RI DoR T-204R-Annual 2017 free printable template

Show details

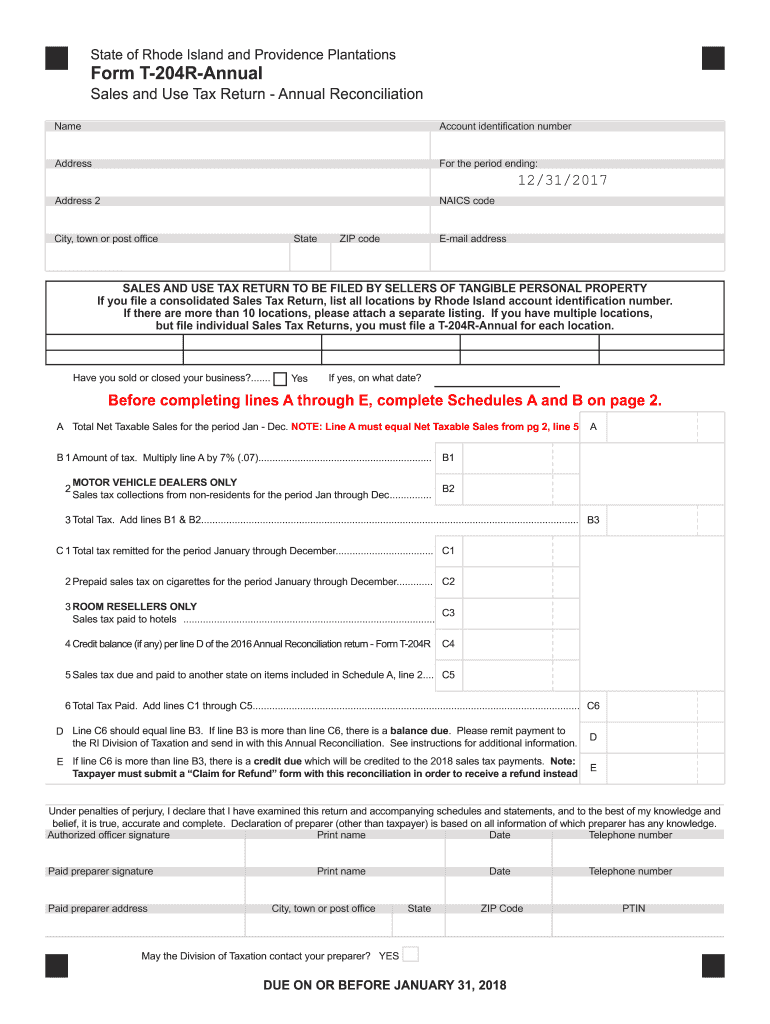

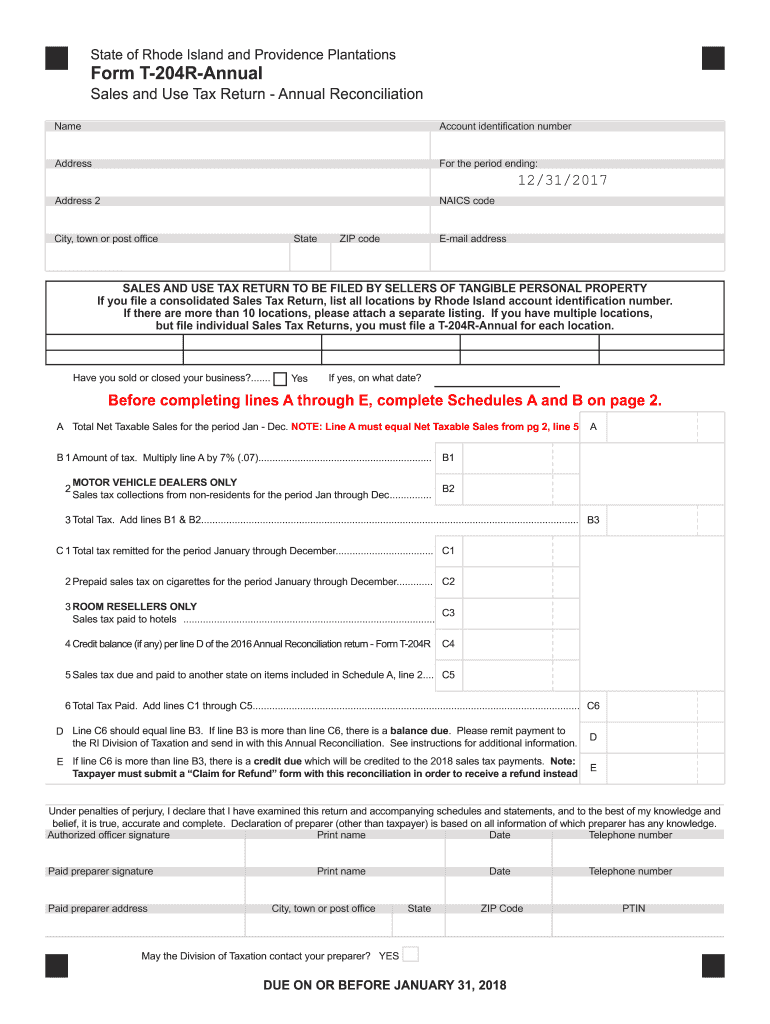

State of Rhode Island and Providence PlantationsForm T204RAnnual Sales and Use Tax Return Annual Reconciliation NameAccount identification numberAddressFor the period ending:12/31/2017 NAILS headdress

