Get the free Money Skills:

Show details

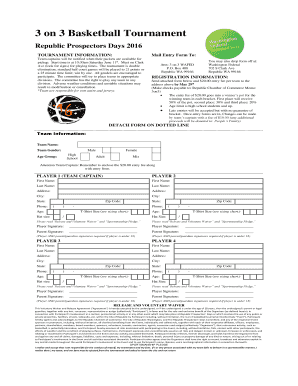

Money Skills: Making the most of your money: Budgeting Age range: 1619Contents 03Activity One: Who needs a budget? 09Activity Two: Getting into the saving habit 14Activity Three: Keeping the bills

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money skills

Edit your money skills form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money skills form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit money skills online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit money skills. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money skills

How to fill out money skills

01

Start by identifying your financial goals. Determine what you want to achieve with your money skills, such as saving for a specific goal or managing your expenses effectively.

02

Track your income and expenses. Keep a record of all your income sources and expenses to get a clear picture of your financial situation.

03

Create a budget. Based on your income and expenses, create a budget that allocates your money towards different categories such as bills, savings, and discretionary spending.

04

Learn about financial concepts. Educate yourself on topics such as investing, savings accounts, credit cards, and loans to make informed financial decisions.

05

Build an emergency fund. Set aside a portion of your income in a separate savings account to cover unexpected expenses or financial emergencies.

06

Pay off debt. If you have any outstanding debt, develop a plan to pay it off systematically, starting with high-interest debts first.

07

Save for retirement. Start planning for your future by contributing to a retirement account or pension scheme.

08

Invest wisely. Learn about different investment options and consider diversifying your investments to grow your wealth.

09

Review and adjust your financial strategy regularly. Periodically assess your financial situation and make necessary adjustments to meet your evolving goals.

10

Seek professional help if needed. If you feel overwhelmed or lack expertise in certain areas, consult a financial advisor or take relevant courses to further improve your money skills.

Who needs money skills?

01

Everyone needs money skills to effectively manage their finances and secure their financial future.

02

Individuals who want to save money for future goals such as buying a house or starting a business.

03

People who want to get out of debt and improve their credit score.

04

Those who wish to achieve financial independence and retire comfortably.

05

Parents or guardians who want to teach their children about money management from a young age.

06

Entrepreneurs or business owners who need to understand financial management for their businesses.

07

Individuals who want to make informed decisions about investments and grow their wealth.

08

Anyone who wants to have greater control over their financial situation and reduce financial stress.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my money skills directly from Gmail?

money skills and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get money skills?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the money skills in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute money skills online?

pdfFiller has made filling out and eSigning money skills easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is money skills?

Money skills refer to the ability to manage finances effectively, including budgeting, saving, investing, and understanding financial concepts.

Who is required to file money skills?

Anyone who wants to improve their financial literacy and learn how to manage their money better is encouraged to develop money skills.

How to fill out money skills?

You can enhance your money skills by reading books or articles on personal finance, attending financial workshops, or seeking advice from a financial advisor.

What is the purpose of money skills?

The purpose of money skills is to help individuals make informed decisions about their finances, save for the future, and achieve their financial goals.

What information must be reported on money skills?

Information such as income, expenses, assets, debts, and financial goals may be reported when discussing money skills.

Fill out your money skills online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Skills is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.