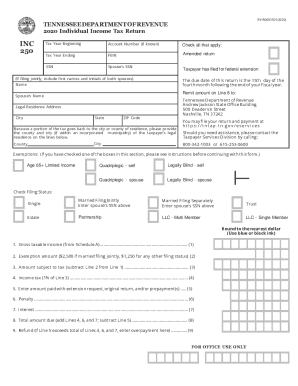

TN DoR INC 250 2017 free printable template

Instructions and Help about TN DoR INC 250

How to edit TN DoR INC 250

How to fill out TN DoR INC 250

About TN DoR INC previous version

What is TN DoR INC 250?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about TN DoR INC 250

What should I do if I realize I made a mistake on my Tennessee individual income tax return?

If you discover an error on your Tennessee individual income tax return, you can submit an amended return. Be sure to use the specific form designated for amendments and clearly indicate the corrections needed. It's important to keep a copy of the amended submission for your records.

How can I verify the status of my Tennessee individual income tax return?

To track the status of your Tennessee individual income tax return, you can utilize the online portal provided by the Department of Revenue. This platform allows you to check if your return has been processed and provides updates on any potential issues or rejections.

Are there privacy and data security measures for my Tennessee individual income tax information?

Yes, the Tennessee Department of Revenue implements various privacy and data security measures to protect your personal and financial information. It is crucial to use secure methods for submission and to be aware of phishing attempts and scams targeting tax information.

What should I do if I receive a notice regarding my Tennessee individual income tax return?

If you receive a notice about your Tennessee individual income tax return, read it carefully to understand the issue. You may need to gather specific documentation to support your case and respond within the timeframe indicated in the notice to avoid further penalties.