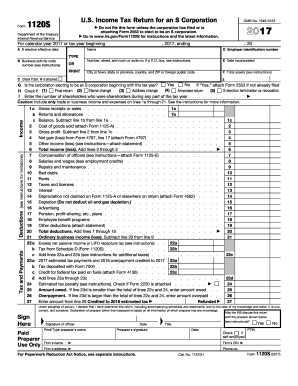

GA DoR 600S 2017 free printable template

Get, Create, Make and Sign form 600s 2017

How to edit form 600s 2017 online

Uncompromising security for your PDF editing and eSignature needs

GA DoR 600S Form Versions

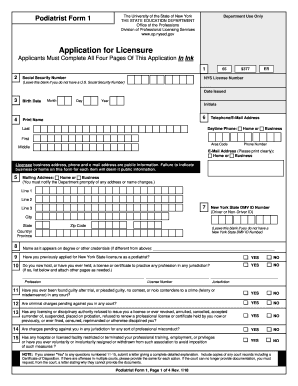

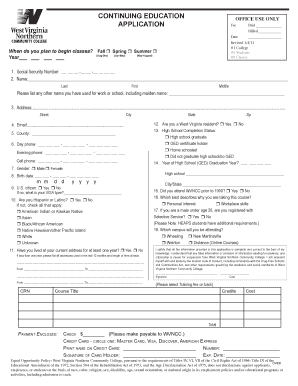

How to fill out form 600s 2017

How to fill out GA DoR 600S

Who needs GA DoR 600S?

Instructions and Help about form 600s 2017

Laws calm legal forms guide form 600 corporation tax return corporations operating in Georgia can file their state income and net worth taxes owed by using a form 600 the document can be obtained from the website of the Georgia Department of Revenue step 1 at the top of the form give the dates for which you are filing and check the boxes next to all applicable statements about the return your filing step 2 in Section A give your federal employer identification number and corporate title name step 3 in Section B give your state withholding tax account number and business address step 4 in Section C give your state sales tax registration number city or town state and zip code step 5 in Section D give your NAILS code the location of your books in case of an audit and a telephone number step 6 in Section E give the date of your incorporation step 7 in section F give the state under whose laws you were incorporated step 8 in Section G give the date under which you were admitted to practice in Georgia step 9 in Section H describe your type of business step 10 right the last tax year whose return was filed by the IRS and the date of the last return filed with Georgia step 11 computer state taxable income and tax do as instructed on lines one through eight of schedule 1 you will need to complete schedules four through seven on the second page first step 12 in schedule to compute your net worth tax do as instructed on lines one through seven step 13 in schedule 3 compute your tax due or overpayment made on lines 1 through 11 step 14 if owed a refund you wish to receive through direct deposit give your account information where indicated on the second page an officer should sign and date the bottom of this page as well as providing their title to watch more videos please make sure to visit laws calm

People Also Ask about

Can I download and print tax forms?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 600s 2017 directly from Gmail?

How can I modify form 600s 2017 without leaving Google Drive?

How do I edit form 600s 2017 in Chrome?

What is GA DoR 600S?

Who is required to file GA DoR 600S?

How to fill out GA DoR 600S?

What is the purpose of GA DoR 600S?

What information must be reported on GA DoR 600S?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.