Get the free PARTNERSHIPS AT

Show details

November 911, 2016 Palm Beach, PRODUCTIVITY AND PARTNERSHIPS SMALL BUSINESS BANKING ON NOVEMBER 911 IN PALM BEACH GARDENS, FLP resented by:http://www.americanbanker.com/conferences/sbb/November 911,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partnerships at

Edit your partnerships at form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partnerships at form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partnerships at online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit partnerships at. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partnerships at

How to fill out partnerships at

01

To fill out partnerships, follow these steps:

02

Gather all the necessary information about the partnership, such as the names and contact details of the involved parties, the purpose of the partnership, and any relevant documents.

03

Determine the type of partnership you are dealing with, whether it is a general partnership, limited partnership, or any other specific type.

04

Prepare the partnership agreement, which outlines the rights and responsibilities of each partner, the duration of the partnership, the capital contributions, and the profit-sharing arrangements.

05

Ensure compliance with any legal requirements or regulations related to partnerships in your jurisdiction.

06

Review the partnership agreement thoroughly to ensure its accuracy and completeness.

07

Have all the involved parties sign the partnership agreement to make it legally binding.

08

Keep a copy of the partnership agreement for your records and distribute copies to all parties involved.

09

Regularly review and update the partnership agreement as needed to reflect any changes in the partnership.

10

Seek legal advice or consult with professionals if you are unsure about any aspect of filling out partnerships.

11

By following these steps, you can successfully fill out partnerships.

Who needs partnerships at?

01

Partnerships are beneficial for various individuals and entities including:

02

- Business owners who want to collaborate with other businesses to expand their market reach and share resources.

03

- Entrepreneurs who wish to start a new venture together and pool their skills, expertise, and capital.

04

- Professionals such as lawyers, accountants, or consultants who want to form a partnership to provide their services collectively and enhance their reputation.

05

- Non-profit organizations or charities that want to join forces with other organizations to maximize their impact and achieve common goals.

06

- Investors who are looking for investment opportunities and prefer sharing risks and returns with other investors in a partnership.

07

These are just a few examples of individuals or entities that might benefit from partnerships. The specific needs and advantages of partnerships can vary depending on the context and goals of the parties involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit partnerships at from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your partnerships at into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete partnerships at online?

Filling out and eSigning partnerships at is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit partnerships at in Chrome?

partnerships at can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

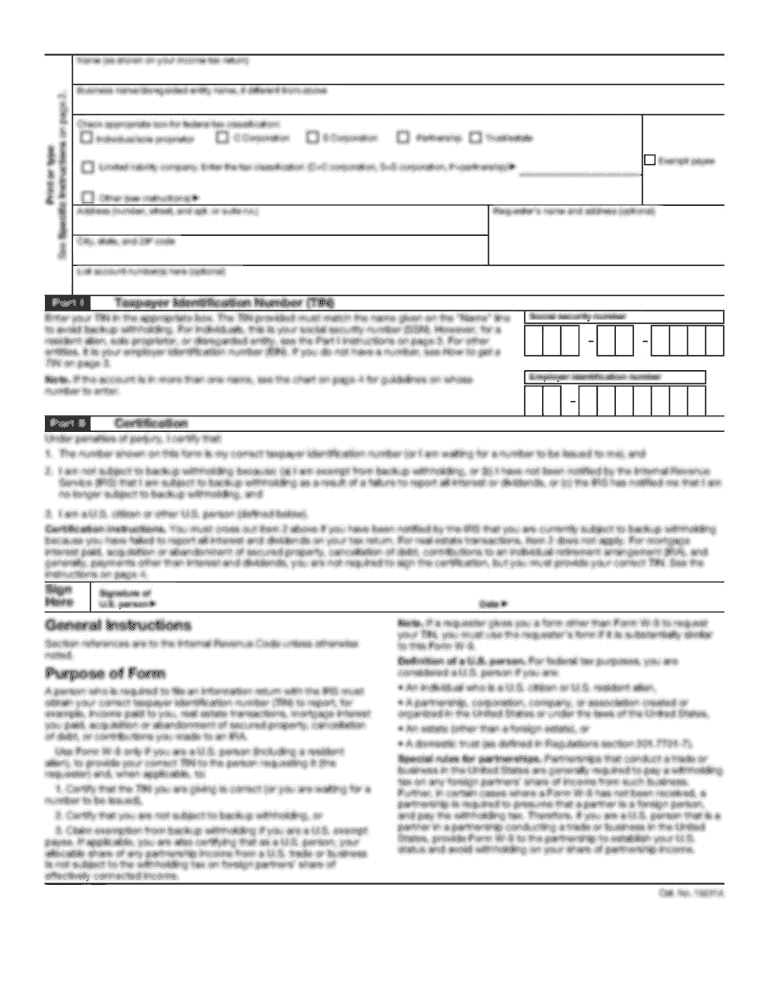

What is partnerships at?

Partnerships at is a tax form used to report the income, deductions, credits, and other tax-related information of a partnership.

Who is required to file partnerships at?

Partnerships are required to file partnerships at to report their financial information to the IRS.

How to fill out partnerships at?

Partnerships at can be filled out by providing all the necessary financial information of the partnership, including income, expenses, and credits.

What is the purpose of partnerships at?

The purpose of partnerships at is to report the financial information of a partnership to the IRS for tax purposes.

What information must be reported on partnerships at?

Partnerships at must report income, deductions, credits, and other tax-related information of the partnership.

Fill out your partnerships at online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partnerships At is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.