Get the free X a single-employer plan;

Show details

Form 5500

Department of the Treasury

Internal Revenue ServiceAnnual Return/Report of Employee Benefit Plan OMB Nos. 12100110

12100089This form is required to be filed for employee benefit plans under

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign x a single-employer plan

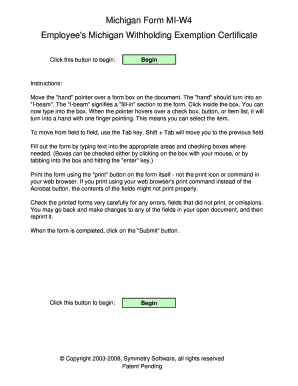

Edit your x a single-employer plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your x a single-employer plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit x a single-employer plan online

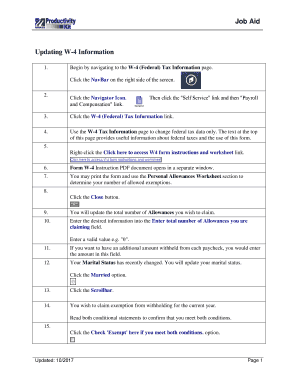

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit x a single-employer plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out x a single-employer plan

How to fill out x a single-employer plan

01

Gather all relevant information about your employees, including their names, social security numbers, and employment start dates.

02

Determine the eligibility criteria for your single-employer plan, such as age and length of service requirements.

03

Choose a plan administrator or trustee who will oversee the plan and ensure compliance with legal and regulatory requirements.

04

Select a plan design that best suits the needs and goals of your company, considering factors such as contribution levels, vesting schedules, and investment options.

05

Create a summary plan description (SPD) that explains the key features of the plan to your employees and provides them with important information about their rights and benefits.

06

Provide enrollment forms to your employees and guide them through the process of filling out the necessary paperwork.

07

Establish a system for collecting and depositing employee contributions into the plan in a timely manner.

08

Monitor the plan regularly to ensure that it remains compliant with legal and regulatory requirements, and make any necessary adjustments or updates as needed.

09

Educate your employees about the benefits of participating in the single-employer plan and provide ongoing communication and support to help them make informed decisions.

10

Review the plan periodically and consider making updates or changes based on the evolving needs of your employees and the company.

Who needs x a single-employer plan?

01

Employers who want to provide retirement benefits to their employees

02

Employers who want to attract and retain talented employees by offering competitive retirement packages

03

Employers who want to take advantage of tax benefits associated with offering a single-employer plan

04

Employers who want to ensure the financial security and well-being of their employees during retirement

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send x a single-employer plan for eSignature?

Once you are ready to share your x a single-employer plan, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I fill out x a single-employer plan on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your x a single-employer plan. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit x a single-employer plan on an Android device?

You can edit, sign, and distribute x a single-employer plan on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your x a single-employer plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

X A Single-Employer Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.