Get the free IFRS 9 for

Show details

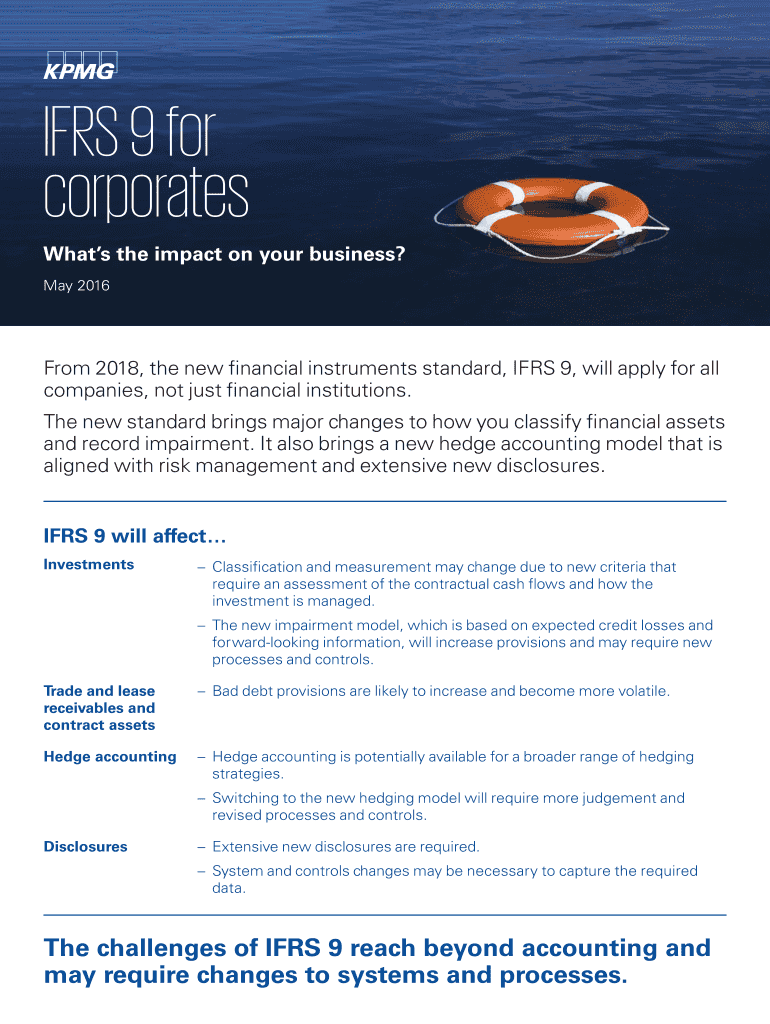

IFRS 9 for

corporates

What's the impact on your business?

May 2016From 2018, the new financial instruments standard, IFRS 9, will apply for all

companies, not just financial institutions.

The new

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ifrs 9 for

Edit your ifrs 9 for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifrs 9 for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ifrs 9 for online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ifrs 9 for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ifrs 9 for

How to fill out ifrs 9 for

01

Start by understanding the basic principles of IFRS 9, which governs the accounting treatment of financial instruments.

02

Identify the specific financial instruments within your organization that are covered by IFRS 9. This may include loans, derivatives, and investments.

03

Gather all relevant financial data and documentation related to these instruments, such as transaction records, valuation reports, and risk assessments.

04

Classify the financial instruments based on their nature and purpose, using the appropriate categories defined by IFRS 9.

05

Determine the appropriate measurement and recognition criteria for each instrument, considering factors like fair value, amortized cost, and impairment.

06

Calculate any necessary adjustments or provisions for impairment or reclassification of instruments according to the guidelines provided by IFRS 9.

07

Prepare the financial statements and disclosures as required by IFRS 9, ensuring compliance with the specific reporting requirements.

08

Review and validate the completed IFRS 9 disclosures, taking into account any relevant auditing or validation procedures.

09

Communicate the financial information and disclosures related to IFRS 9 to stakeholders, such as investors, regulators, and auditors.

10

Regularly monitor and update the accounting treatment of financial instruments in accordance with any changes or updates to IFRS 9.

Who needs ifrs 9 for?

01

IFRS 9 is primarily needed by organizations that engage in financial activities and have financial instruments on their balance sheets.

02

This includes banks, insurance companies, investment firms, and other entities that deal with loans, derivatives, hedging instruments, or investments.

03

IFRS 9 provides a standardized framework for accounting and reporting of financial instruments, ensuring transparency and comparability in financial statements.

04

By following IFRS 9 guidelines, these organizations can accurately measure and disclose the value, risks, and performance of their financial instruments,

05

which is essential for making informed investment decisions, assessing creditworthiness, and ensuring regulatory compliance.

06

Furthermore, entities operating in jurisdictions that have adopted IFRS as the accounting standard must comply with IFRS 9 reporting requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ifrs 9 for in Gmail?

ifrs 9 for and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the ifrs 9 for electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ifrs 9 for in minutes.

How can I fill out ifrs 9 for on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your ifrs 9 for. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is ifrs 9 for?

IFRS 9 is for addressing the accounting for financial instruments.

Who is required to file ifrs 9 for?

Entities that prepare financial statements in accordance with International Financial Reporting Standards (IFRS) are required to file IFRS 9.

How to fill out ifrs 9 for?

IFRS 9 is filled out by analyzing and classifying financial instruments, measuring them at fair value or amortized cost, and recognizing any impairment losses.

What is the purpose of ifrs 9 for?

The purpose of IFRS 9 is to provide a single, principles-based approach to the classification and measurement of financial instruments.

What information must be reported on ifrs 9 for?

IFRS 9 requires reporting information on the classification, measurement, and impairment of financial instruments.

Fill out your ifrs 9 for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifrs 9 For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.