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI DoR T-204R-Annual

Edit your RI DoR T-204R-Annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI DoR T-204R-Annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI DoR T-204R-Annual online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit RI DoR T-204R-Annual. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI DoR T-204R-Annual Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI DoR T-204R-Annual

How to fill out RI DoR T-204R-Annual

01

Obtain the RI DoR T-204R-Annual form from the Rhode Island Department of Revenue website or the local office.

02

Fill out your personal information, including your name, address, and social security number.

03

Enter relevant financial data for the year, including income, deductions, and credits.

04

Follow the instructions carefully for each section, ensuring that all numbers are accurate.

05

Review all information for completeness and correctness to avoid errors.

06

Sign and date the form at the designated area.

07

Submit the completed form by the specified deadline, either online or by mailing it to the appropriate address.

Who needs RI DoR T-204R-Annual?

01

Individuals or businesses required to report annual income for tax purposes in Rhode Island.

02

Taxpayers who have earned income and need to report it to the Rhode Island Department of Revenue.

03

Professionals who qualify under specific tax regulations and must file an annual return.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1040 form and why is it used?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Do I have to file state taxes in Rhode Island?

Every nonresident individual required by the laws of the United States to file a federal income tax return who has income derived from or connected with Rhode Island sources must file a Rhode Island individual income tax return.

Does Rhode Island have a sales tax?

The sales tax is a levy imposed on the retail sale, rental or lease of many goods and services at a rate of 7%. Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business. The tax is collected by the vendor and remitted directly to the state.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How do I file my state taxes in Rhode Island?

You have the following options to pay your tax: Mail in a check. You need to attach Payment Voucher (Form RI-1040V) One Capitol Hill. Electronic Filing. Providence, RI 02908-5806. Send credit card payment through third-party website. Send e-payment through state website.

What states do not require you to file a tax return?

Alaska, Florida, South Dakota, Nevada, Texas, Washington and Wyoming do not collect income tax. If you live and work in those states, you don't have to file an income tax return in those states.

Is a 1040 and a W-2 the same thing?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

How do I file a sales tax return in Rhode Island?

How to File and Pay Sales Tax in Rhode Island File online – File online at the Rhode Island Division of Taxation. File by mail – You can use the Rhode Island Streamlined Sales Tax Return and file and pay through the mail, though you must file and pay online if your tax liability in the previous year was $200 or more.

What is a RI-1040 form?

The RI-1040 Resident booklet contains returns and instructions for filing the 2021 Rhode Island Resident Individual Income Tax Return. Read the in- structions in this booklet carefully. For your convenience we have provided “line by line instructions” which will aid you in completing your return.

Do I have to file a state tax return in Rhode Island?

ing to Rhode Island Instructions for Form RI-1040: If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return.

Who has to file a RI tax return?

Rhode Island Residents If you are a Rhode Island resident and filed a federal tax return or you are an individual and your income exceeded the federal exceptions, you are required to file a Rhode Island resident tax return using Form RI-1040.

How do tax sales work in Rhode Island?

Tax sales are held in the form of auctions. The winning bidder is NOT the person willing to pay the most money, but rather the person willing to receive the smallest percentage of ownership. For instance, $5,000 may be owed to a city or town in unpaid taxes, interest and legal fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my RI DoR T-204R-Annual in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your RI DoR T-204R-Annual and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get RI DoR T-204R-Annual?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the RI DoR T-204R-Annual in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete RI DoR T-204R-Annual online?

With pdfFiller, you may easily complete and sign RI DoR T-204R-Annual online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is RI DoR T-204R-Annual?

RI DoR T-204R-Annual is a tax form used in Rhode Island for reporting annual income tax withholding information for employees and independent contractors.

Who is required to file RI DoR T-204R-Annual?

Employers and businesses that withhold Rhode Island income tax from employee wages or contractor payments are required to file the RI DoR T-204R-Annual.

How to fill out RI DoR T-204R-Annual?

To fill out RI DoR T-204R-Annual, you generally need to provide details such as your business information, the total amount of income tax withheld, and any payments made during the year.

What is the purpose of RI DoR T-204R-Annual?

The purpose of the RI DoR T-204R-Annual is to report the total amount of state income tax withheld from payments made to employees and contractors for a tax year.

What information must be reported on RI DoR T-204R-Annual?

The information that must be reported on RI DoR T-204R-Annual includes the employer's name and tax identification number, total withholdings for the year, and any adjustments or payments made.

Fill out your RI DoR T-204R-Annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI DoR T-204r-Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.