MI MI-1045 2017-2026 free printable template

Show details

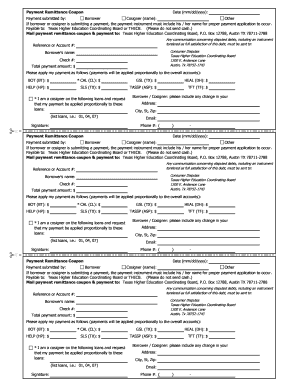

Michigan Department of Treasury (Rev. 09-11), Page 1. Application for Michigan Net Operating Loss Refund MI-1045. Issued under authority of Public Act 281 of ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign michigan payments form

Edit your reform tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI MI-1045 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI MI-1045 online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI MI-1045. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MI MI-1045

How to fill out MI MI-1045

01

Obtain the MI MI-1045 form from the Michigan Department of Treasury website or local tax office.

02

Fill out your personal information in the designated areas, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the MI MI-1045.

04

Provide information about the type of income you are reporting, such as wages or other sources.

05

Complete any additional sections as required for deductions or credits.

06

Review your information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed MI MI-1045 form to the Michigan Department of Treasury either by mail or electronically, as instructed.

Who needs MI MI-1045?

01

Individuals who have overpaid their Michigan income tax and wish to file for a refund.

02

Taxpayers who are eligible for credits or deductions that exceed their tax liability.

03

Residents who have received a notice from the Michigan Department of Treasury regarding an audit or correction.

Fill

form

: Try Risk Free

People Also Ask about

What is the Michigan form 2210 2022?

The MI-2210 computes interest to April 18, 2023, or the date of payment, whichever is earlier. This part of the form breaks down underpayments to the payment period they are due, then gives the interest rate for that period.

What is MI-1040 form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

What is the total exemptions for Michigan MI W4?

For the 2022 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent. An additional personal exemption is available if you are the parent of a stillborn child in 2022.

What is Michigan MI W4?

MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE (Form MI-W4) Your employer is required to notify the Michigan Department of Treasury if you have claimed 10 or more personal or dependency exemptions or claimed that you are exempt from withholding.

What is form 2210 used for?

Purpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

How do you avoid penalty 2210?

If your current year total tax minus the amount of tax you paid through withholding is less than $1,000, you are not required to pay the underpayment penalty and do not need to complete Form 2210. Different rules apply if at least two-thirds of your income is from farming or fishing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MI MI-1045 online?

With pdfFiller, it's easy to make changes. Open your MI MI-1045 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the MI MI-1045 in Gmail?

Create your eSignature using pdfFiller and then eSign your MI MI-1045 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit MI MI-1045 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing MI MI-1045, you can start right away.

What is MI MI-1045?

MI MI-1045 is a form used in the state of Michigan for reporting and calculating Michigan individual income tax withholding.

Who is required to file MI MI-1045?

Employers who withhold Michigan income tax from their employees' wages are required to file MI MI-1045.

How to fill out MI MI-1045?

To fill out MI MI-1045, an employer must provide information such as their business name, identification number, total wages subject to withholding, and the total amount withheld for the tax year.

What is the purpose of MI MI-1045?

The purpose of MI MI-1045 is to report the total Michigan income tax withholding amounts and to reconcile the withheld amounts with the employer’s tax liability.

What information must be reported on MI MI-1045?

The information that must be reported on MI MI-1045 includes the employer's name, address, identification number, total wages paid, total Michigan income tax withheld, and any adjustments or corrections.

Fill out your MI MI-1045 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI MI-1045 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.