Get the free SCHEDULED OC (FORM 40 OR 40NR) Alabama Department of Revenue Other Available Credits...

Show details

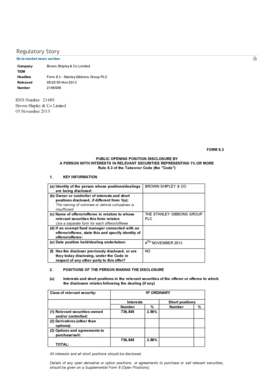

SCHEDULED(FORM 40 OR 40NR)*170008OC×Alabama Department of RevenueOther Available Credits2017ATTACH TO FORM 40 OR 40NRName(s) as shown on Form 40 or 40NR PART A Credit For Taxes Paid To Other States

We are not affiliated with any brand or entity on this form

Instructions and Help about scheduled oc form 40

How to edit scheduled oc form 40

How to fill out scheduled oc form 40

Instructions and Help about scheduled oc form 40

How to edit scheduled oc form 40

To edit the scheduled oc form 40, you can use a PDF editor such as pdfFiller. Open the form in the editor, and utilize the available tools to make necessary changes. Ensure that all information is accurate before saving your edits. Once finalized, you can print or save the updated form for your records.

How to fill out scheduled oc form 40

Filling out the scheduled oc form 40 requires several steps to ensure accuracy. Begin by gathering necessary information, including income details and other financial records. Follow the instructions provided on the form carefully, filling in each section completely. Finally, review the form for errors before submitting it to the appropriate entity.

Latest updates to scheduled oc form 40

Latest updates to scheduled oc form 40

Stay updated with any changes to the scheduled oc form 40 by checking the IRS website regularly. Updates may involve changes in filing procedures, due dates, or specific reporting requirements. Always ensure you are using the most recent version of the form to avoid compliance issues.

All You Need to Know About scheduled oc form 40

What is scheduled oc form 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About scheduled oc form 40

What is scheduled oc form 40?

The scheduled oc form 40 is an IRS document used to report certain types of income and deductions specific to certain taxpayers. It is important for individuals who have received payments that require federal reporting to properly complete this form.

What is the purpose of this form?

The purpose of the scheduled oc form 40 is to document and report specific financial information to the IRS. This form helps the IRS ensure compliance with tax laws by providing a record of income that may not be captured through standard employment wages.

Who needs the form?

Taxpayers who have received payments from sources such as self-employment or other non-traditional income streams need to file scheduled oc form 40. If you are an independent contractor or a freelancer, this form is essential for reporting your earnings accurately.

When am I exempt from filling out this form?

You may be exempt from filing scheduled oc form 40 if your income does not meet the minimum threshold set by the IRS. Additionally, if your income is reported using other forms, you may not need to file this one. Always check IRS guidelines for specific exemptions related to your filing situation.

Components of the form

The scheduled oc form 40 is composed of several key sections, which typically include income categories, deductions, and taxpayer information. Each section must be filled out according to the specific instructions provided on the form.

What are the penalties for not issuing the form?

Failing to issue scheduled oc form 40 when required can result in penalties from the IRS. Penalties may include fines or interest on unpaid taxes. It is crucial to file the form correctly and on time to avoid these potential penalties.

What information do you need when you file the form?

When filing scheduled oc form 40, you will need information such as your total income from various sources, any applicable deductions, and your taxpayer identification details. Ensuring you have complete and accurate documentation is vital for a successful filing.

Is the form accompanied by other forms?

The scheduled oc form 40 may need to be submitted alongside other forms depending on your tax situation. For instance, if you are self-employed, you might need to submit it with a Schedule C or other relevant documents. Review the IRS instructions for guidance on required accompanying forms.

Where do I send the form?

The scheduled oc form 40 should be sent to the appropriate IRS address based on your state of residence and the form’s purpose. Be sure to check the IRS guidelines to ensure you are sending it to the right location. Sending it to the wrong address can delay processing and lead to penalties.

See what our users say