Get the free (SECCI) for KBC Credit Card

Show details

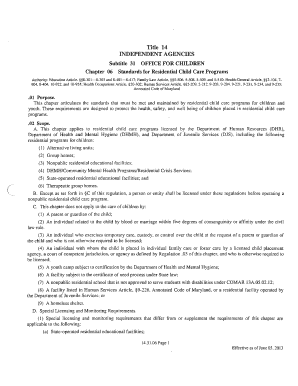

Standard European Consumer Credit Information (SE CCI) for KBC Credit Card Name and Contact details of the Creditor Creditors Bank Ireland plcAddressSandwith Street, Dublin 2, IrelandTelephone01 664

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secci for kbc credit

Edit your secci for kbc credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secci for kbc credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing secci for kbc credit online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit secci for kbc credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secci for kbc credit

How to fill out secci for kbc credit

01

To fill out the SECCI for KBC credit, follow these steps:

02

Start by gathering all the necessary information and documents, such as your personal identification details, income proof, and any supporting documents as required by KBC.

03

Carefully read through the SECCI form provided by KBC. It contains important information about the credit terms, interest rates, fees, and other relevant details. Make sure you understand all the terms and conditions before proceeding.

04

Fill in your personal details accurately, including your name, address, contact information, and social security number.

05

Provide details about the credit product you are applying for, including the loan amount, repayment period, and any additional features or options you may have chosen.

06

If applicable, provide information about any collateral or guarantor involved in the credit agreement.

07

Review all the information you have provided to ensure its accuracy and completeness.

08

Sign and date the SECCI form to indicate your agreement with the terms and conditions.

09

Make a copy of the completed SECCI form for your records.

10

Submit the filled-out SECCI form along with any supporting documents to KBC as per their instructions.

11

Wait for KBC's review and approval process to complete. They will communicate the outcome to you accordingly.

Who needs secci for kbc credit?

01

Anyone who is applying for a credit product from KBC may need to fill out the SECCI form.

02

The SECCI (Standard European Consumer Credit Information) is a document that provides clear and concise information about the terms and conditions of the credit agreement. It helps borrowers make informed decisions and understand their rights and obligations.

03

Therefore, individuals who are interested in obtaining credit from KBC, such as personal loans, mortgages, or credit cards, need to fill out the SECCI form as part of the application process.

04

It ensures transparency and allows borrowers to compare different credit offers effectively. Regardless of the type of credit product, KBC requires applicants to complete the SECCI form to ensure compliance with consumer protection regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my secci for kbc credit in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your secci for kbc credit and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit secci for kbc credit from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your secci for kbc credit into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete secci for kbc credit on an Android device?

Complete your secci for kbc credit and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is secci for kbc credit?

SECCI stands for Standard European Consumer Credit Information. It is a standardized document that provides key information about a credit agreement, such as interest rate, total amount payable, and other important terms and conditions.

Who is required to file secci for kbc credit?

The lender or financial institution offering the credit is required to provide the SECCI document to the consumer before the credit agreement is signed.

How to fill out secci for kbc credit?

The SECCI document is typically filled out by the lender or financial institution based on the details of the specific credit agreement being offered.

What is the purpose of secci for kbc credit?

The purpose of the SECCI document is to provide consumers with clear and standardized information about the credit agreement, helping them make informed decisions and understand the terms and conditions of the agreement.

What information must be reported on secci for kbc credit?

The SECCI document must include key information such as the total amount payable, the annual percentage rate (APR), the total cost of credit, and any other important terms and conditions of the credit agreement.

Fill out your secci for kbc credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secci For Kbc Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.