NC DoR E-595E 2018 free printable template

Show details

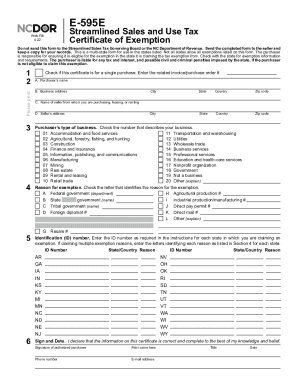

E-595E Streamlined Sales and Use Tax Agreement Certificate of Exemption Web-Fill 1-18 PRINT CLEAR This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. Ncdor. gov or you may contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 toll free. Seller You are required to maintain proper records of exempt...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR E-595E

Edit your NC DoR E-595E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR E-595E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC DoR E-595E online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NC DoR E-595E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR E-595E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR E-595E

How to fill out NC DoR E-595E

01

Obtain a copy of the NC DoR E-595E form from the North Carolina Department of Revenue website.

02

Fill in the name and address of your business at the top of the form.

03

Provide your North Carolina sales tax account number in the appropriate field.

04

Indicate the type of purchases you will be making (e.g., tangible personal property, services).

05

Sign and date the form to certify the accuracy of the information provided.

06

Submit the completed form to your vendor to ensure you are not charged sales tax on eligible purchases.

Who needs NC DoR E-595E?

01

Businesses purchasing items for resale in North Carolina.

02

Organizations that qualify for exemption from sales tax.

03

Any entity looking to make tax-exempt purchases within the state.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim back US sales tax?

The US Government does not refund Sales Tax to Visitors US Customs and Border Protection has clarified on the CBP website that says, “The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government …”.

How to file for sales tax refund in North Carolina?

Filing a claim for refund using Form E-588, Business Claim for Refund State, County and Transit Sales and Use Taxes. The claim must identify the taxpayer, the type and amount of tax overpaid, the filing period to which the overpayment applies, and the basis for the claim.

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

Who qualifies for sales tax exemption in North Carolina?

In North Carolina, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several examples of exemptions to the state sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in research and development.

How do I file a sales tax refund in NC?

Filing a claim for refund using Form E-588, Business Claim for Refund State, County and Transit Sales and Use Taxes. The claim must identify the taxpayer, the type and amount of tax overpaid, the filing period to which the overpayment applies, and the basis for the claim.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the NC DoR E-595E in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NC DoR E-595E in seconds.

How do I edit NC DoR E-595E on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share NC DoR E-595E from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete NC DoR E-595E on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your NC DoR E-595E. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NC DoR E-595E?

NC DoR E-595E is a form used in North Carolina for exempting certain purchases from sales and use tax under specified conditions.

Who is required to file NC DoR E-595E?

Organizations, businesses, or individuals making purchases that qualify for exempt status under North Carolina law are required to file NC DoR E-595E.

How to fill out NC DoR E-595E?

To fill out NC DoR E-595E, provide the purchaser's details, description of the property or services being purchased, and indicate which exemption applies.

What is the purpose of NC DoR E-595E?

The purpose of NC DoR E-595E is to document tax-exempt purchases and to ensure compliance with sales tax regulations in North Carolina.

What information must be reported on NC DoR E-595E?

The information required on NC DoR E-595E includes the purchaser's name, address, type of organization, and a detailed description of the item or service being purchased.

Fill out your NC DoR E-595E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR E-595e is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.