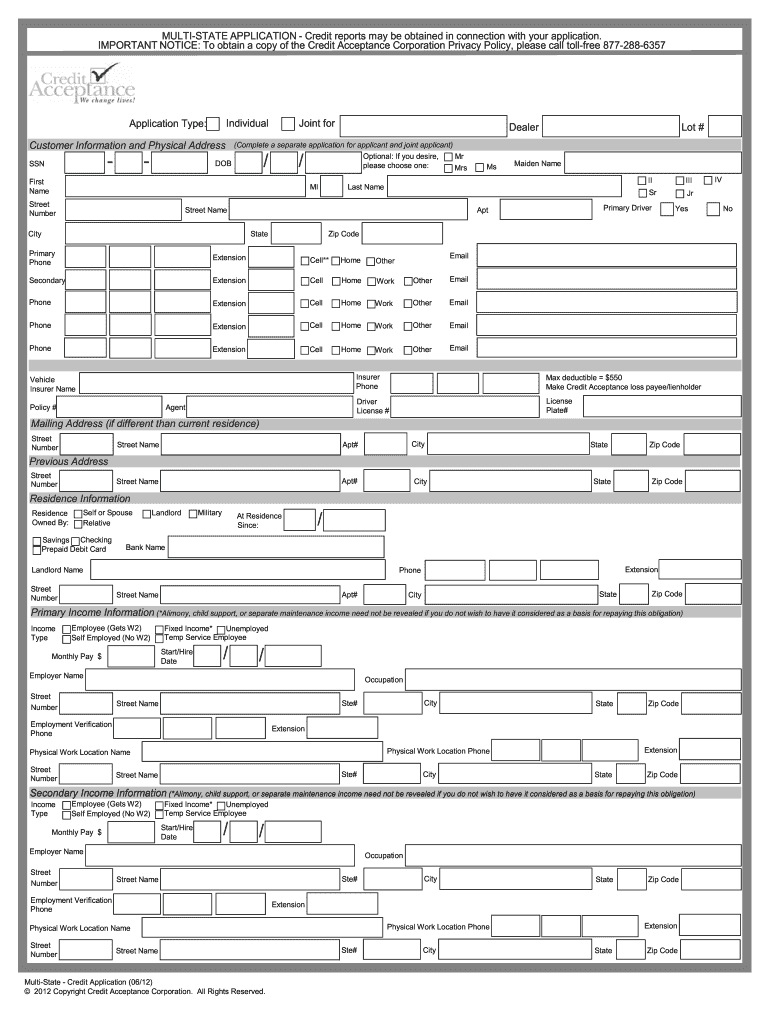

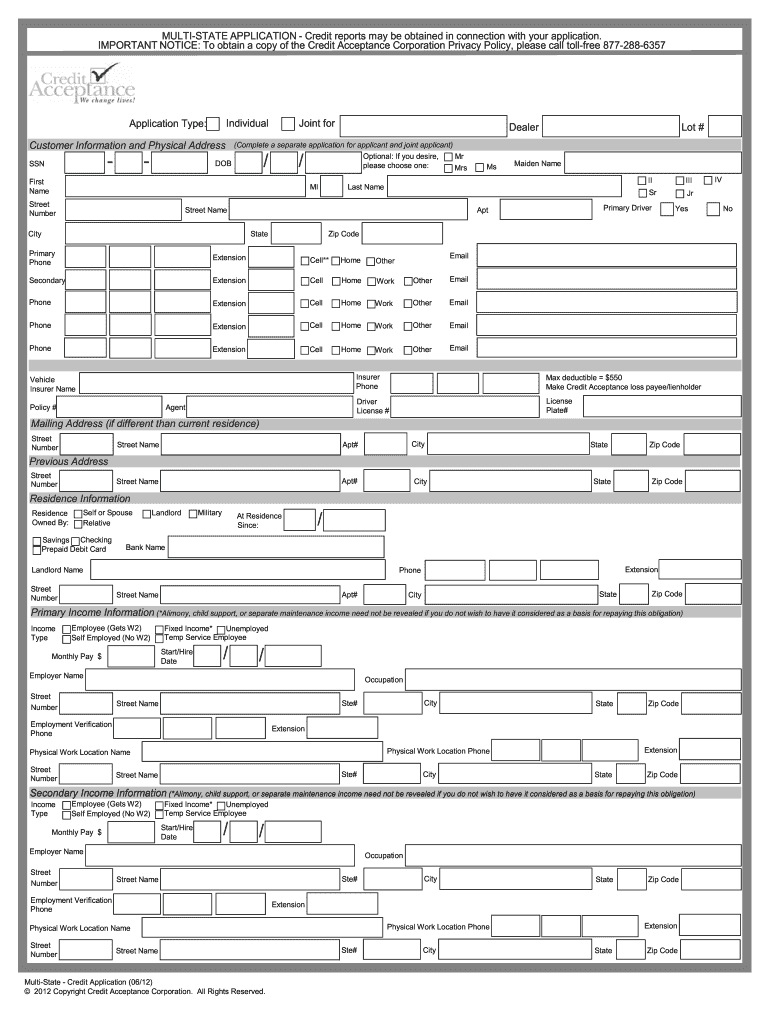

Get the free application for credit

Get, Create, Make and Sign application for credit

Editing application for credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for credit

How to fill out application for credit:

Who needs application for credit:

Instructions and Help about application for credit

Ever had your credit card application denied no one likes rejection, but there are a few things you can do to improve your chances of being approved it helps to know how credit card companies decide whether to approve potential customers well they're going to take a look at how you've handled your credit in the past taking a look at how you've made your monthly payments taking a look if you're meeting your minimum payment expectations how much debt have you gotten yourself into and also taking a look at how much new credit you've applied for and you're also taking a look at what your income may be with that in mind let's say you do get denied what went wrong there are a few things it could be maybe you simply made a mistake on the application maybe your credit report has an error it could be that you're recently unemployed or your income is too low of course a bad credit history will also affect your approval and even if your credit history looks good if you're applying for a lot of credit at once a bank may suspect you're having financial problems if you are denied credit what should you do step 1 check your credit report for errors you can get one free copy of your credit report per year from each of the three major credit bureaus by going to annual credit report.com, so it's recommended that you review your credit report at least on an annual basis to make sure that everything is correct on your credit report if an error isn't to blame you probably need to work on your credit take a look at your credit report to be able to see well if there's a delinquency as a reason for having your credit card declined well what was that delinquency how long ago was it has it been resolved if it hasn't resolved then going ahead and taking a look as to how to be able to resolve it are you missing payment due dates now if you're having difficulties it's always recommended that you reach out to either your lender or your creditor depending on whom it may be and have them explore options with you so that you are current you may need to reevaluate your credit usage a good rule of thumb is to keep your credit card balances at less than one-third of your total available credit that's the sum of all your credit limits if you were denied over an income issue you might have to apply for credit until you find employment or your income increases when you're ready to apply for a card again do your homework give the issuer a call ask what their approval guidelines are for that particular card do they have a minimum income requirement what credit score are they looking for finally take care when filling out the application, so you always want to make sure that you print clearly on the applications and also have the banker whoever gave you the application review it to make sure that you filled in everything, and you're not missing any information with a little research and maybe some credit repair you'll do well to be approved the next time around Kristin Wong Car cards...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete application for credit online?

How do I edit application for credit online?

How do I edit application for credit straight from my smartphone?

What is application for credit?

Who is required to file application for credit?

How to fill out application for credit?

What is the purpose of application for credit?

What information must be reported on application for credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.